Avis Budget Group (CAR), along with its subsidiaries, operates car and trucking rental services. I am bearish on the stock.

Initial Bull Run

Avis stock has sustained a bull run of more than 5x its initial stock price a year ago. The stock turned into a meme concept with severe translation into unjustified stock appreciation amid an infinitesimal increase in cross-border travel numbers.

During the past month, however, we’ve seen a sell-off of meme stocks in general as the market has gained a grip of reality.

Valuation

The proclivity of bull investors can’t possibly sustain itself if we observe the stock’s current valuation metrics.

Based on Avis’ five-year relative basis, its price-to-sales ratio is overvalued by 3.1x, and its price-to-cash flow is overvalued by 1.4x.

These metrics combined indicate that there’s no rational way to justify the stock’s current price relative to its income statement; if this was a growth stock, the exorbitant surpluses that these ratios are trading at could’ve been excused, but considering the business’ lifecycle, it’s safe to say that we’re looking at an overvalued stock here.

Identified Risks

The most significant risk on the table is the rising competition in rental vehicles. We’re witnessing a rise in e-hailing services, and Avis’ business model seems outdated relative to recently developed solutions.

Furthermore, TipRanks’ risk detector indicates that there’s a production risk present. This makes logical sense as the current supply chain bottlenecks in the semiconductor space are causing issues to downstream firms. I see this as a persistent issue until we find solutions to increase labor productivity

Insider Selling

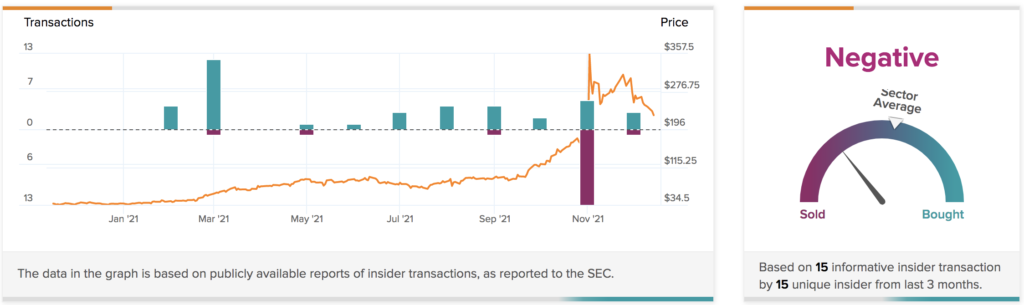

As a final downer, I’d like to outline recent insider activity. TipRanks’ insider selling chart monitors the rate at which the company’s management has been selling their shares in the company.

According to the latest quarterly report, 4.6 million shares have been sold by insiders, and the general internal mood of the company is pessimistic regarding the stock’s prospects.

Wall Street’s Take

Turning to Wall Street, analysts are generally bearish, with a Moderate Sell consensus rating. The average Avis price target on the street is $225.83, representing just 0.8% in upside potential.

Concluding Thoughts

Avis Budget stock has outperformed due to irrational market support. This is one of those stocks that could keep losing value as market liquidity continues to diminish.

Disclosure: At the time of publication, Steve Gray Booyens did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >