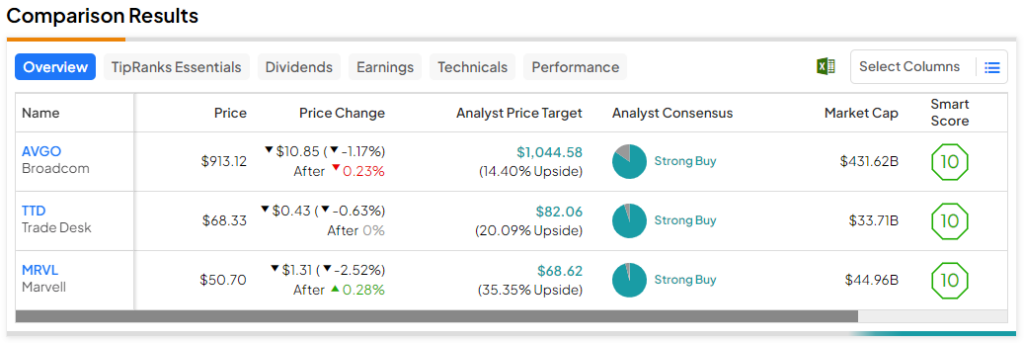

The artificial intelligence (AI) boom kicked off one of the fiercest rallies for the tech scene this year. Moving into 2024, look for a new class of highly-rated tech companies — Wall Street analysts have Strong Buys on tech plays, including AVGO, TTD, and MRVL — to rise at the hands of potentially lower rates and additional clarity on where each firm stands on generative AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Therefore, let’s use TipRanks’ Comparison Tool to check in on the three Strong Buy-rated tech plays to see how much room they have to run as they catch up with the likes of 2023’s hottest AI plays.

Broadcom (NASDAQ:AVGO)

Broadcom is a $482 billion semiconductor giant that had a glorious year, rising more than 70% year-to-date. Its stake in the AI game is a major reason why investors have flocked to a semiconductor stock that used to command a dividend yield closer to 4%. Sadly, the yield has shrunk to 2% after more than doubling from last year’s lows.

Despite the higher price of admission and smaller yield, analysts still remain upbeat on the stock, with a Strong Buy rating from the community. It’s not just about AI upside, either. The company’s $69 billion VMWare merger is finally a go. Post-merger, I remain as bullish as ever.

Furthermore, the added benefits of the deal could kick in “immediately,” at least according to KeyBanc Capital Markets analyst Weston Twigg, who sees the deal as a timely booster of both earnings per share (EPS) and gross margins.

Twigg is right to be so bullish about the value to be unlocked following the Broadcom-VMWare deal. In a prior piece dated August 2022, I praised Broadcom for getting what I thought was a good deal for the virtualization software company, noting my belief that the firm scored “a great deal” as it jumped in during a “steep dip in [VMW] shares.” The deal was a long time coming, and it’s now time to reap the rewards.

Even at 28.5 times trailing price-to-earnings (P/E), AVGO trades at a discount to the 34.1 times multiple of the semiconductor industry average. Throw the software exposure and AI upside into the equation, and the stock seems more than deserving of a P/E north of 30 times.

What is the Price Target of AVGO Stock?

AVGO is a Strong Buy, according to analysts, with 11 Buys and two Holds assigned in the past three months. The average AVGO price target of $1,044.58 implies 14.4% upside potential from here.

The Trade Desk (NASDAQ:TTD)

