The cryptocurrency market has been on a downslide recently, with cryptos like Bitcoin (BTC) sliding 37% year-to-date. On Wednesday, the cryptocurrency dropped below $30,000. According to a News18 report, globally, the market capitalization of crypto on Wednesday was $1.29 trillion, a drop of 1.4% over the previous day.

Last week, there was a ripple effect in the crypto market as the sister token of stablecoin TerraUSD, Luna, crashed to $0, effectively becoming worthless. TerraUSD is a stablecoin that is decentralized, runs on Ethereum, and is supposed to maintain a value of $1.00.

According to a CNBC report, there is a link between UST and luna. The report states that UST has no real-world assets, making it different from other stablecoins like USDC and tether, and its “$1 peg is supposed to be governed by underlying code.”

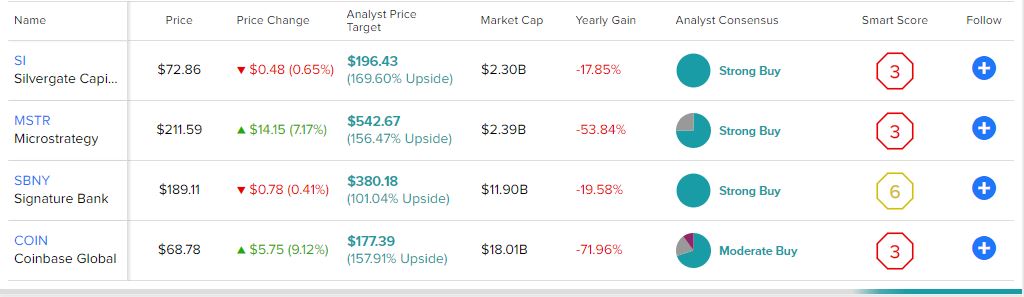

The luna meltdown and the drop in bitcoin have affected stocks invested heavily in cryptocurrency. We used the TipRanks stock comparison tool to look at some of these crypto stocks. We will also examine what Wall Street analysts are saying about these stocks, especially after the luna debacle and the recent drop in cryptocurrencies.

Silvergate Capital (NYSE: SI)

Silvergate Capital is the parent company of Silvergate Bank, which is headquartered in San Diego and is a “California state-chartered bank.” Silvergate Bank provides financial infrastructure services and solutions to participants in the digital currency industry.

The decline in Bitcoin has left investors concerned about Silvergate Capital, as it provides loans to institutional clients with bitcoin as collateral through its core lending product, SEN leverage. Shares of Silvergate have tanked 37% in the past month.

Wedbush analyst David Chiaverini however, is of the opinion that these investor concerns are “unwarranted.” The analyst pointed out that with $450 million of outstanding SEN leverage loans and commitments of $1.1 billion, “the product has yet to see any losses nor forced liquidations, even throughout other periods of bitcoin volatility.”

Chiaverini also envisioned a hypothetical scenario: since SI is entirely reliant on crypto deposits, even if these crypto deposits went to zero, “the company’s 1Q22 TBV [tangible book value] of $36.59 should represent a reasonable benchmark valuation as capital is returned to shareholders, in our view.”

As a result, the analyst remained bullish on the stock while lowering the price target from $200 to $160, the lowest price target on the Street. Chiaverini’s price target implies an upside potential of 118.7% at current levels.

Other Wall Street analysts are also upbeat about the stock, with a Strong Buy consensus rating based on seven unanimous Buys. The average SI stock forecast is $196.43, implying 168.1% upside potential at current levels.

MicroStrategy (NASDAQ: MSTR)

MicroStrategy is a business intelligence company, which according to the company’s CEO, Michael J. Saylor, is the “world’s largest publicly traded corporate owner of bitcoin with over 129,200 bitcoins.”

Saylor also stated on its Q1 earnings call that the company had taken its first “bitcoin-backed term loan.”

Shares of MicroStrategy fell 12.2% on Wednesday as, according to a Wall Street Journal report, the company’s new CFO, Andrew Kang, commented on its bitcoin strategy, “At this time, we do not have any intention to sell. There are no scenarios that I’m aware [of in which] we would sell.”

According to the report, MSTR had bought “129,218 bitcoins to date, at an average price of $30,700 per bitcoin, as of May 2.” Bitcoin has recently dropped below $30,000.

