With inflation rocketing in the UK, investors need solid choices to see them through the turbulence – so we’ve used TipRanks’ tools to highlight two solid British choices tipped by top analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Investors should stick with stocks for the long term and choose sectors that can smoothly sustain this inflation period.

Tobacco manufacturer Imperial Brands (GB:IMB) and global fashion brand Burberry (GB:BRBY) are two perfect stocks in this situation. These stocks have solid backing from analysts and also tick the right boxes for income investors.

Investors can use the TipRanks share screener tool to list out such stocks for better results.

Let’s have a closer look at them.

Imperial Brands

Imperial Brands(IB) is a British tobacco manufacturing company with some leading brands such as West, Davidoff, Winston, Pulze, iD, and more.

The company’s stock was well ahead of the market’s performance last year with a 39% return. The company has managed to achieve a dividend yield of 6.92% along with buy-back initiatives. The company’s dividends are also fundamentally strong, based on strong free cash flow.

The combination of the defensive attitude of the stock and the passive income makes it an attractive investment opportunity.

The company is facing some challenges in the smoke-free market, where it has more competition. IB is facing tough competition from companies like British American Tobacco (GB:BATS) which is growing its non-combustible business at a faster speed.

However, IB’s luxury brands like Davidoff and Gauloises continue to gain more market share and offset other declines.

Is Imperial Brands a good stock to buy?

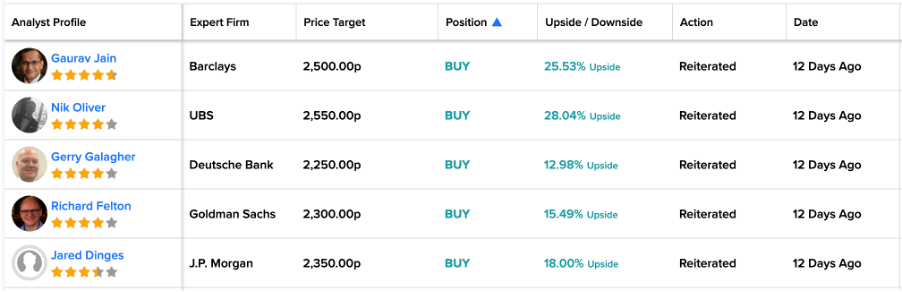

According to TipRanks’ analyst rating consensus, Imperial Brands’ stock has a Strong Buy rating.

The IMB target price is 2,308.3p, which is 16% higher than the current price level. The price has a high forecast of 2,550p and a low forecast of 2,050p.

The stock enjoys a Buy rating from analysts of Goldman Sachs, J.P. Morgan, Barclays, UBS, Deutsche Bank, and more.

Burberry

Burberry is a UK-based iconic luxury fashion brand offering clothing and accessories. With a history of 156 years, Burberry is among the leading brands in the global fashion industry.

The company’s stock has been on a volatile journey in the last year. It still managed to stay in the green zone with a return of around 5%. This was a relief for its shareholders, as the company struggled during the lockdowns, with China being its main market.

However, performance has picked up again since the stores opened in China and other regions are already on an encouraging The company’s comparable store sales grew by 16%, excluding China, as reported in its first quarter update. The store sales in EMEIA grew by 47%, pushed by higher tourists in Europe.

The company’s outlook looks better now with improved financial performance and higher margins. Overall, luxury goods companies are the least affected by rising inflation. With its brand heritage, Burberry is more than capable of passing higher costs to its customers.

Burberry’s share price forecast

According to TipRanks’ rating consensus, Burberry stock has a Moderate Buy rating.

The BRBY target price is 1,953.9p, which represents a growth of 4% on the current price level. The price target has a high forecast and a low forecast of 2,410p and 1,650p, respectively.

Conclusion

In the current times of reduced growth and high inflation, investors can hopefully rely on these two stocks to keep the momentum going.