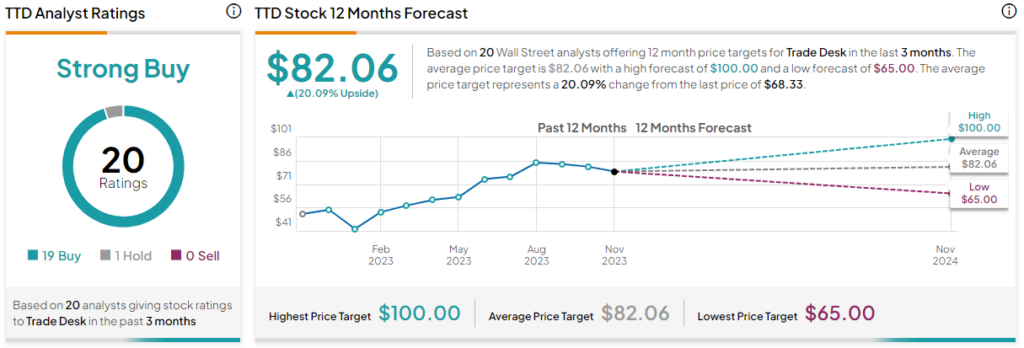

It’s been a choppy year of relief for the programmatic ad company, which now sits up 56% year-to-date but down more than 21% from its 52-week high, just shy of $92 per share. Despite the rougher recent sledding, all but one of 20 analysts remain bullish on the stock’s prospects for the year ahead. Personally, I don’t see a wave of downgrades coming as ad spending looks to turn in the new year.

In short, The Trade Desk has been hit by headwinds that are not unique or detrimental to the firm. Whenever nearer-term headwinds get the better of a stock that still has solid long-term fundamentals, you may have an opportunity to buy the dip. I, for one, am staying bullish on the firm as it navigates what remains of the harsh environment.

On the AI front, The Trade Desk’s Kokai platform looks full of potential. As ads and AI join forces, it’s hard to imagine The Trade Desk not gaining further ground in an ad world that’s becoming increasingly entrenched with consumer data. The firm’s AI tailwind, I believe, makes TTD stock worth hanging onto as what remains of the ad slump comes to pass.

What is the Price Target of TTD Stock?

The Trade Desk is a Strong Buy, according to analysts, with 19 Buys and one Hold assigned in the past three months. The average TTD stock price target of $82.06 implies 20.1% upside potential.

Marvell Technology (NASDAQ:MRVL)

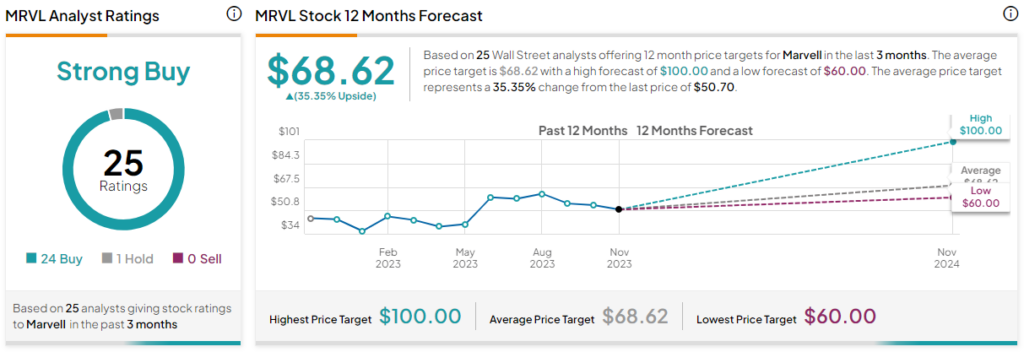

Marvell is a semiconductor tech titan that has plenty to gain from the rise of AI. I found it quite excessive that shares dipped more than 5% following a quarterly result that underwhelmed markets. Clearly, many lack patience when it comes to Marvell’s AI capabilities. Nonetheless, analysts are sticking with their upbeat recommendations following the post-earnings stock flop, and AI is a major reason why. Unless you’re a trader in search of a quick buck, it’s hard not to be bullish on last Friday’s weakness.

Raymond James analyst Srini Pajjuri stated that its “growing AI exposure and double-digit longer-term growth potential” are reason enough to command a “premium” price tag. I’m inclined to agree, but I do acknowledge it will take time for the AI tailwind to come into full effect.

For the current fiscal year, AI-related sales are expected to be in the ballpark of $400 million. That’s not a massive sum for the firm, but the figure is poised to double to $800 million in the next fiscal year. That’s some serious growth that long-term investors should not discount just because the latest quarter disappointed.

Piper Sandler’s Harsh Kumar, who has a Buy rating on the stock alongside a freshly lower $70 price target (down from $75), is also bullish on growth arising from the data center.

What is the Price Target of MRVL Stock?

Marvell’s a Strong Buy, according to analysts, with 24 Buys and one Hold assigned in the past three months. The average MRVL stock price target of $68.62 implies 35.35% upside potential.

Conclusion

Tech’s run could continue in the new year. The analyst community is upbeat about the trio of names outlined in this piece as they embrace the AI age with open arms. Of the three, analysts see the most upside (about 35%) from Marvell stock.