ASML Holding’s (ASML) unmatched competitive advantage, or “moat,” in the semiconductor industry continued to demonstrate its qualities and ability to drive robust results, even during the current, uncertain trading environment. The company’s latest results exhibited fantastic growth momentum, which, along with the company’s ever-growing backlog, should keep driving strong shareholder returns moving forward.

I remain bullish on ASML stock.

ASML’s Unmatched Moat

ASML puffs a distinctive moat when it comes to its patent-protected EUV faculty, which has enabled the company to effectively form a legal monopoly in the space.

The reason ASML’s proprietary capabilities are incredibly noteworthy is due to solving the industry’s greatest problem. Basically, the long-term development of the semiconductor industry is based on the concept that the energy, cost, and time required for electronic calculations can be reduced by condensing transistors on microchips.

This is precisely what ASML’s lithography systems can accomplish, which is largely determined by the wavelength of the light employed and the numerical aperture of the optics.

Since ASML is the sole player globally that offers EUV lithography systems, virtually every semiconductor manufacturer out there is in critical need of the company’s solutions if they wish to stay ahead of the curve.

From an investor’s point of view, ASML makes for a great investment since one does not need to speculate which semiconductor player will be the prevalent one over the next decade. Essentially ASML is positioned to profit from the ever-expanding demand for semiconductors anyhow.

The global semiconductor industry is projected to grow by a compound annual growth rate of 12.2% through 2029, essentially securing an expanding backlog for ASML.

What makes ASML’s moat and overall investment case quite unique, too, is that the company should remain the chief supplier of semiconductor solutions even in the subsequent generation of semiconductor manufacturing. This is due to lithography research being incremental and demanding progressive advancements.

In other words, it’s practically impossible to surpass an industry leader with the scale of ASML since you can’t skip a generation of know-how and manufacturing prowess.

Q2 Results Demonstrated Robust Momentum Despite Underlying Macro Challenges

The semiconductor industry can be extremely cyclical since semiconductor sales are correlated with discretionary spending. If consumer spending declines, so will the sales of semiconductor manufacturers. Yet, ASML’s latest results demonstrated fantastic resiliency. ASML wrapped up the first half of Fiscal 2022 on a superb note. In Q2, net sales came in at $5.6 billion (€5.4 billion), suggesting year-over-year growth of 35%.

ASML also posted net bookings of €8.5 billion, up 21.3% compared to Q2-2021. This suggests that the company’s performance in the coming quarters should remain robust and with no unpleasant surprises.

This is due to the company’s moat, as mentioned earlier, that allows the company to develop a growing backlog. Thus, its performance is less sensitive to short-term market shocks.

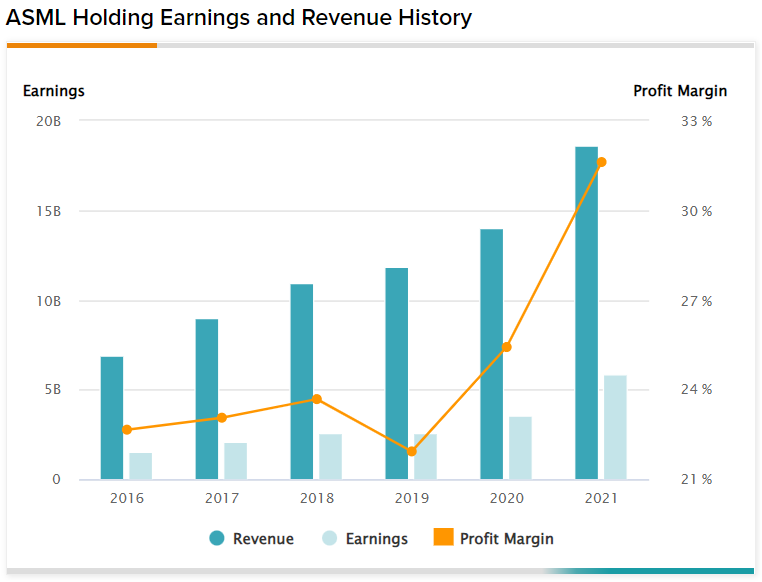

I am particularly excited about ASML’s ongoing margin evolution, which is achieved through extending economies of scale. Gross margins in Q2 came in at 49.1%, compared with 49% last year. That isn’t a huge expansion, but gross margins have gradually expanded from the low 40% range in 2015, which is of crucial importance to ASML’s future earnings growth.

Accordingly, net income margins also expanded, with ASML posting €1.41 billion in net income for the year or €3.54 per share. This implies a year-over-year growth of 103%, obviously well-above revenue growth, exhibiting ASML’s scaling economics.

For Q3, management expects net sales between €5.1 billion and €5.4 billion. At first glance, this implies an uninspiring performance in terms of growth versus the prior-year period’s €5.24 billion in net sales.

However, the lack of growth is only due to a notable number of fast shipments, resulting in roughly €2.8 billion of expected revenue shifting from Q3 to Fiscal 2023. In fact, even taking into account this present “technical” issue, the company is still expected to deliver revenue growth to be close to 11.8% in Fiscal 2022.

At the end of the day, demand for ASML’s one-of-a-kind technology remains very high. Due to ASML operating through its delivering on its backlog, its only limitation in terms of its revenue growth is its own mastership to advance its capacity to fulfill said backlog.

Wall Street’s Take on ASML Stock

Turning to Wall Street, ASML Holding has a Strong Buy consensus rating based on three Buys assigned in the past three months. At $661.33, the average ASML stock projections suggest 14.4% upside potential.

The Takeaway – Buy the Momentum?

In the short term, ASML’s investment case is about buying the company’s growing backlog momentum. The underlying macro environment may remain shaky, but AMSL should be one of the few companies in the space whose sales could withstand short-term shocks in the end-consumer demand.

In the long run, nothing has changed regarding ASML’s investment case. The company’s role in the semiconductor industry is virtually irreplaceable. If you are bullish on the semiconductor space, there doesn’t seem to be a reason not to be bullish on ASML.