Shares of Intel (INTC) fell 11.68% at the market close on Friday, following the release of its third-quarter 2021 results after the markets closed on October 21. The company’s non-GAAP earnings of $1.71 per share surged 58.3% year-over-year. Revenues of $18.09 billion, which excludes the NAND memory business, were up 4.8% year-over-year.

Despite the year-over-year rally, the third quarter turned out to be the sixth consecutive quarter to incite negative sentiment among investors. The pessimism wiped off $26.6 billion of market capital. According to the outlook provided by management, Intel’s capital spending plans are expected to be a drag on the gross margins.

Following the results, Needham analyst Quinn Bolton weighed in on the company’s fundamental developments and plans, saying he believes that possibly “the only good news is that the bad news is out.”

Firstly, the company brought in a new CEO, Pat Gelsinger, which, Bolton believes can be good for Intel. “With new CEO Pat Gelsinger, we believe Intel will be able to identify weaknesses in its processor roadmap and re-establish its processor performance leadership,” explained the analyst.

Still, the biggest concerns causing a buzz on Wall Street were the capital expenditure and Research & Development plans for the next 2-3 years. Management says they will lead to a decline in non-GAAP gross margin and keep free cash flows under pressure.

Nonetheless, Bolton sees a silver lining in the cloud stemming from Intel’s divestment strategy. He said, “Further, we think Intel plans to protect its share in DCG (Data Center Group) from Advanced Micro Devices (AMD) by competing more on price while regaining its technological leadership with 7nm (process-based chips). While likely drag on gross margin, we believe Intel’s recent success in improving its GM through divesting lower-margin businesses and gradually improving 10nm cost savings can help partially offset the gross margin pressures from more competitive pricing.”

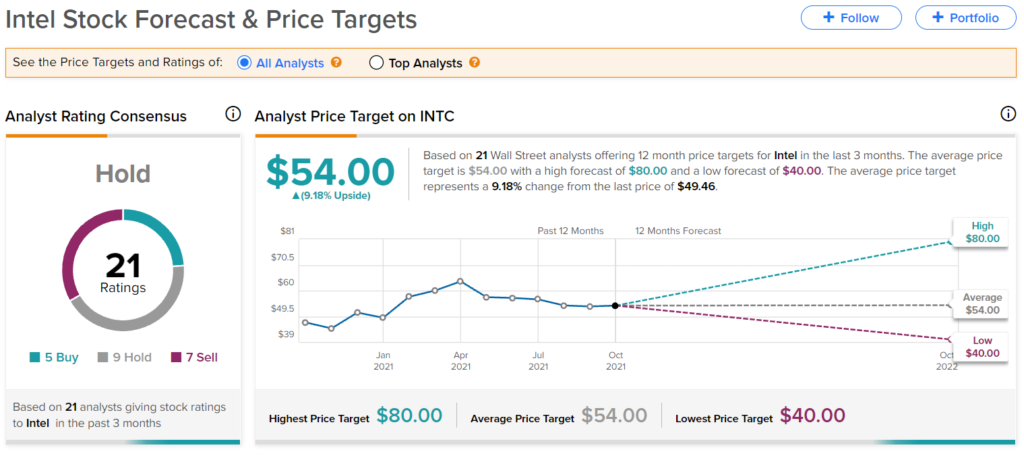

Bolton reiterated a Buy rating on the stock, with a price target of $60. Turning to Wall Street, the analyst consensus, however, seems to be cautious about Intel, with a Hold rating based on 5 Buys, 9 Holds, and 7 Sells. The average Intel price target of $54 indicates an upside potential of 9.18%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclosure: At the time of publication, Chandrima Sanyal did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.