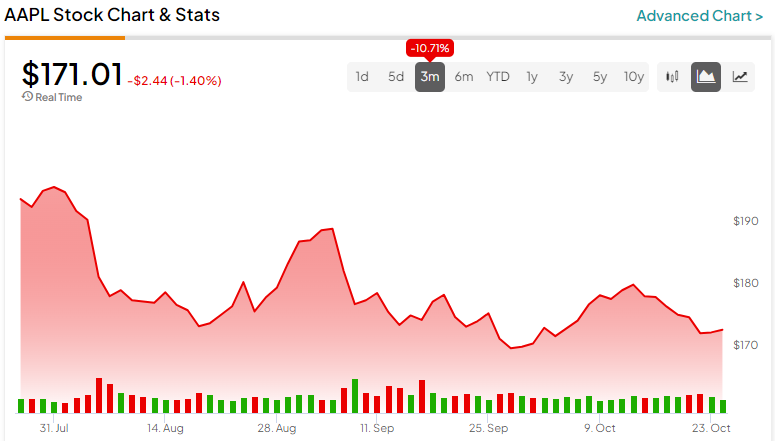

Apple (NASDAQ:AAPL) stock is stuck in the same rut it fell into back in August. Undoubtedly, a plethora of bad news has acted as an overhang on the stock, weighing it down by enough to make it one of the cheapest of the “Magnificent Seven” stocks, at least according to its trailing price-to-earnings (P/E) multiple. Things are looking grim from a macro vantage point, with rates on the 10-year Treasury note creeping higher, but that’s not all.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

They’re also looking quite grim for the latest iPhone 15, with many firms stepping forward, remarking on lackluster sales projections in China. Despite recent negativity, I remain incredibly bullish on Apple stock as the valuation seems modest given the long-term fundamentals, which remain strong.

iPhone 15 Feels the Heat as Chinese Sales Look Sluggish

Apple’s iPhone 15 has seen notable, upgrade-worthy updates to its predecessor. That said, overheating concerns were a hot topic (sorry for the pun) that was quick to be raised by early consumers.

Fortunately, Apple was quick to issue a hotfix in its latest iOS update for heat issues that were apparently software-related and not due to “compromises made in the thermal design,” as Apple analyst Ming-Chi Kuo previously pointed out.

Even with the heat issues out of the way, the iPhone 15 line is experiencing a slow start in China. This can be attributed to Huawei’s advancements and previous reports of the Chinese government advising its staff against using iPhones at work.

In any case, China has since denied any iPhone bans. And with Apple CEO Tim Cook reportedly meeting with the Chinese Commerce Minister, I’d argue there’s a good chance that Cook could ease the tensions and help the iPhone 15 have a strong finish in China after a relatively slow start, according to analysts like those at Jefferies.

For now, China concerns seem overblown, and Cook’s charm is perhaps discounted. At around 29 times trailing P/E and around 26 times forward P/E, Apple certainly looks to be the value play of the “Magnificent Seven” batch, which has grown more expensive in recent months.

Why Pay a High Multiple for a Slowly-Growing Company?

If we’re looking at the rear-view mirror and the immediate road ahead, then sure, Apple stock may struggle to break out to a new high. However, if you consider viewing Apple through a longer-term perspective, I do think the current valuation, which is on the high end even for Apple standards (Apple stock’s five-year historical P/E lies at 25.8 times), will prove more than worthwhile.

Though it seems like a long, long time ago that Apple unveiled its Vision Pro spatial computer (or mixed-reality headset, if you prefer), its release is just around the corner. And sales expectations seem modest at best.

The real upside could lie in an unexpected surge in demand after enough Apple fanatics have had a chance to test one out in the Apple Store. When it comes to new tech, especially devices that cost more than $3,000, you really must try before you buy. Early signs suggest those who try the device will be blown away. Not many people have had the privilege of trying the Apple Vision Pro, but many of those who have (think tech reviewers and influencers like Marques Brownlee and iJustine) were impressed.

There’s a major difference between being just impressed and forking-out-$3,500-to-buy-the-device-on-the-spot level of impressed. Only time will tell how the Vision Pro fares. At this juncture, however, you’d be hard-pressed to find anybody on Wall Street who believes the device will have a material impact on the stock in the near future.

Yes, it’ll take time before Vision Pro has a chance to disrupt. The price tag is a major hurdle for all but the most affluent Apple consumer. Indeed, there were notable groans heard when Apple revealed the pricing of its headset back in June. For now, YouTube tech reviewer Marques Brownlee thinks the Vision Pro is a “rich person’s toy” after giving the device a go for 30 minutes.

However, as Apple shrinks the form factor and upgrades the hardware over time, it’ll start becoming less of a toy and more of an essential product that a big chunk of Apple’s billions of users may consider buying, perhaps within the next three years.

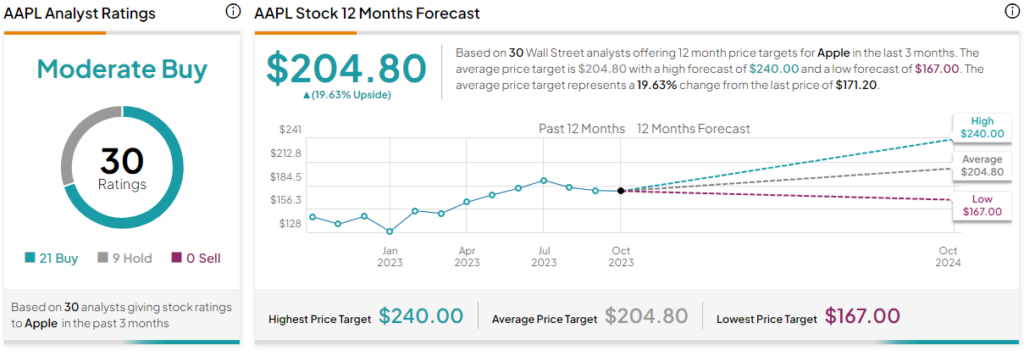

Is AAPL Stock a Buy, According to Analysts?

On TipRanks, AAPL stock comes in as a Moderate Buy. Out of 30 analyst ratings, there are 21 Buys and nine Hold recommendations. The average Apple stock price target is $204.80, implying upside potential of 19.6%. Analyst price targets range from a low of $167.00 per share to a high of $240.00 per share.

The Bottom Line on Apple Stock

For an investor looking to put money to work for the next three years, Apple stock does certainly seem like a great value here, while it’s trading at around $171 per share. In three years’ time, I believe there’s a good chance Apple stock could command an even higher multiple as we gain greater clarity from Vision Pro and its expedition into the virtual world.

Finally, let’s not forget about Apple’s AI upside potential (Hey, Siri, when’s the next big update?) as well as the continued progress of its A and M-series chips.