The slide in cryptocurrency has also left MSTR investors concerned about the company’s term loan backed by bitcoin. It is because, according to BTIG analyst Mark Palmer, “Twitterverse was abuzz with commentary about the potential for the company to face a margin call on its recently issued, bitcoin-backed term loan.”

However, the top-rated analyst stated that Saylor commented that MSTR “would need to maintain $410mm in bitcoin as collateral underpinning the $205mm loan, and that it had 115,109 bitcoins available to shore up that collateral as needed such that any qualms regarding a margin call were plainly unwarranted.”

According to Palmer, Saylor added that this margin call buzz was just “FUD” – “fear, uncertainty, and doubt.”

The analyst remained optimistic about the stock, with a Buy rating and a Street-high price target of $950 based on a “sum-of-the-parts (SOTP) analysis in which we combine the value of the company’s holdings of bitcoin and the value of its enterprise analytics software business.”

Palmer’s valuation assumes that the price of BTC will be $90,000 by the end of 2023. The analyst’s price target implies an upside potential of 349.7% at current levels.

MSTR also has a Strong Buy consensus rating based on three Buys and one Hold from other Wall Street analysts. The average MSTR stock forecast is $542.67, implies 155.8% upside potential from current levels.

Signature Bank (NASDAQ: SBNY)

Signature Bank is a full-service commercial bank based out of New York “with 38 private client offices throughout the metropolitan New York area, including those in Connecticut as well as California and North Carolina.”

SBNY also has some of its deposits in cryptocurrency. According to Wedbush analyst David Chiaverini’s estimate, it is around $29 billion. Shares of SBNY have also tanked 41% year-to-date.

Similar to Silvergate, Chiaverini also put forth a hypothetical scenario where $29 billion of its crypto deposits were to leave the bank. In this scenario, the analyst hypothesized that “SBNY’s 2023 EPS could be negatively impacted by ~20% relative to our existing estimate.”

While the analyst’s current EPS estimate for 2023 is $29, crypto deposits leaving the bank could drag down this EPS estimate to $22.50. According to Chiaverini, “SBNY’s valuation is attractive even if we removed crypto from our estimates.”

As a result, the analyst reiterated a Buy on the stock but lowered the price target from $375 to $295, implying upside potential of 55.8% at current levels.

The rest of the analysts on the Street are also bullish about the stock, with a Strong Buy consensus rating based on 11 unanimous Buys. The average SBNY stock forecast is $380.18, implying 101.1% upside potential from current levels.

Coinbase Global (NASDAQ: COIN)

Coinbase, a cryptocurrency exchange platform, is another stock whose stock price has taken a beating following the drop in crypto prices. Yesterday, the stock plunged 9.9% to close at $63.03. Year-to-date, the stock has cratered by approximately 73% and is currently trading far off from its yearly high of $368.90.

COIN has also decided to go slow on hiring new employees as the crypto market continues to struggle. To add to the company’s woes, COIN’s Q1 results didn’t seem to reassure investors.

The company reported revenues of $1.17 billion, falling short of analysts’ expectations of $1.5 billion. Its net loss came in at $1.98 per share versus a profit of $3.05 per share in the same period a year back. Analysts were estimating a profit of $0.05 per share.

Moreover, COIN’s trading volumes declined to $309 billion in Q1 from a record $548 billion in Q4.

However, Needham analyst John Todaro remained optimistic about the stock as he continues “to see longer-term growth opportunities for the company” regarding blockchain rewards and cloud subscription services.

While Todaro reiterated a Buy rating on the stock, keeping in mind these long-term opportunities, the analyst did reduce his estimates for Q2 and now expects revenues of $1.03 billion in Q2, from an earlier $1.54 billion.

The analyst also reduced the price target by more than half from an earlier $360 to $173 “on macro and crypto market uncertainty.” Todaro’s price target implies an upside potential of 150.3% at current levels.

However, Wall Street analysts are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 14 Buys, four Holds, and two Sells. The average COIN stock forecast is $177.39, implying 158.9% upside potential from current levels.

Bottom Line

From the above list, it is evident that even with the volatility in crypto prices, Wall Street analysts continue to remain bullish about stocks heavily invested in cryptocurrency.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure