Shares of Apple (NASDAQ: AAPL) have tanked 16.7% this year as investors have been concerned about the impact of rising interest rates and soaring inflation on the premium technology retailer. Apple is expected to announce its fiscal Q3 results on July 28, and investors will be watching closely how these macroeconomic challenges affect the company’s topline performance.

However, top-rated Rosenblatt Securities analyst Barton Crockett is of the opinion that Apple is likely to out-perform its peers in fiscal Q3 and will likely exceed consensus estimates. Let us look at the reasons behind the analyst’s confidence in the stock.

Apple’s Fiscal Q3 Outlook

Wall Street analysts expect Apple to generate revenues of $82.97 billion, while analyst Crockett has projected Apple to generate revenues of $83.5 billion. Apple had refrained from giving any kind of Q3 revenue guidance, citing supply challenges and disruptions due to COVID that were impacting customer demand in China.

Consensus estimates peg the fiscal Q3 earnings at $1.16 per share, while analyst Crockett’s estimate stands at $1.17 per share.

Sales of Apple’s iPhone & Macs Could Trend Higher in Q3

Crockett has projected iPhone sales of $39.2 billion in fiscal Q3, a decline of 1% year-over-year. However, the analyst cited Canalys data to point out that while globally, smartphone shipments dropped 9% year-over-year in the June quarter, Apple’s iPhone shipments were up 7%.

The Mac could generate sales of $8.6 billion, reflecting a growth of 5% year-over-year, according to the analyst.

Apple’s Sales in China Could Be on the Rebound

Apple CFO, Luca Maestri, had warned on its fiscal Q2 earnings call that the impact of supply chain logjams and chip shortages could result in a revenue hit of between $4 billion and $8 billion, “which is substantially larger than what we experienced during the March quarter.”

But Crockett has stated that unit shipment data on a monthly basis from the China Academy of Information and Communications Technology indicates that international mobile phone shipments (mainly Apple) rebounded in the June quarter, up 24% year-over-year versus a 24% fall in shipments for local brands.

The analyst added that although there “hasn’t always been a great correlation historically between Apple’s China revenues and this shipment data. But it’s still a supportive backdrop.”

China is an important market for Apple and comprised 18.8% of its total sales in the March quarter.

Crockett’s Take on APPL

Analyst Crockett is positive about Apple’s 10-year deal to carry all of Major League Soccer (MLS) on its Apple TV platform. This deal, which was announced back in June, is worth $2.5 billion and will be in effect from next year.

However, the analyst still worries about the future. The analyst pointed out that even if the company performed remarkably well in the June quarter, concerns remained. Crockett cited a trade press report from Digitimes, which stated that Apple plans to initially produce 90 million of its new iPhone 14s. This ties in with the analyst’s estimate of unit growth in the low single digits for iPhone 14.

However, Crockett questioned whether, given the high rate of inflation, consumers would “hold off or trade down in devices?”

As a result, the analyst remained sidelined on the stock with a Hold rating and a price target of $168 on the stock, implying an upside potential of 10.8% at current levels.

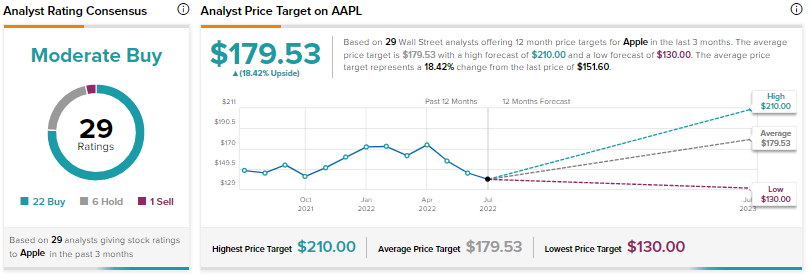

The rest of the analysts on the Street, however, are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 22 Buys, six Holds, and one Sell. The average Apple price target of $179.53 implies an upside potential of 18.4% at current levels.

Bottom Line

While Apple could sail through the June quarter, it still remains to be seen how the macro volatility could impact this tech retailer over the medium to long term.

Apple scores a nine out of 10 on the TipRanks Smart Score system, indicating that the stock is highly likely to outperform the market.

The TipRanks Smart Score system is a data-driven, quantitative scoring system that analyses stocks on eight major parameters and comes up with a Smart Score ranging from 1 to 10. The higher the score, the more likely the stock will outperform the market.