Anyone involved in the investing game will know it’s all about “stock picking.” Choosing the right stock to put your money behind is vital to ensure strong returns on an investment. Therefore, when the Wall Street pros consider a name to be a “Top Pick,” investors should take note.

Using the TipRanks platform, we’ve looked up details on three stocks that have recently gotten ‘Top Pick’ designation from some of the Street’s analysts.

So, let’s dive into the details and find out what makes them so. Using a combination of market data, company reports, and analyst commentary, we can get an idea of just what makes these stocks compelling picks for the second half of 2021, and why all three are rated as Strong Buys by the analyst consensus.

Mimecast, Ltd. (MIME)

We’ll start with Mimecast, a cloud-based cybersecurity company with a focus on email management. The company’s products offer customers protection from ransomware, data loss, supply chain impersonation, brand exploitation, and other forms of email-related security breaches. Mimecast got its start in 2003, and is based in London, UK.

MIME has been reporting sequential quarterly revenue gains in every quarter for the past two years. The most recent print, for Q4 of fiscal year 2021, had beats on both the top-and bottom-line, showing $133.9 million of revenue, up 17% from the year-ago quarter. EPS came in at 9 cents, more than double the F4Q20 report of 4 cents. Mimecast generated $24 million in free cash flow during the quarter.

Mimecast achieved these sound results on the heels of strong retention numbers. The company reported a net revenue retention rate of 104%, with an upsell rate of 113%. Management noted that Web Security, Awareness Training, and Internal Email Protection were particular points of strength, with the segments adding 300, 800, and 900 customers respectively. While these numbers are objectively good, they represent a slide for MIME; pre-pandemic revenue retention was consistently near 110%.

Mimecast works hard to keep its product offerings strong, to maintain those retention numbers. In one example, earlier this month Mimecast announced a new product, CyberGraph, that uses AI to detect phishing and impersonation attacks.

Nehal Chokshi, 5-star analyst with Northland Securities, notes that the retention rate is down, but points out that it is rising – and that management has plans in place to address the issue. He writes, “As employment levels begin to rise, which our channel checks as well as our pulse of small business call from June 23rd indicate is a tailwind, the effective 600bp of net revenue retention rate from declining employment levels should reverse. Less obvious is increased customer loyalty that should show up as reducing churn as FY22 plays out as a result of (1) MIME working with customers in distress from the pandemic and (2) continued increase in # of SKUs per customer to 3.5, from 3.3 at the beginning of the pandemic, which has historically correlated with higher loyalty as well.”

Chokshi rates MIME as Outperform (i.e., a Buy), as befits a Top Pick, and his $80 price target implies a one-year upside of 45%.

Overall, MIME derives its Strong Buy consensus rating from 10 reviews, including 8 Buys and 2 Holds. The shares are trading for $55.24 and their $62.90 average price target suggests room for another 14% in price appreciation. (See MIME stock analysis at TipRanks.)

Read more: 2 Top Picks From a Top Analyst on Wall Street

Super Micro Computer (SMCI)

Sticking with tech, we’ll look at Super Micro Computer. This information tech company specializes in server-based computing, designing and producing blades, networking devices, rack solutions, servers, and server management software for data centers, cloud computing applications, and high performance computing.

The pandemic showed an opening for companies able to supply the infrastructure needed for cloud and data center applications – exactly Super Micro Computer’s niche. The company announced in June that it had expanded its manufacturing capacity and doubled its output. SMCI now boasts that it can deliver over two million servers annually. The move to increased production is meant to meet the rising global demand in cloud and data storage.

Super Micro reported in May its results for the second quarter of fiscal year 2021, coinciding the calendar Q1. Revenue was up, both sequentially, by 7.8%, and year-over-year, by 16%. EPS came in at 35 cents, 6 cents better than the same quarter last year. Both results beat the analysts’ expectations. The company used $124 million of cash flow in operations, and reported capex of $19 million. Total cash holdings at the end of the quarter was $179 million, against a bank debt of $85 million.

A stable niche business, expanding production, and a sound balance sheet have all impressed Northland’s Chokshi, who covers SMCI. He writes, “With the expanded lower cost manufacturing base, we expect SMCI’s superior efficiency emanating from the company’s unique building block architecture to drive share gains with large hyperscale data centers… We believe shares are extremely attractively priced at 10x EV/NI on a FY22 basis.”

