The cliché says, ‘May you live in interesting times.’ We certainly are, as far as the stock markets are concerned. The strong bull market of 2021 turned into a full-on correction as 2022 got underway, but an upturn this month has moderated the year-to-date losses. The main takeaway for investors is volatility; it remains to be seen if the March gains are here to stay, or just transitory.

No matter which way the market goes, investors can always find a clear path forward in the stock reviews from the Street’s best analysts. These are the top stock pros, with long-term reputations for successful calls on equities. The top analysts can boast success rates better than 70%, and an average return, based on the performance of the stocks they review, of 25% or higher. (See the Top Wall Street Analysts chart)

So let’s get started following some top analysts, choosing them based on their great track records. The TipRanks database tracks over 7,900 of Wall Street’s analysts. We’ll look at three stocks which have been recently recommended by analysts rated at the very apex of the field.

Ambarella (AMBA)

First up is Ambarella, one of the semiconductor chip industry’s fabless firms. This simply means that Ambarella designs its chips, promotes and markets them, and may produce limited numbers of prototypes, but outsources the large-scale manufacturing of the silicon chips to larger chip foundries. Ambarella chiefly designs and distributes chips for video applications, specialized for high-res video compression and advanced image processing. The company’s chips are found in applications ranging from solid-state pocket vidcams to action cameras to dashboard cams to wearable cameras to drones, and are even found in broadcast television.

Ambarella’s shares saw a sharp drop at the end of February, coinciding with the Feb 28 release of the company’s fiscal 4Q22 financial results. A look into the numbers will show us both strength and weakness, and may shed some light on the shares’ performance.

To start with, Ambarella reported $90.2 million at the top line, and 45 cents per share at the bottom. These were significantly higher than year-ago values of $62.1 million and 14 cents, the EPS beat the forecast by over 7%. However, the revenue guidance of $88.5 million to $91.5 million for fiscal 1Q23 was a little light compared to consensus expectation of $90.9 million. Management’s stated belief that margins will contract slightly going into fiscal 2023 did not help, either.

Top analyst Quinn Bolton, rated #2 overall in the TipRanks database, is not worried, and paints an upbeat picture of Ambarella’s prospects in the long term.

“In the current environment for semiconductor equities, where investors appear increasingly concerned that the semiconductor industry may be getting late into the current upcycle, we believe investors are quick to sell companies that see any increases in channel or customer inventory levels. While we understand these concerns for semiconductor stocks that may have exposure to the broader semiconductor cycle, we believe these concerns are unfounded for companies such as Ambarella that are secular growth stories,” Bolton opined.

Looking closer at the company’s prospects, Bolton writes: “Demand remains robust, CV adoption is expanding across the IoT camera and automotive segments driving blended ASPs higher and the automotive pipeline is building, with a significant opportunity for L2+ vehicles.”

To this end, Bolton rates AMBA shares a Buy, and his $175 price target suggests the stock has ~82% upside ahead of it. (To watch Bolton’s track record, click here)

Overall, this stock has picked up 15 analyst reviews recently, and they break down to 13 Buys, 1 Hold, and 1 Sell, for a Strong Buy consensus view. The average price target of $177.07 implies a one-year upside of ~84% form the current share value of $96.01. (See AMBA stock forecast on TipRanks)

DZS (DZSI)

Let’s stay in the tech sector, and take a look at DZS. This company lives in the network hardware niche, where it is a major supplier of broadband connectivity and communications software in the global markets. DZS provides a wide range of products and services, including optical line terminals, P2P switches, residential and business gateways, wi-fi access points, and mobile and optical edge solutions. DZS also provides customer support centers, professional services, and consulting services.

Broadband is big business, generally, and has gotten a boost from the corona crisis and its push toward increased remote and online activity. DZS has seen that boost stay in place in the past year. For 4Q21, the most recent reported, the company showed $98 million in revenue, at the top end of the previous published $80 million to $100 million guidance. The company’s adjusted EPS, however, came in 5 cents, missing the 9-cent forecast by 45%.

Looking forward, however, there is reason to believe that a broadband access firm like DZS can make gains in the near- to mid-term. In her recent comments in Louisiana, Vice President Harris reminded us that the Administration is pledged to spend $65 billion on buildouts of broadband access in rural and other underserved areas; this represents an clear opportunity for a broadband hardware provider.

