Another iPhone reveal, another underwhelming post-keynote reaction in shares of Apple (AAPL), which continues to drag its feet into late September.

While the iPhone 13 lacked any breakthrough feature such as satellite connectivity, which some people expected, there’s no denying the incremental upgrades that had Apple users lining up (digitally) to get their pre-orders in.

In any case, I remain bullish on AAPL stock, as the first round of iPhone 13s are shipped to the many fans who pre-ordered. (See Apple stock charts on TipRanks)

Apple’s iPhone 13 Reveal

Undoubtedly, Apple stuck with its Base, Pro, and Pro Max models, with the added surprise of a Mini model, for its latest slate of iPhones.

Other than the new iPhone, there was a long-awaited update to the iPad Mini and Apple Watch Series 7. The whole keynote was rather unexciting, apart from the intriguing drone shots that took keynote viewers through some incredible Californian scenery.

Apple stock has sagged considerably, flirting with a correction before bouncing back modestly to around $145 per share. Despite no must-have features or surprises, the iPhone 13 still has the potential to be one of Apple’s best sellers in years.

The new design didn’t change massively, or include satellite connectivity, as some speculators had hoped. Still, Apple fans can look forward to the slightly smaller notch, increased battery life, incredible new A15 Bionic chip, a much-improved camera, and some Pro-exclusive features, among other incremental improvements.

Pricing Sweet Spot

Most iPhone 12 users will probably hold off on the 13, as the upgrades may not be worth paying one’s way out of a telecom contract a year early. Still, many iPhone users are due for an upgrade, and they’re also getting a great value proposition.

As you may know, few firms have the magnitude of pricing power as Apple. They can ask nearly $800 for a pair of headphones (the AirPods Max), and many Apple users won’t think twice about the price.

The company’s brand is unmatched, as too is its ability to raise prices, inflationary environment or not. That’s why it was an exciting move when Apple decided not to hike prices through the roof on its iPhone 13 lineup, especially given the fact that inflation is running rampant.

The iPhone is still not cheap. But gig-for-gig, models remain nearly static versus last year’s devices. Why didn’t Apple hike prices considerably to further pad investors from the recent surge in inflation?

With a 1TB option on its “most Pro” model, customers will likely be beckoned in by relatively reasonable prices, only to pay up more for the extra storage. Apple’s decision to keep prices modest may be to really take market share in what could be the “prime phase” of this 5G upgrade cycle.

Add trade-ins, which reduce prices further, sweetened telecom subsidies, and BNPL (Buy Now, Pay Later) options into the equation, and the stage looks to bet set for an incredible top-line beat, the likes of which we may not have seen since the radically redesigned iPhone X upgrade cycle.

Wall Street’s Take

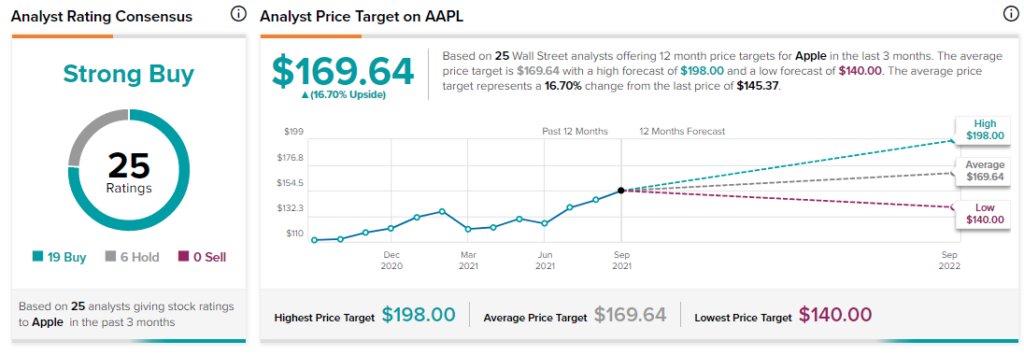

According to TipRanks’ consensus analyst rating, AAPL stock comes in as a Strong Buy. Out of 25 analyst ratings, there are 19 Buy recommendations, and 6 Hold recommendations.

The average AAPL price target is $169.64. Analyst price targets range from a low of $140 per share, to a high of $198 per share.

Bottom Line

While the keynote wasn’t too impressive, analysts seem to be liking the iPhone 13’s chances of moving shares higher over the next 12 months.

Early signs point to the iPhone 13 being a profound success, both in the U.S. and in China, where Chinese e-commerce retailer JD.com (JD) sold 3 million pre-orders on Day 1.

Apple’s website was also reportedly overwhelmed by pre-orders, which can only bode well for future results.

Disclosure: Joey Frenette owned shares of Apple at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.