The valuations of bank stocks could further decline due to concerns over earnings. Despite those worries, Wedbush analyst David Chiaverini has named a few bank stock picks.

The swift action by the regulators to inject liquidity into the banking system and alleviate concerns regarding the unrealized losses on the books of the banks will likely stem the run on the bank (large deposit outflow). However, the increase in the cost of deposits and the expected slowdown in loan growth could lower near-term net interest margin and net earnings, further lowering the price/earnings (P/E) multiples.

A U.S. official told Reuters that the outflow of deposits that negatively impacted several regional banks “had slowed and in some cases reversed.” While the development is positive, banks will need to raise rates to attract or retain deposits amid a heightened competitive environment and rising interest rates. This could lead to lower credit availability and higher credit costs, thus negatively impacting the profitability of banks.

Bank Stocks: Analysts Weigh In

Morningstar analyst Eric Compton highlighted that the future of bank stocks remains uncertain due to the doubts surrounding the deposit movement. He believes that the lower credit availability and softness in the economy could lead to a reduction in earnings expectations for the second half of this year.

While Compton views the “U.S. equity markets as broadly undervalued,” he sees additional pressure on prices in the short term.

Wedbush analyst David Chiaverini expects continuing deposit outflows to tighten lending standards, reduce credit availability, and negatively impact the economy. Chiaverini also expects credit costs to increase.

The analysts said, “We conducted a TBV [Tangible Book Value] burndown analysis to gauge the potential downside to TBV in recessionary scenarios, and if these scenarios come to fruition, the bank group wouldn’t be trading as attractively as it appears on the surface.”

Against this backdrop, Chiaverini’s top picks include M&T Bank (NYSE:MTB), Regions Financial (NYSE:RF), and Comerica (NYSE:CMA).

While Chiaverini is bullish about these banks, let’s check what TipRanks’ data indicates about their prospects.

Is M&T Bank Stock a Good Buy?

M&T operates through its subsidiary, M&T Bank, which offers banking products and services in 12 states. It delivered stronger-than-expected Q4 earnings and sports a Strong Buy consensus rating on TipRanks, based on six Buy and two Hold recommendations.

Analysts’ average price target of $185.09 on M&T stock implies 52.07% upside potential from current levels. Further, it offers an attractive dividend yield of over 4%.

What’s the Prediction for Regions Financial Stock?

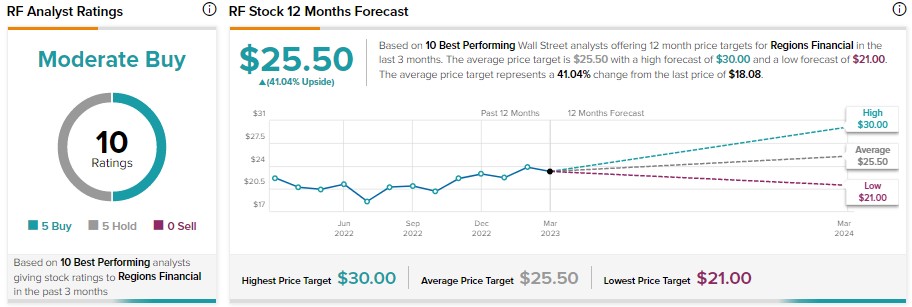

Regions Financial is a bank holding company operating through Regions Bank. It delivered solid revenue and earnings on the back of higher net interest income and operating leverage. RF stock has five Buy and five Hold recommendations for a Moderate Buy consensus rating.

Moreover, analysts’ average price target of $25.50 implies 41.04% upside potential from current levels.

Is Comerica Stock a Buy or Hold?

Higher loans, solid credit quality, and improving efficiency drove Comerica’s top and bottom line performance in Q4. However, it is on Moody’s (NYSE:MCO) downgrade review list due to concerns about unrealized losses in the asset portfolio.

CMA stock has received six Buy, three Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $83.33 implies 86.96% upside potential.

Bottom Line

Lower credit availability, higher credit costs, and negative investor sentiment could continue to play spoilsport for banks in the short term. Among MTB, RF, and CMA stocks, MTB, with its Strong Buy consensus rating and significant upside potential of over 52%, appears attractive.