With inflationary pressure unlikely to subside soon, auto insurance companies have been putting forth applications in several states to increase premiums in the range of 7% to 20%.

Post the pandemic, profits of the auto insurance companies have been marred by elevated costs of repairing vehicles, due to the shortage of labor. This, in turn, has led to higher expenses related to claim settlements. Further, the disrupted supply chain has hit the auto industry real hard by making replacement parts more expensive.

Meanwhile, insurers are witnessing a surge in road accidents as well. This is because more and more people took to the roads after the COVID-19 restrictions were lifted.

To counter this, many insurance companies are seen raising premiums state-wise, considering traffic volumes, accident frequency and claim rates, and theft and vandalism instances in a particular state.

Now, let’s talk about two stocks that look well-positioned to gain from higher premiums.

The Allstate Corporation (NYSE: ALL)

Allstate offers property & casualty (P&C), and other insurance products in the United States and Canada. It is the third-largest P&C insurer and the largest publicly-held personal lines carrier in the United States.

The company has already raised its premiums by an average of 9.3% in about 28 U.S. states. Further, the company plans to boost profitability by reducing expenses and generating higher revenue from the rise in the rates of premiums.

Last week, Citigroup analyst Michael Ward CFA initiated coverage on the stock with a Buy rating and a price target of $159 (16.2% upside potential from current levels).

Overall, the Street has a Moderate Buy consensus rating on the stock based on six Buys, six Holds and one Sell. Allstate’s average price target of $146.36 implies 6.9% upside potential from current levels.

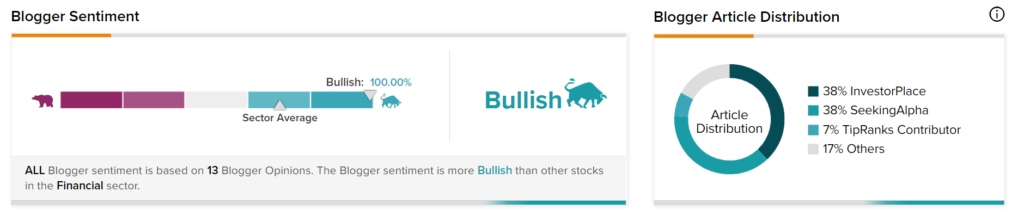

TipRanks data shows that financial bloggers are 100% Bullish on ALL, compared to a sector average of 70%.

The Progressive Corporation (NYSE: PGR)

Progressive is one of the biggest auto insurers in the United States. The company also offers residential property insurance, reinsurance, and other specialty property-casualty insurance and related services.

In February, Progressive received 47 rate-hike approvals across 11 states. The company now plans to spend more on advertisements to attract more clients.

Recently, Raymond James analyst Charles Peters reiterated a Buy rating on Progressive with a price target of $135, implying 12.2% upside potential from current levels.

Based on three Buys, six Holds and four Sells, the stock has a Hold consensus rating. Progressive’s average price forecast of $112 implies 6.9% downside potential from current levels.

TipRanks data shows that financial bloggers are 88% Bullish on PGR, compared to a sector average of 70%.

Closing Note

The aforementioned companies are likely to capitalize on the current opportunity as there is no indication of inflation slowing down in the near term.

Read full Disclosure