It probably won’t come as much of a surprise to learn that Barrick Gold (GOLD), the world’s second largest gold mining company, is enjoying a successful 2020. Gold performs particularly well during global crises, and hardly any come any bigger than the current pandemic. As a result, the precious metal has been changing hands for prices not seen since 2013. Barrick has benefited from gold’s upward trend, with the mining stock up by 40% year-to-date.

CIBC analyst Anita Soni argues Barrick stock has a way to go yet. The analyst reiterated an Outperform rating, while increasing the 12-month price target from $33 to $36. Investors stand to take home gains in the shape of 38%, should the target be met over the following 12 months. (To watch Soni’s track record, click here)

So, what is behind Soni’s positive thesis? Well, a solid Q1 report, despite COVID-19’s sharp impact, helps. At $0.16 Q1 Non-GAAP EPS hit the estimates, and while revenue of $2.72 billion missed the consensus call by $70 million, the figure still represented year-over-year growth of 30.1%.

But essentially, it’s all about the gold, and with prices on the rise, Soni believes the precious metal is on the cusp of another bull cycle.

With gold currently going for roughly $1,702 per oz, the analyst believes Barrick will have FCF of $2 billion in 2020 – more than enough to “reinvest in the business and return capital to shareholders.” The company also owns a number of world class assets including Goldrush, Four Mile, Abierto Norte, Alturas and Lagunas Norte. As Soni expects the gold rally to continue, she argues Barrick’s exploration assets “will gain increasing investor attention.”

Soni further noted, “With a strong balance sheet, we continue to remain positive on the stock as Barrick is midway through its portfolio rationalization and optimization after two major acquisitions, and we expect continued delivery on synergies and cost reductions. Barrick has managed well through Q1 (few COVID-19- related impacts) and its diversified operational base has attracted, and should continue to attract, investors’ attention.”

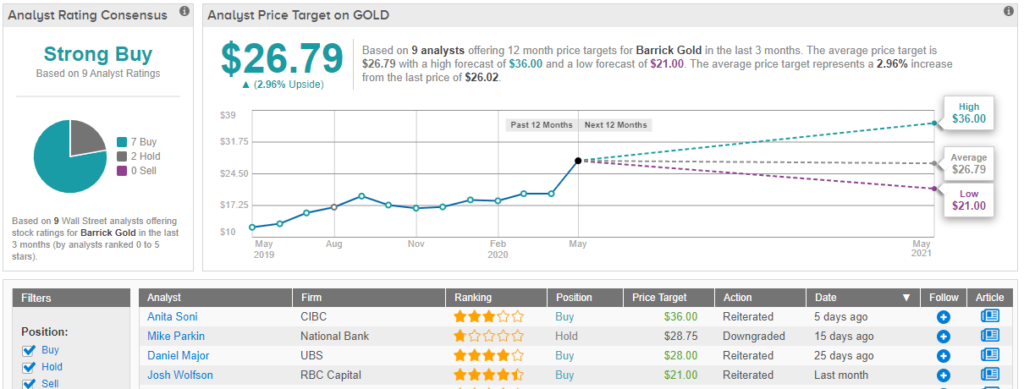

Let’s turn our attention now to the rest of the Street, where based on 7 Buys and 2 Holds, GOLD currently carries a Strong Buy consensus rating. Although with an average price target of $26.79, the analysts project a modest 3% upside over the coming months. Either the analysts have yet to update their GOLD models, or perhaps some believe the stock has soared enough for now. (See Barrick Gold stock analysis on TipRanks)

To find good ideas for gold stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.