I am bullish on Baidu (BIDU). The stock has decreased 35.4% over the past six months, presenting a good opportunity for buy-the-dip investors.

Baidu operates China’s biggest search engine portal, with over 74% of the market share market share in desktop and mobile search.

BIDU is currently trading at a discount from its 52-week high of $354.82, suggesting that this could be a good time to go long on the stock. (See Baidu stock charts on TipRanks).

Undervalued but Highly Profitable

China has a growing digital advertising industry, worth $97 billion a year. BIDU therefore deserves a higher valuation than its forward P/E of 17.1x.

Search engine peers Google (GOOGL) and Microsoft (MSFT) have forward P/Es of 28.2x, and 33.4x, respectively. Google’s net income margin is only 28.5%, compared to Baidu’s TTM net income margin of 37.2%.

Growth Drivers from Cloud Computing and AI

Baidu is one of the world’s leading AI companies. The cloud AI software market is growing at a 20.3% CAGR. This niche business will be worth $13.1 billion by 2026.

BIDU has a strong tailwind from the fast-growing (17.5% CAGR) $371.4-billion global cloud computing industry. Baidu’s portfolio of services is as comprehensive as Microsoft’s Azure platform.

Self-Driving Taxis and Cars

Baidu is already operating the first paid self-driving taxi in Beijing. Apollo Go robotaxis tout Level 4 autonomy.

The global robotaxi industry was worth $450 million last year. It is growing at a 59.2% CAGR. It will have a market size of $45.4 billion by 2030.

Baidu could become a serious rival to Tesla (TESLA) in China and Asia. Tesla’s net income margin is only 5.1%, and yet it touts a forward P/E of 114.7x.

Tesla has no Level 4 commercial self-driving electric car or robotaxi service.

Robust Financial Numbers

Baidu currently holds $26.2 billion in cash. This is greater than its total debt load of $13.81 billion. Its short-term assets of $30.85 billion is higher than its short-term liabilities $13.14 billion.

The company’s net operating cash flow is $4 billion, which is enough to cover interest payments of its short-term debt of $468.4 million.

Baidu has a Piotroski F Score of 7.

Wall Street’s Take

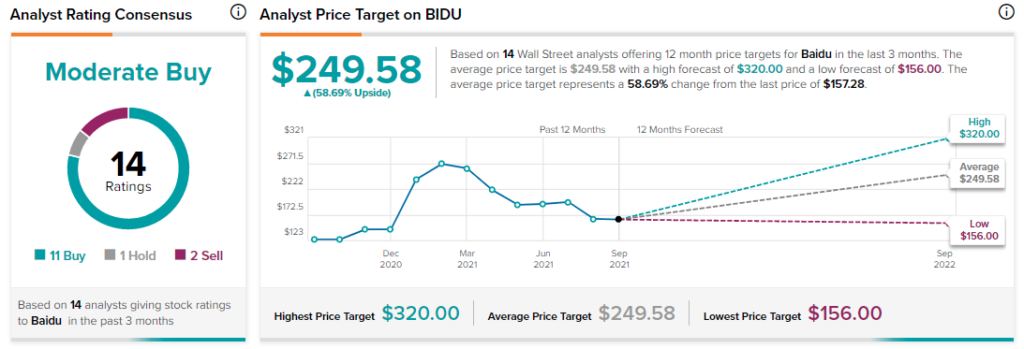

Wall Street analysts consider Baidu a Moderate Buy, based on 11 Buys, one Hold, and two Sells. The average BIDU price target is $249.58, indicating 58.7% upside potential.

Conclusion

The relative undervaluation of Baidu against Google and Microsoft is a golden opportunity. The company has multiple catalysts from its self-riving cars, cloud computing, and AI services.

Disclosure: At the time of publication, Motek Moyen did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.