The recent decline in Apple (AAPL) stock of more than 13% from its peak might be just what the doctor ordered for long-term growth investors. After all, buying the dip on this stock has proven to be a winning long-term strategy for investors, historically-speaking.

Those who bought the dip following the COVID-19 outbreak have seen gains of approximately 133.8% since the stock’s March 2020 lows. That’s certainly not a bad return for 15 months’ work. (See Apple stock chart on TipRanks)

However, the nagging question many investors have is – just how long is Apple’s growth runway? Is this a stock that can continue to “wow” its customer base, and avoid the inevitable margin deterioration that competition and product fatigue create?

Let’s discuss why Apple may indeed continue to overcome these obstacles. These obstacles have been the driving force behind most of the recent selloffs in AAPL stock we’ve seen in recent decades.

Continued Innovation to Drive Investment Thesis in AAPL Stock

Investors in AAPL stock seem to come for the growth, but stay for the innovation. Indeed, Apple’s next “big thing” is always right around the corner. Accordingly, this is a stock that never seems to fail when it comes to aggressively tackling new segments.

The next “big thing” investors seem to want to see is an Apple Car. Entire websites have been set up to discuss rumors around what’s potentially going on with “Project Titan” and Apple’s work on autonomous driving technologies.

However, in the absence of the Apple Car, which will most certainly (maybe?) be announced soon, Apple has been hard at work driving innovation with its current product line.

BofA Securities recently released an intriguing note on Apple’s current upgrade cycle and near-term prospects. Among the items of note, a strong 5G upgrade cycle and improved margins due to a pandemic recovery in growth markets and higher-end product and services sales drew the attention of analysts.

Of course, iPhones continue to comprise the majority of Apple’s current revenue stream. While the company has been hard at work making services and other high-margin revenue streams a greater percentage of its overall business, iPhone sales are still the line item most in view for investors in AAPL stock.

Accordingly, if this 5G upgrade cycle proves to be as strong as analysts believe, Apple could see some near-term momentum.

But wait, there’s more.

The company’s planned refresh of its Apple Watch lineup stands to provide some nice additional revenue diversification for investors. Indeed, if consumers buy into the upgraded health features, spanning display and speed upgrades, AAPL stock could continue to see gains buoyed by faster earnings growth.

Additionally, the success Apple has seen with its M1 chip release has been noted by investors. The hope is that through increased adoption of the Mac (in all its forms), consumers will buy into the entire Apple ecosystem. This “halo effect” is one key reason Apple has been so successful. Investors are betting Apple’s closed ecosystem will continue to produce results.

What Analysts Are Saying About AAPL Stock

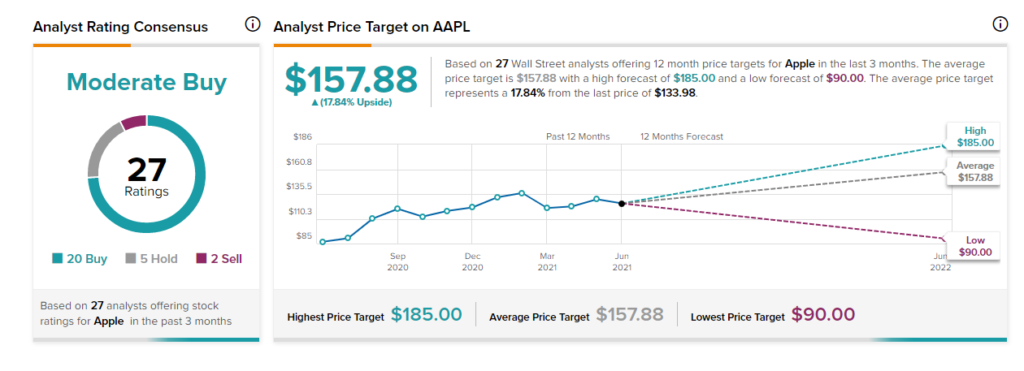

According to TipRanks’ analyst rating consensus, AAPL stock comes in as a Moderate Buy. Out of 26 analyst ratings, there are 19 Buy recommendations, 5 Hold recommendations, and 2 Sell recommendations.

As for price targets, the average analyst Apple price target is $157.88. Analyst price targets range from a low of $90.00 per share to a high of $185.00 per share.

Bottom Line

Investors betting on Apple are making a long-term bet on the ability of this company to continue to innovate its way toward sustained long-term growth. Investors who have bet on this company in the past haven’t been disappointed. Thus, it’s easy to see the argument that now is not the time to give up on this beacon of American innovation.

However, there will always be some nagging questions in the minds of many new investors in AAPL stock as to whether this sort of innovation can be sustained. Accordingly, we’ll likely see additional selloffs over time.

That said, the best thing to do with long-term winners like AAPL stock is to hold through the volatility, and buy the dips if possible. This most recent correction, albeit small, looks like an attractive entry point for investors today.

Disclosure: Chris MacDonald held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.