There seems to be no respite for the investors of cloud communications solutions provider Avaya Holdings Corp. (AVYA) anytime soon. Only days ago, the company reported disappointing preliminary third-quarter numbers on multiple fronts. It announced cost cuts, lowered revenue and EBITDA projections, hinted at an impairment charge, and sacked its CEO, Jim Chirico. Shares had dropped 57% in response on July 29.

Dismal Third-Quarter Numbers

Avaya’s stock sank 45.5% yesterday after the release of its preliminary third-quarter numbers and business update. All in all, shares are now down 97% so far in 2022. Its Q3 revenue dropped 21.2% over the prior year to $577 million. the net loss per share at $0.24 came in wider than expectations by a massive $0.29.

The company witnessed a 97% growth in OneCloud annualized recurring revenue and 40% growth in Cloud, Alliance Partner, and Subscription (CAPS) revenue as compared to the prior year. It ended the quarter with a cash balance of $217 million as compared to a cash balance of $498 million at the end of September 2021.

Moreover, Avaya expects to take an impairment charge of between $1.27 billion and $1.8 billion associated with its intangible assets and goodwill.

Alan Masarek, the newly appointed CEO of the company, stated, “Our preliminary financial results for the quarter reflect operational and executional shortcomings, amplified against the backdrop of a volatile economic environment. We are taking aggressive actions to right-size Avaya’s cost structure to align with our contractual, recurring revenue business model.”

He added, “The July 2022 financing, together with our cost-cutting initiatives, are important steps towards maintaining our financial and operating flexibility to continue to invest in our business and to sustain our business model transition.”

Problems Continue to Compound at Avaya

In July, the company raised a total of $600 million via exchangeable notes and a term loan. Its first debt maturity comes in 2023 followed, by 2027 and 2028. It is this debt level that is causing major ripples. Avaya has roped in advisors to gauge options for the 2023 convertible notes. This, coupled with a decline in revenue and operating losses has prompted Avaya to determine, “That there is substantial doubt about the company’s ability to continue as a going concern.”

To compound matters further, Avaya’s Audit committee has undertaken an investigation regarding circumstances around its third quarter results and is also separately investigating a whistleblower letter. The company also conceded that it would not be able to file its Form 10-Q on the required date. Avaya now has current debt maturities of $327 million, and interest expense this quarter was $54 million.

The drop in revenue, operational loss, and a shadow of whether Avaya can continue to operate has impacted its debt and the clients of Goldman Sachs (GS) (GB:0R3G) and JPMorgan Chase (JPM) (GB:0Q1F) who bought it.

According to the Wall Street Journal, names including Brigade Capital and Symphony Asset management subscribed to the debt offerings and paper losses are in excess of $100 million. Avaya had informed lenders that it was on track to hit its projections and now its bonds are plummeting in value.

Is Avaya a Good Stock to Buy?

It is not a surprise then that the Street has a Moderate Sell consensus rating on the stock alongside a price target of $3.38. However, Goldman Sachs’ Rod Hall has reiterated a Buy but decreased the price target to $3 from $8. The lowered price target still implies a potential upside of 391.72% for Avaya.

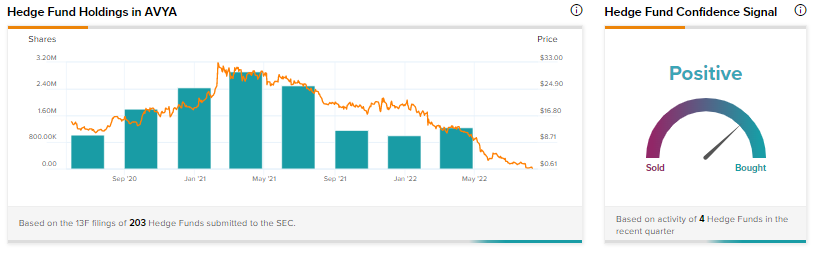

Along with Goldman Sachs, hedge funds are also positive on Avaya and have increased holdings in the stock by 244,700 shares in the last quarter. Here too, Donald Ellis Morgan’s Brigade Capital Management has upped its Avaya holdings by 70.74%.

Can History Repeat for Avaya?

Avaya has had a history of annual losses and its own doubts about whether it can go on as a going concern may sound familiar to some. It had sought to put its affairs in order and filed for chapter 11 bankruptcy protection in 2017 as well. Finally, a TipRanks Smart Score of five means the stock may not outperform the broader market anytime soon.

Read full Disclosure