When it comes to banks worldwide, there are a few names that carry real power. Among them is Barclays (BCS), one of the biggest British banks around. Yet even these major names can slip occasionally, though Barclays’ latest troubles may be more than a slip.

The company lost 3.1% in premarket trading Monday, and those losses continued into the early trading day itself. I’m staying neutral on Barclays. Its latest troubles will certainly hurt it. However, considering Barclays’ overall track record and book of business, it may not hurt very much, or for very long.

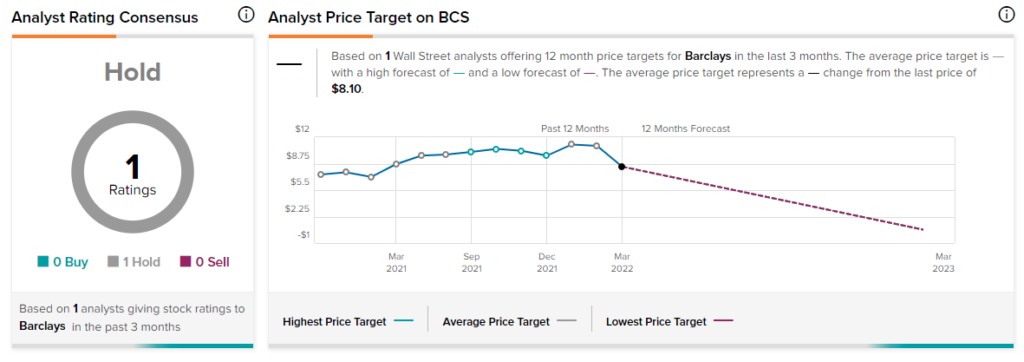

Barclay’s spent much of the last 12 months in a very narrow range, commonly trading between $8 and $11 per share. A brief burst of optimism allowed the company to challenge $12 per share, but that optimism was quickly lost and the company fell back to around $8 before recovering to current levels.

The latest news was a clear black mark on the company. A recent series of bond trades hurt the company badly by most reasonable standards. Reports noted that Barclays issued $15.2 billion worth of exchange traded notes (ETNs) more than it actually registered for sale.

In order to compensate for the error, Barclays would need to buy the notes back at their original prices. The total of which comes to around 450 million pounds sterling, about $589 million U.S. This would delay the bank’s plan to launch a $1-billion stock buyback plan to sometime in the second quarter of its Fiscal 2022.

Wall Street’s Take

Turning to Wall Street, Barclays has a Hold consensus rating. That’s based on one Hold assigned in the past three months. The average Barclays price target does not currently exist, as the Hold rating did not come with a price target.

Hedge Funds Coming Back

Barclays has lost much of its former luster with hedge funds, but there are signs that luster may be coming back. The TipRanks 13-F Tracker reveals that interest in Barclays from hedge funds was on the decline from January of 2020 all the way until July of 2021. However, starting with July 2021, interest has been growing, if slowly.

Much the same could be said about Barclays’ dividend history. The dividend fluctuated from November 2015 to February 2018, when it started a steadily upward track.

This upward track lasted until February 2019, when it declined, and then vanished altogether for all of 2020. It made a return in February 2021, and has been rising ever since.

A Massive Minor Misstep

It is impressive, no matter how you slice it, that a company that screwed up to the tune of around half a billion dollars will see little fate worse than a delayed share buyback program. Delayed by only one quarter, no less.

Additionally, just two weeks ago, the company announced that it would suspend further sales of both its iPath Pure Beta Crude Oil and its iPath Series B S&P 500 VIX Short-Term Futures ETNs. Both will be brought back in play, reports note, as soon as there is capacity for such sales to take place.

When a company can basically shrug off a half-billion-dollar mistake with little more than a delayed plan to buy back its shares, that’s actually a good sign for investors. It looks like Barclays would be able to survive anything short of the collapse of western civilization.

If it also offered a stable dividend, that would make it a lock for income investors. However, Barclays’ dividend is anything but stable.

Moreover, Barclays’ top brass isn’t exactly all that stable either. Reports reveal that Barclays suspended a bonus valued at millions of pounds sterling going to former chief executive Jes Staley.

The freeze was connected to potential connection between Staley and recently deceased Jeffrey Epstein. However, Barclays should be able to survive that connection readily; Staley has been out as chief executive since November.

Concluding Views

Barclays is a stock to watch. Let this latest debacle go under the bridge, and keep an eye on its share price and dividend. If both manage to stabilize for a while, this could be an absolute winner of an income stock.

Forgiving Barclays’ dividend instability may be a simple enough matter. After all, the dividend was pulled during 2020. We all remember what happened in 2020. In some cases, it’s still happening to this very day.

Share price stability will make it attractive, but a stable dividend to go with it would make it unstoppable. So, for now, I remain neutral on Barclays. I also acknowledge that could turn around once the bank exhibits just a little more stability than it’s already displayed.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure