The influence of Generative AI on cloud providers has become more evident in 2023, but its effect on the edge computing domain has yet to manifest itself. However, that is all about to change, says Morgan Stanley analyst Erik Woodring.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“As AI permeates into new consumer use cases, we expect the edge to become an emerging enabler of AI inferencing in 2024 given the benefits of lower query costs, improved latency, greater personalization, better data security/privacy, and easier accessibility,” the analyst opined.

While the tech giants have dominated the AI theme so far, one name has been conspicuously absent from the conversation. Yet, according to Woodring, that is about to change, too, with the biggest tech giant of them all, Apple (NASDAQ:AAPL), about to enter the frame.

“While some investors question Apple’s AI intentions, we believe Apple will be an AI enabler,” Woodring went on to say. “For AI to provide truly differentiated outcomes, it needs to leverage unique data sets, and Apple’s 2B+ devices and 1.2B+ users generate more insightful data than most platforms we can think of.”

When combining Apple’s strong emphasis on data privacy, alongside its cutting-edge smartphone and PC hardware, all vertically integrated across hardware, silicon, software, and services, Woodring thinks Apple has the potential to become a “true ‘AI Enabler’ in ways many others can’t.”

According to Woodring, Apple’s potential monetization of generative AI could follow five probable paths: Hardware share gains, new avenues for traffic acquisition costs (TAC), better Services monetization, App Store purchases, and a premium Siri subscription service.

Due to the enhanced AI user experience Apple would offer, Hardware share gains are “the most likely outcome.” Woodring reckons that for every point of smartphone market share Apple could add through AI, it would result in an additional 12 million iPhone units sold, approximately $11 billion in revenue (equivalent to 3 points of company growth), and an increase in EPS ranging from $0.13 to $0.19.

Regarding Services, through methods such as expanding user penetration, raising prices, or establishing new commercial distribution agreements, including traffic acquisition costs (TAC), should result in improved monetization.

“Finally,” adds Woodring, “Apple could launch a premium Siri subscription service, and we estimate that if Apple charged just $5 per month for Siri, every 10% penetration of the iPhone installed base would drive an incremental $7B+ of high-margin Services revenue per year, or about 7 points of growth to Services.”

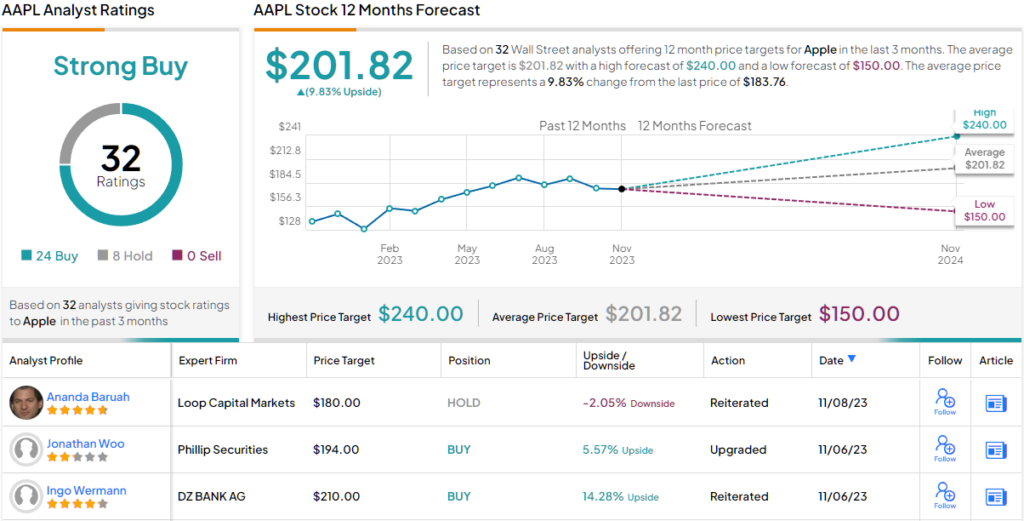

With that confident outlook in tow, Woodring maintained an Overweight (i.e., Buy) rating on Apple shares to go alongside a $210 price target, implying the stock will climb 14% higher over the coming months. (To watch Woodring’s track record, click here)

Elsewhere on the Street, AAPL claims an additional 23 Buys and 8 Holds, all coalescing to a Strong Buy consensus rating. The average target currently stands at $201.82, making room for one-year growth of 10%. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.