After a slow start to the year, Apple (AAPL) stock appears to be picking up steam. Along with some of its peers in the mega-cap group, the tech giant will report the June quarter’s (FQ3) results today. Canaccord’s Michael Walkley thinks Wall Street is underestimating the progress being made at the world’s most valuable company.

“Apple continues to demonstrate the strength of its product ecosystem, and we believe consensus estimates will prove conservative for Q3 results and Q4 guidance should Apple return to providing guidance,” the 5-star analyst wrote.

In fact, heading into the print, to reflect his growing confidence, Walkley has made some adjustments to his AAPL model.

The F3Q21 EPS estimate is raised from $0.94 to $1.03 and C2021/C2022 EPS estimates are increased from $5.12/$5.49 to $5.45/$5.85, respectively.

The new targets are a reflection of “strong demand trends” for Apple’s flagship product – the iPhone.

Walkley’s surveys suggest healthy iPhone 12 demand “at leading U.S. carriers.” And in combination with a big promotional push, the analyst thinks the iPhone product line is set to generate higher revenue what the Street is accounting for. As such, Walkley raised his June quarter iPhone estimate from 45 million units to 47 million units.

However, it is not only the iPhone which appears to be outperforming. “Strong growth trends” are continuing across all product lines, with Apple “outperforming its competitors across all hardware categories,“ whilst Apple’s services segment is also expected to maintain “high-teens double-digit growth.”

In fact, looking ahead, Walkley anticipates “higher-margin services revenue growth” to charge ahead of total company growth and “drive gross margin expansion.”

It all adds up to a long list of reasons to back Apple’s continued success.

“With the 5G upgrade cycle likely a benefit through at least C2022, other hardware categories growing double-digits, and continued mix shift toward high-margin services, we believe the share price remains compelling for longer-term investors,” the analyst summed up.

Adding to the revisions above, then, Walkley also has a new price target for the shares. The figure moves from $165 to $175, suggesting 12-month returns of 18%. No need to add, Walkley’s rating stays a Buy. (To watch Walkley’s track record, click here)

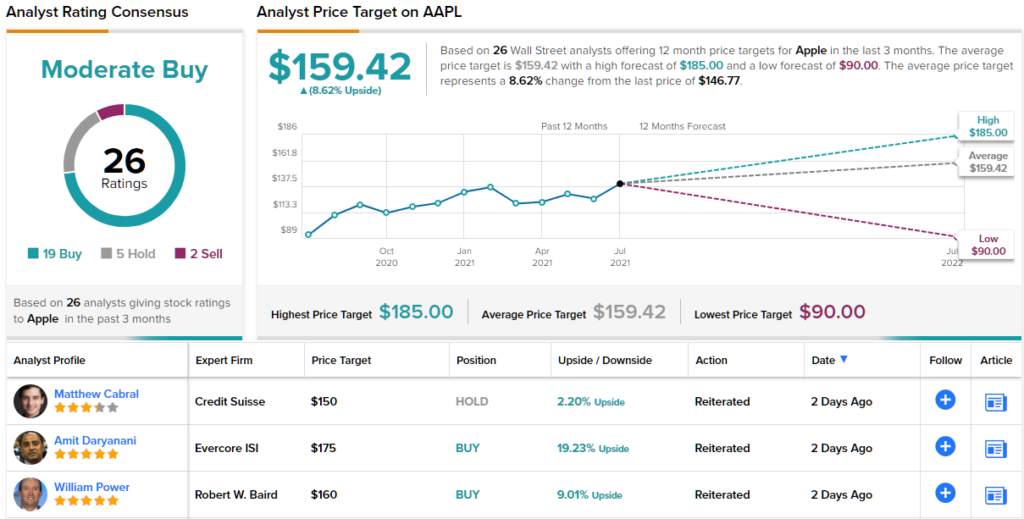

Most of Walkley’s colleagues agree, although a few have some reservations. The stock’s Moderate Buy consensus rating is based on 19 Buys vs. 5 Holds and 2 Sells. The average price target suggests more modest returns; at $159.42, the figure implies ~9% upside for the year ahead. (See Apple stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment