Apple (AAPL) stock is attempting to stage a rebound from a brutal plunge into bear-market territory. Though the iPhone maker found itself in the minority group of FAANG stocks that clocked in stellar quarterly results this earnings season, the stock could not hold its own with the S&P 500 (SPX) plunging as fast as it was.

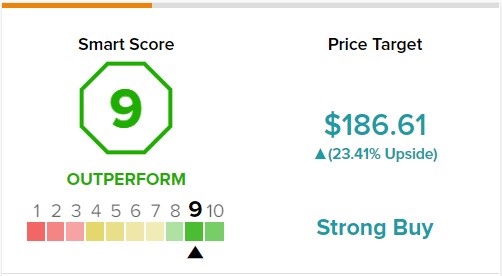

However, on TipRanks, AAPL receives a Smart Score rating of 9 out of 10, indicating that there is a high chance for the stock to outperform the broader market.

Though Apple’s latest round of results was extraordinary, the cautious guidance caused investors to throw in the towel. More supply-chain constraints are expected to hit Apple’s June quarterly revenues by as much as $8 billion. COVID-19 lockdowns in China have weighed heavily on many firms.

Although Apple did a great job navigating through similar disruptions in the past, China’s zero-COVID policy adds a considerable layer of uncertainty to an already hazy macro environment.

Could the coming $4-8 billion sales hit be one of many from flip-flopping lockdowns in China? Or could the worst already be in the rear-view mirror, with Shanghai scheduled to lift lockdowns on June 1?

It’s impossible to tell at this juncture, but it’s hard to imagine a scenario where Apple won’t be able to make up for lost sales in a future quarter once operations are back up to full speed.

As Apple looks to get operations back in order, the company has another potential catalyst up its sleeve that could power the stock higher: the VR/AR headset. Reportedly, Apple demoed its headset to the board of directors. Little is known about specifics, but showcasing the cutting-edge device in private could signify that it’s almost ready for prime time.

Though metaverse (or omniverse) hype has faded, with Meta Platforms (FB) and other tech stocks plunging violently in response to rising interest rates, Apple’s headset could reignite excitement in a hurry. Undoubtedly, it’s been such a long time since Apple unveiled something to the magnitude of the original iPhone. Its mixed-reality headset could be the device that takes the metaverse concept and runs with it.

With China’s lockdowns scheduled to lift for summer and a VR/AR headset that could be less than a year from launch, I remain bullish on Apple stock.

VR/AR Headset Could Have a Sizeable Impact on Apple Stock

Apple’s VR/AR headset went from an exciting rumor to something that could help take the stock to the next level. Undoubtedly, Apple is unlikely to demo something to its board of directors until it has a relatively-polished product on its hands.

With the recent trademarking of “realityOS,” Apple’s next game-changing device feels as close as ever. Indeed, it’s an exciting time to be an Apple investor, with the stock down around 17% from its all-time high, given how material the mixed-reality headset could be.

Even if the VR/AR headset has entered its advanced stages, it’s difficult to forecast when Apple will pull the curtain on its latest innovation.

The company’s annual WWDC (Worldwide Developers Conference) is just a few days away. Though the conference unveils many cutting-edge innovations, it’s unlikely that the VR/AR headset will be unveiled at such an event. The device could land in the back half of 2022. Further, I wouldn’t be surprised if the company needs time to add more polish.

Should Meta be Scared as Apple Looks to Reinvent the VR/AR Headset?

Currently, Meta is one of the go-to metaverse plays for investors. CEO Mark Zuckerberg has not shied away from its plans and intentions. Its Oculus Quest and Cambria headsets aim to be one of the top devices in the VR/AR headset market. However, there are many other challengers already, including HTC and Valve. Nonetheless, it’s arguable that Meta has the edge, given its deep pockets and renewed focus.

Still, it’s tough to get excited about Meta and the current state of its metaverse lineup. Meta’s VR-based social platform Horizon Worlds recently eclipsed 300,000 users, with impressive growth since its launch.

As Apple aims to reinvent the VR and AR experience, with its more than 1 billion active iPhone users, it could easily take away the shine from Meta.

For now, the last thing Apple CEO Tim Cook should do is rush his efforts, as Zuckerberg did. Only when the device and software are ready to impress will Cook give the green light for launch.

Wall Street’s Take

Turning to Wall Street, AAPL stock comes in as a Strong Buy. Out of 27 analyst ratings, there are 21 Buys and six Hold recommendations.

The average Apple price target is $186.61 implying upside potential of 23.4%. Analyst price targets range from a low of $160.00 per share to a high of $210.00 per share.

The Bottom Line on Apple Stock

After a steep valuation reset, Apple stock trades at 24.6 times trailing earnings. That’s a price that’s too cheap to pass up, given the VR/AR headset in the pipeline and the alleviation of COVID-19 supply-chain disruptions likely to accompany the lifting of lockdowns in China.

Read full Disclosure