Once heralded as a hot public market debut that could potentially enliven the dying IPO market, British semiconductor firm ARM Holdings (NASDAQ:ARM) carried the hopes of Wall Street. Unfortunately, its lackluster performance following its debut may chill the IPO arena. I am neutral on ARM stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

High Hopes for ARM Stock Fizzled Out Fast

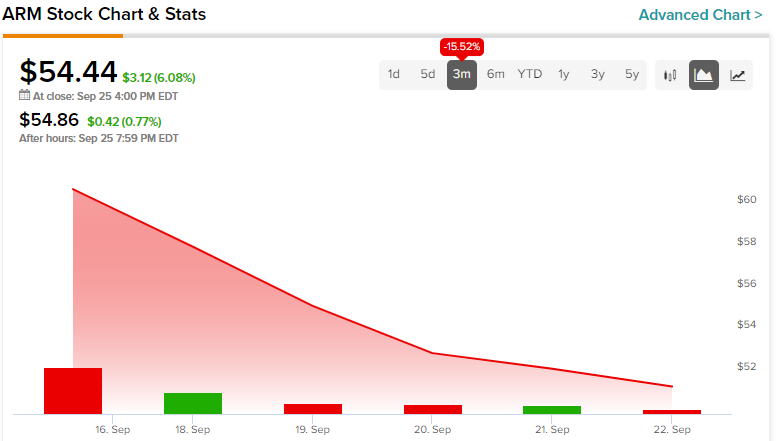

As TipRanks contributor Joey Frenette mentioned last week, the semiconductor and software design specialist enjoyed an impressive launch day. Frenette stated that ARM stock surged more than 25%, peaking at roughly $68 per share. However, the euphoria fizzled fast, leading to serious questions about both the company and the IPO market.

First, the public debut of ARM stock commanded serious attention for its underlying distinct approach. Unlike many other semiconductor firms, ARM doesn’t manufacture chips. Instead, it designs the architecture for processors. From there, ARM licenses these designs to other firms, who utilize said architecture in their own products.

Second, and perhaps more importantly, ARM enjoys significant importance regarding artificial intelligence (AI) and machine learning (ML). By designing specific processor architectures optimized for AI and ML workloads, the technology firm helps accelerate digital intelligence integrations. So, it’s no surprise that ARM stock popped higher, as Frenette stated.

However, with shares closing at $54.44 today, the semiconductor specialist deals with serious questions. ARM stock is not much higher than its initial offering price of $51 and is well below its peak. Generally, the idea of early bird investing is to cash out, not to be cashed into an unsustainable valuation.

And that’s the worry right now for ARM stakeholders. Despite its recent sell-off, Frenette wrote, “ARM stock is still far from cheap at 20.4 times price-to-sales (P/S) and nearly 140 times trailing price-to-earnings (P/E), both of which are well above the semiconductor industry averages.”

Therefore, investors may want to reconsider the idea of participating in this and other IPOs.

New Listings Suffer from Poor Timing

Perhaps in any other circumstance, ARM stock would have jumped higher, given the excitement of the AI and ML revolution. However, serious reservations have emerged about broader economic stability. Therefore, the potential rotation out of risk-on assets toward risk-off alternatives poses dangers for the IPO market.

The evidence seems quite clear. Aside from ARM, grocery delivery service Instacart (NASDAQ:CART) initially benefited from anticipation, only to disappoint later. Notably, the initial offering price for CART stock was $30 per share. Today, the stock sits right around there, at $30.39.

That’s not at all encouraging for what many on Wall Street hoped would be the reemergence of new listings. According to an article from law company Ernst & Young, as of the date of its publication (July 25, 2023), the global IPO market raised $60 billion, a decline of 5% by volume and down 36% by value on a year-over-year basis.

Unfortunately, the anticipated recovery of public market debuts might not materialize. In some ways, it’s easy to understand why Instacart failed to capture hype. As a consumer luxury service, it’s nice to have but not necessary. On the flip side, ARM stock should outperform expectations. Tied to one of the most relevant sectors in the investment arena, the company shouldn’t be struggling for speculators.

That the semiconductor specialist couldn’t sustain its initial pop tells you what you need to know. Investors are likely rotating out of risk, which doesn’t bode well for any high-risk market niches.

Fundamentals Point to a Rough Landing

Among the biggest reasons to be skeptical about ARM stock centers on the Federal Reserve. Last week, the central bank kept interest rates unchanged, as the Street expected. Policymakers also portrayed the broader economy in generally optimistic terms. Still, they also hinted at another rate hike before the end of the year.

That implication appears to have hurt the appetite for risk-on trades. Most noticeably, the cryptocurrency market has been muted. In the equities space, the red ink within the freshly-listed securities is glaring. Basically, it may be time to read between the lines. Investors lack confidence in the Fed engineering a soft landing and are responding accordingly.

Is ARM Stock a Buy, According to Analysts?

Turning to Wall Street, ARM stock has a Hold consensus rating based on one Buy, three Holds, and one Sell rating. The average ARM stock price target is $50.75, implying 1.11% downside risk.

The Takeaway: ARM Stock Sends a Huge Warning Against IPOs

If ARM Holdings represented the litmus test for IPOs, speculators of the craft should be concerned. Increasingly, the market does not appear to have the appetite for risk, leading to red ink for ARM stock. Even more glaring, the underlying enterprise is incredibly relevant to AI and ML. If that can’t convince investors to buy, it’s hard to see how less-pertinent companies can succeed.