As the second quarter gets underway, the Street’s analysts are reiterating their Top Picks of the year. These are the stocks that are likely to ensure the best returns going forward.

Analysts have been analyzing each stock carefully, looking at its past and current performance, its trends on a variety of time frames, management’s plans – the analysts take everything into account. Their recommendations provide valuable direction for building a resilient portfolio.

Against this backdrop, we’ve used the TipRanks database to pull up details on three stocks that the Street’s analysts have tapped as Top Picks for 2022. Are these the right stocks for your portfolio? Let’s take a closer look.

BellRing Brands (BRBR)

First up is BellRing Brands, a spin-off firm from the well-known Post food company. BellRing focuses on active nutrition brands, and produces and markets a range of protein shakes, powder mixes and additives, and snack bars. The company’s most recognizable brand is Power Bar, which has a global reach.

In the last reported quarter, Q1 of fiscal year 2022, BellRing posted $306.5 million in revenue, rising 8.5% year-over-year. EPS, at 25 cents, was up ~67% y/y.

Investors should note that BellRing’s parent company, Post, recently divested itself of its holdings in BRBR. Prior to March of this year, Post had an 80% stake in BellRing; that has now been reduced to 14.2%. Post distributed its interest to its shareholders, who now hold some 57% of BellRing’s outstanding stock shares.

This stock gets ‘top pick’ status from BMO Capital, where 5-star analyst Kenneth Zaslow explains why: “In our view, BRBR is among the most undervalued food assets within our coverage given its likely recovery in earnings power. First, we believe BRBR should exceed consensus in F2023, as we expect it to achieve at least $300 million in EBITDA driven by consistent capacity investments over the next two years, more aggressive pricing actions, and ongoing momentum in powders. Second, POST’s distribution of its 80% ownership interest in BRBR should create liquidity to attract incremental shareholders.”

Zaslow’s comments come along with an Outperform (i.e. Buy) rating on the stock, and his $36 price target implies a one-year upside of 39%. (To watch Zaslow’s track record, click here)

This is hardly the only bullish view of this nutrition company. BRBR shares have 8 recent analyst reviews, including 7 Buys over 1 Hold, for a Strong Buy consensus rating. The stock is selling for $25.82 and its $31.86 average price target suggests its has 23% upside ahead of it. (See BellRing stock forecast on TipRanks)

Churchill Downs (CHDN)

Next up, Churchill Downs, is best known as the venue of the Kentucky Derby – North America’s premier horse race, run annually since 1875. Churchill Downs is also a parent company, owning additional race tracks as well as brick-and-mortar casinos in eight states, totaling 11,000 slot machines and over 200 games. In addition to all of this, Churchill Downs is also the owner of a major online betting venue for racing, sports, and casino games.

The COVID pandemic hit Churchill Downs hard, as it did most leisure and entertainment venues, and the company recorded a net loss of $81.9 million in the corona crisis year of 2020. Last year, however, saw a strong rebound as the pandemic began to recede, the economy reopened, and consumers started spending their pent-up savings – with a strong appetite for entertainment. Churchill Downs reported net income of $249.1 million in 2021, marking a huge turnaround. In the most recent reported quarter, 4Q21, the company showed a net revenue figure of $1.59 billion, up 52% year-over-year.

