The tech surge has appeared limp lately, with hints a possible trend reversal might be on the way. But Apple (AAPL) stock is having none of it – yet. Along with the share price reaching new milestones on an almost daily basis, the giant from Cupertino is rewarded with another boost from Wall Street’s analyst corps.

Joining the fray, Merrill Lynch analyst Wamsi Mohan bumped up his price target for Apple from $390 to $410, implying modest potential upside of 6% from current levels. No change to Mohan’s rating, which remains a Buy. (To watch Mohan’s track record, click here)

So, why amid a pandemic, which has resulted in a contracting economy and high unemployment rates, does Apple’s share price keep soaring? On a fundamental level, Mohan believes several “improving trends” are helping to fuel the surge.

Among these Mohan counts “continued strong App store revenue growth.” Based on third part data, in fiscal 3Q, App Store revenue increased by 30% year-over-year, while overall in fiscal 2020, App Store sales are up by 23% compared to last year.

Mohan adds to the list “lower iPhone channel inventory,” and the fact that Apple’s trade-in prices are lower than those of third parties, indicating to Mohan that “near term demand is robust enough and does not need incremental incentives.”

Additionally, a Merrill Lynch smartphone survey revealed Apple fans displayed strong brand loyalty, with the iPhone representing the “stickiest” of all smartphone brands. This is hardly surprising for a brand boasting hardcore fans known to queue overnight outside of Apple stores before a new product launch.

However, the fundamental analysis doesn’t tell the whole story. Mohan argues investors view Apple as a safe place to park their cash for another set of reasons.

These include, “(1) a liquid investment to weather an uncertain environment, (2) a tech “story” stock with a catalyst of 5G, (3) a large cap tech name relatively less exposed to the regulatory risks (including recent EU tax related litigation win), (4) a beneficiary of passive inflows, and (5) an alternative to low rates.”

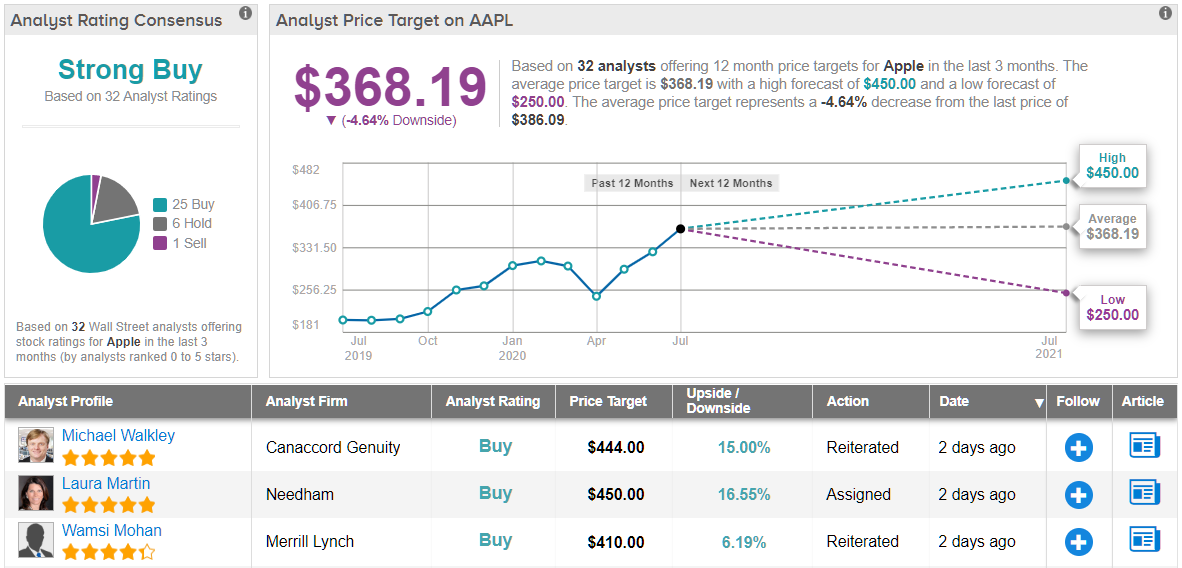

Apple has plenty of support from the rest of the Street, too. AAPL’s Strong Buy consensus rating is based on 25 Buy ratings, 6 Holds and 1 Sell. On the other hand, the $368.19 average price target indicates the analysts expect shares to drop by nearly 5% from current levels. (See Apple stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.