Top-rated Wedbush analyst Daniel Ives cheered Apple’s fiscal Q3 results and commented that the growth and demand story remained robust for this Cupertino technology giant.

Shares of Apple (NASDAQ: AAPL) have gone up 13% in the past month even as the challenging macroeconomic environment has raised concerns about the tech major’s Q3 results.

Apple’s Fiscal Q3 Results

Apple generated record Q3 revenues of $82.96 billion, up 2% year-over-year, beating the consensus estimate of $82.59 billion. This figure was despite supply chain constraints, currency fluctuations, and the impact of the closing of its business in Russia. The increase in revenues is attributed to strong iPhone and Services sales.

Indeed, the company’s product segment sales set a record in the June quarter with revenues of $63.4 billion. Apple’s product business consists of the iPhone, iPad, and Mac range of products.

Apple CFO, Luca Maestri, stated on its fiscal Q3 earnings call that its Services business “set a June quarter revenue record of $19.6 billion, up 12% over a year ago, with all-time revenue records in the Americas and the rest of Asia Pacific and June quarter records in Europe and Greater China.”

The Apple Services business consists of Apple’s advertising, cloud and payment services, and digital content services.

Meanwhile, earnings came in at $1.20 per diluted share, compared to $1.30 a share in the year-ago quarter. However, the Q3 EPS exceeded analysts’ estimates of $1.16 a share.

Apple’s Fiscal Q4 Outlook

Apple remained optimistic about its Q4 outlook and expects revenues to “accelerate” year-over-year despite an adverse impact of around 600 basis points due to exchange rate fluctuations. The company’s management stated on its fiscal Q3 earnings call that it expects supply chain logjams to ease up in Q4 when it comes to its products business.

However, when it comes to its Services segment, Apple anticipates revenues to increase in the September quarter, but sequentially, this revenue growth could decelerate as a result of macroeconomic volatility and currency fluctuations.

Apple has projected a gross margin to range between 41.5% and 42.5% in Q4.

Apple’s China Market is on a Rebound

China is an important market for Apple and comprised 17.6% of its sales in the June quarter with revenues of $14.6 billion.

Apple CEO, Tim Cook, commented on this market during its Q3 earnings call. Cook pointed out that the Services business in China “grew strong double digit better than the company average, and they set a new June quarter revenue record during the quarter.”

Ives viewed Apple’s performance in China as a “Top Gun Maverick type feat for Cook & Co. given the ongoing COVID shutdown and speaks to the overall demand story seen with Apple.”

Ives retained a Buy rating and a price target of $200 on the stock, implying an upside potential of 27.1% at current levels. The analyst’s price target is close to the stock’s Street high price target of $210.

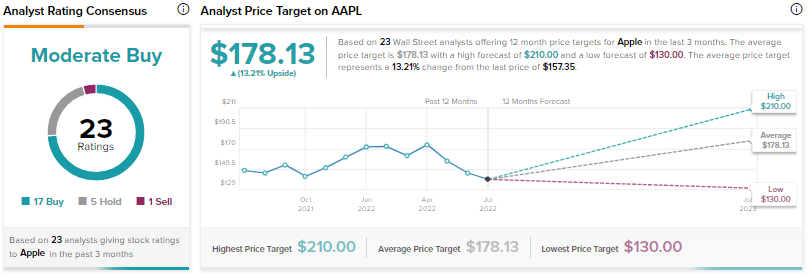

Wall Street analysts remained cautiously optimistic about Apple with a Moderate Buy consensus rating based on 17 Buys, five Holds, and one Sell. At the time of writing, the average Apple price target was $178.13, which implies an upside potential of 13.2% at current levels.

Bottom Line

Apple’s upbeat Q3 results, especially in a volatile macro environment, are good news for Apple’s investors and analysts alike.

Apple scores a nine out of 10 on the TipRanks Smart Score system, indicating that the stock is highly likely to outperform the market.

The TipRanks Smart Score system is a data-driven, quantitative scoring system that analyses stocks on eight major parameters and comes up with a Smart Score ranging from 1 to 10. The higher the score, the more likely the stock will outperform the market.