The arrival of the COVID-19 pandemic impacted and changed the retail sector in a major way. Companies with a large retail presence had to manoeuvre as outlets stayed shut and fast adoption of online channels became the norm.

In such a fast-changing and demanding backdrop, the Wall Street Journal reported that major retail names are seeing leadership changes at the top.

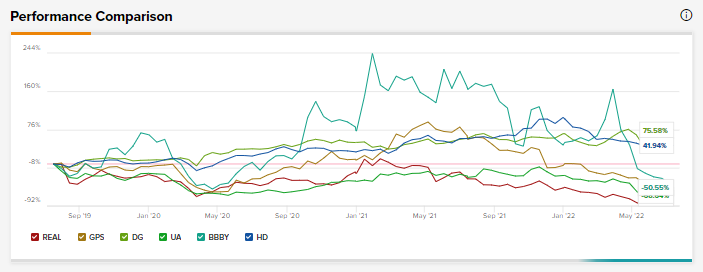

This year, rising inflation, changing consumer preferences, and supply chain challenges have continued to challenge the sector. Consequently, names such as Under Armour, Bed, Bath & Beyond (BBBY), and RealReal are down over 70% over the past year.

RealReal (REAL)

RealReal’s share price has dropped 81% so far in 2022 and the stock still has a short interest of about 15%, meaning bears have the upper hand. Last month, Julie Wainwright, the founder of the online marketplace for resale luxury goods, stepped down from her roles as CEO, Chairperson, and Board member.

While the Board finalizes a new name to take the top job, Wainwright will be an advisor to the company.

Under Armour (UA)

Under Armour’s margins were impacted by supply chain constraints during Q1, and margin pressures are expected to haunt the company in the near future as well. Following a near 60% share price slide this year, the stock also has a short interest of about 5%.

Only weeks after this Q1 showing, Patrick Frisk stepped down as President, CEO, and Board member of the company. Frisk will act as an advisor until September 1 for Under Armour till a successor is finalized.

Gap (GPS)

Similar developments have taken place at Gap (GPS), with its shares spiralling down 73.5% over the past 12 months and, amid present challenges, short interest is running high at about 13%.

On Monday, Sonia Syngal, a veteran of 18 years, stepped down as the President, CEO, and Board member of Gap. The Executive Chairman of the Board, Bob Martin, has taken over as the President and CEO of the company. In the meantime, a search for her replacement is ongoing.

Gap expects revenue to decline in Q2 while margin pressures continue and the adjusted operating margin percentage is seen to be zero to slightly negative.

Dollar General (DG)

Dollar General, the only exception in this list with price gains of 12.4% over the past year, also announced the retirement of its CEO, Todd Vasos, on Tuesday.

Vasos too will remain in a special advisory capacity with the company and will retire on November 1. Dollar General has promoted COO Jeffery Owen as the new CEO.

Notably, during Vasos’ stint as CEO, the company added 7,000 new locations and expanded its top line by 80%. Dollar General is the biggest retailer by store count in the U.S. at present.

These retail majors continue to navigate a fast-changing landscape amid a host of challenges. Despite the price declines, the Street continues to see pockets of opportunity in the space, with triple-digit potential upside in RealReal and Under Armour at 234.96% and 161.71%, respectively.

At the same time, Bed, Bath & Beyond (BBBY) and Home Depot (HD) too have dropped over the past year. While analysts expect a 21.23% upside in HD, BBBY is expected to drop 12% more from current levels as inventory challenges and changing consumer interests continue to impact the company.

Closing Note

These top brass transitions come at a time when the retail sector has been facing one challenge after another for almost three years now. How the new appointments bear fruit for these stocks remains to be seen.

Read full Disclosure