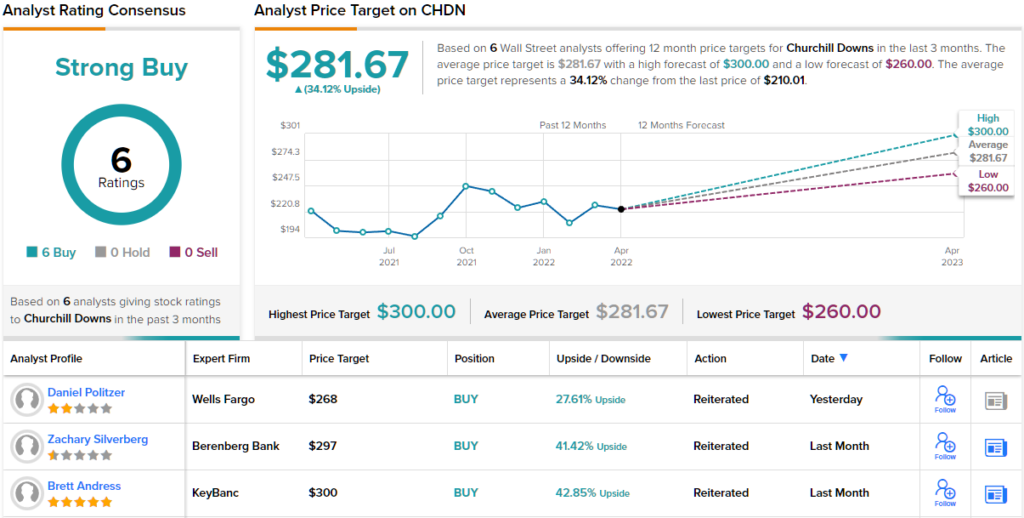

Berenberg analyst Zachary Silverberg is unequivocal about this stock – he says, ‘Churchill Downs remains our top pick.’ Getting into details, the analyst adds, “We favor Churchill Downs given the growth opportunities and strong margins across its gaming, racing, and historical racing (HRM) and digital segments, which generate strong cash flow. CHDN has an experienced management team, solid balance sheet, and near-term upcoming catalysts that should allow the stock to outperform, in our view.”

In line with these bullish comments, Silverberg sets a Buy rating on CHDN. His price target, at $297, suggests a 12-month upside of 41%. (To watch Silverberg’s track record, click here)

It’s not just that Silverberg calls this stock a Top Pick, Wall Street as a whole is bullish, too. The shares have a unanimous Strong Buy consensus, based on 6 positive analyst reviews. The average price target is $281.67, implying a 34% upside potential from the current trading price of $210. (See CHDN stock forecast on TipRanks)

MiMedx Group (MDXG)

The last Top Pick we’re looking at is MiMedx, a pioneer in placental biologics, using amniotic tissue in the development of regenerative medicines. The company has used this as a base to create a line of placental tissue allografts, patent-protected, through a proprietary process. So far, the company’s products have found use in the treatment of chronic non-healing wounds, offering wound covers that promote closure. The company also has a research pipeline focused on treating pain and improving function in patients suffering from degenerative musculoskeletal disease.

In the 4Q21 report, released in February, MiMedx showed $67.4 million at the top line. The quarterly revenue total was driven by a double-digit increase in product sales from the company’s existing portfolio of approved wound treatments. EPS for the quarter came to a 1-cent profit; this was a hefty turnaround from the 17-cent loss reported in 4Q20.

The company is moving to expand its footprint in the wound-treatment niche. In March of this year, MiMedx announced a partnership with the wound care management provider WoundGenex, a move that will make WoundGenex’s Premier Graft available to MiMedx’s client base.

This stock has caught the eye of Northland analyst Carl Byrnes, who writes, “We are reiterating our Top Pick 2022 as we believe MiMedx will witness significant acceleration of Section 361 AWC product sales in 2H22. Its long-term prospects remain compelling w/ topline growth of 11-14% sustainable for the foreseeable future, while be well positioned to witness potential accelerated topline growth in 2024 and beyond with entry into international markets and progression of mdHACM for the treatment of knee osteoarthritis (potential commercialization in 2026). The current valuation represents a compelling risk/reward profile…”

To this end, Byrnes gives the stock an Outperform (i.e. Buy) rating, and sets a $23 price target. His target implies a robust upside of 424% in the year ahead. (To watch Byrnes’ track record, click here)

Byrnes’ is one of two recent reviews on this stock, both of which are positive and support the Moderate Buy consensus rating. The shares are priced at $4.39 and their $15.75 average target indicates room for ~259% upside by the end of the year. (See MDXG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.