Stifel analyst Tore Svanberg, ranked #20 overall, acknowledges the expansionary environment for broadband when he writes, “The company’s differentiated high-speed broadband and X-Haul wireless solutions are well positioned to capitalize on increased spending in support of more pervasive broadband build-outs in both North America and Europe as well as continued rollout/densification of 5G network deployments.”

“We expect these opportunities, along with increased geographic revenue diversification and competitively differentiated software services, to provide upside to margins over time and believe our estimates could prove conservative given our expectation for market share gains over the next few years,” the top analyst added.

Svanberg’s comments back up his Buy rating, while his $20 price target implies the stock has a 50% upside in the next 12 months. (To watch Svanberg’s track record, click here)

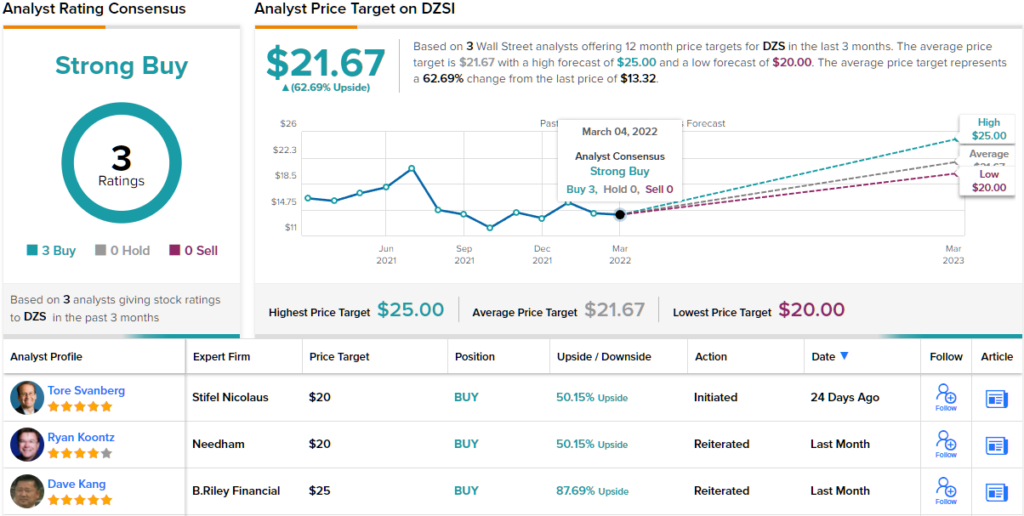

Like Svanberg, other analysts also take a bullish approach. DZSI’s Strong Buy consensus rating breaks down into 3 Buys and zero Holds or Sells. Given the $21.67 average price target, shares could climb ~63% in the coming twelve months. (See DZS stock forecast on TipRanks)

Ceva, Inc. (CEVA)

Last up is another semiconductor company, Ceva. Ceva focuses on DSP, or digital signal technology, and its products form an essential link in wireless tech; DSP has vital uses in the consumer, industrial, IoT, and mobile wireless niches. Ceva’s products have found uses in a wide range of applications, from 5G mobile infrastructure to AI networks to virtual reality headsets. In short, Ceva fits into the connection, no matter how it is made.

Ceva posted strong financial results for 4Q21. In the report, released last month, the company noted that the top line hit a quarterly record, for the third consecutive quarter – Q4 revenues came in at $34, which was also a company record for a single quarter. Non-GAAP diluted EPS, at 22 cents, was up 10% from the year ago quarter. For the year as a whole, the top line rose from $100.3 million in 2020 to $122.7 million in 2021, a gain of 22%.

Even though the financial results were strong, CEVA stock has failed to gain much traction lately. Shares are down 27% in the past 12 months. Some analysts, however, see this an opportunity for investors to get in at a discount.

Kevin Cassidy, of Rosenblatt Securities, is one. He writes of Ceva, “We see the company having transformed from a licensor of IP cores to a licensor of IP platforms including full turn key integrated circuit development. This change increases leverage both in license and royalty revenue. CEVA’s design expertise has growing importance as IoT products need to be connected locally or through the cellular network. Further, the recent share price pull back has offered an interesting entry point.”

Cassidy, who holds the #32 spot in the TipRanks database, sets a Buy on CEVA, along with a $60 price target that indicates potential for ~54% upside this year. (To watch Cassidy’s track record, click here)

There are only three recent share reviews for Ceva, but they are in agreement: this is stock is a Buy. The average price target is $58, suggesting ~49% upside from the share price of $39.01. (See CEVA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.