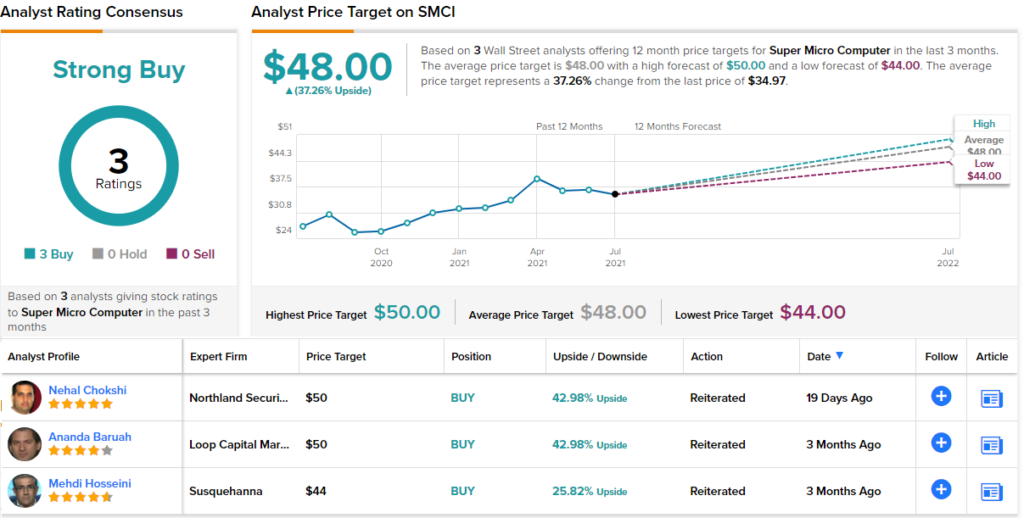

As another of Chokshi’s Top Picks, SMCI also gets an Outperform (Buy) rating. The analyst’s $50 share price target implies 43% appreciation over the coming year.

This stock has an asset that investors should always note – a unanimous rating from the Wall Street consensus. All three recent reviews have been positive, making for a Strong Buy rating on the shares. SMCI has an average price target of $48, implying a 37% upside from the share price of $34.97. (See SMCI stock analysis at TipRanks)

Scotts Miracle-Gro Company (SMG)

Let’s shift gears. The last stock on our list is, in the analyst’s view, an unorthodox call – but it’s worth a closer look from investors. Scotts Miracle-Gro is well known as a maker of garden products – RoundUp brand weed killer, various plant foods, and seeds. In addition to RoundUp, the company’s brands include Ortho and the eponymous Miracle-Gro.

In addition to its traditional, long-time presence in the yard and garden market, Scotts has also moved into the cannabis market. The company’s Hawthorne subsidiary has seen strong growth in recent quarters, and management’s guidance for cannabis revenue growth in the full year 2021 is in the 40% to 45% range.

In the most recent quarter, Q2 (the company’s fiscal quarter ended on April 3), Scotts reported continued strong customer demand in all divisions, with overall US consumer sales rising 23%. Hawthorne’s sales led the way, and rose 66% in the second quarter. Total revenue came in at $1.83 billion, up 32% yoy, and EPS came in at $5.43, for a 52% gain. Once again, the results bettered the consensus estimates.

At the same time, Scotts shares are down 29% since they peaked in early April this year. In a counterintuitive way, the economic reopening may be partly to blame for this. As consumers head back to restaurants and brick and mortar retail, home and garden may take a backseat – and investors are pulling away from SMG in some anticipation of that effect. Truist analyst Bill Chappell notes this, as a ‘return to normal’ issue.

Chappell is still bullish on SMG, however, and sees current share price weakness as an entry opportunity. He describes the stock as a ‘favorite pick,’ and writes, “we note that the company has a track record of special dividends when it is flush with cash, and would not be surprised to see one announced before FYE. We believe the news-flow will become incrementally more positive for the [cannabis] legalization trend as we near election season… We continue to believe that the hydroponics industry is the safest way to play the cannabis legalization trend in the US. SMG is the clear leader in what we view as a duopoly.”

Chappell rates SMG shares as a Buy, and his $250 price target anticipates 38% share growth in the next 12 months. (To watch Chappell’s track record, click here.)

Chappell represents the bulls on Scotts, but he is not alone. The Strong Buy consensus rating is based on a 4 to 1 breakdown of Buys over Holds. The shares are priced at $180.41, with an average price target of $228.6 that implies an upside of 27% for the year ahead. (See SMG stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.