We’re getting near an inflection point in the markets, and change is in the air. In the immediate short-term, the Fed is expected to slow down on its rate-hike policy. While another rate hike – seventh for 2022 – is widely predicted for this month, Fed Chair Jerome Powell made it clear yesterday that the Fed will likely raise rates by 50 basis points, rather than 75.

Chalk that up to two factors: the slowdown in the rate at which inflation is increasing, per the October numbers, and the risk that pushing interest rates too high will tip the economy into a recession. Last month, inflation slowed its pace of increase from 8.2% annualized to 7.7%; and if inflation is starting to cool, then the Fed can scale back its rate hike policy on the not-illogical theory that a recession is becoming the larger macro risk.

A pullback from high rates will likely boost the stock markets, and following this line, Wall Street’s analysts are finding stocks with potential to jump as markets shift. Naturally, every investor would like to double their money, and some analysts have pointed out two stocks that may do just that.

Indeed, according to the TipRanks database, these stocks hold ‘Strong Buy’ ratings from the Street’s analysts, and boast triple-digit upside potential for the coming year. Let’s find out just why these stocks may double or more in the year to come.

COMPASS Pathways (CMPS)

The first stock we’ll look at is COMPASS, a biopharma firm with a sound position in the development of psychedelic drugs for the mental health sector. The company is actively pursuing the use of psilocybin as the base for new treatments of psychiatric disorders. Psilocybin occurs in nature, where it is an active ingredient of ‘magic mushrooms;’ COMPASS has harnessed it as the base for three clinical trial programs, in the treatment of treatment-resistant depression (TRD), post-traumatic stress disorder (PTSD), and anorexia. COMPASS’s TRD track received Breakthrough Therapy designation from the FDA several years ago.

The leading track follows COMP360, a potential treatment for TRD. Recent data from a phase 2b study released this month showed that 30% of patients showed remission at three weeks following a single 25mg dose. The trial is the largest study of its kind in TRD, and has demonstrated sustained responses at 12 weeks, along with a favorable toleration and safety profile. COMPASS is already planning a Phase 3 program, to start before the end of this year.

The same drug candidate, COMP360, is also undergoing study on the PTSD and anorexia tracks. COMPASS has ongoing Phase 2 trials of the drug against both of these conditions.

Berenberg analyst Caroline Palomeque looks at the potential of COMP360 going forward, and likes what she sees.

“It has been estimated by the National Institute of Health’s National Institute of Mental Health (NIH NIMH) that about 21 million people in the U.S. have MDD, and of these, 30.9%, or 8.9 million, have TRD. Compass has positioned COMP360 to be the first one-time dose and long-acting drug to treat TRD… In our view, COMP360 could generate ~$2.3bn in peak U.S. sales,

representing a multi-billion dollar market opportunity with low single-digit

penetration into the TRD market,” Palomeque wrote.

With an outlook like that, it should be no surprise that Palomeque sides with the bulls on this stock. His comments come with a Buy rating, and a $33 price target that indicates potential for a powerful 222% share growth on the one-year time horizon. (To watch Palomeque’s track record, click here)

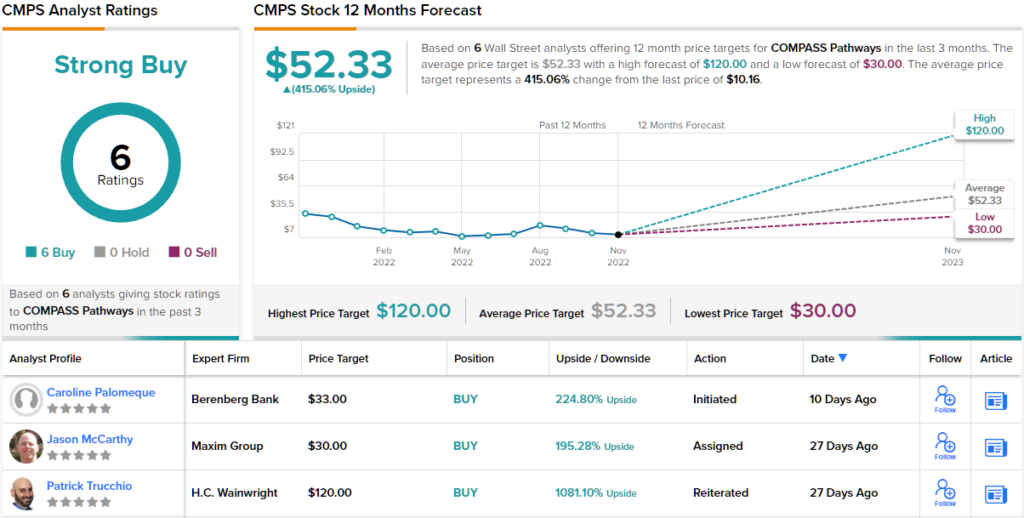

From the unanimous consensus on COMPASS, a Strong Buy based on 6 recent positive analyst reviews, it’s clear that the Street agrees with the bullish position on this stock. The shares are currently selling for $10.16, and their $52.33 average price target suggests a very impressive upside of 415% going forward. (See CMPS stock forecast on TipRanks)

Wallbox N.V. (WBX)

The next stock on analysts’ radar is Wallbox, a company that provides solutions for EV charging that are adaptable to customer needs. The Spanish-based company offers a wide range of chargers, suitable for both residential and commercial needs, and compatible with both Type 1 and Type 2 vehicle charger connections. The residential models are also capable of bi-directional operations, allowing customers to send power from a fully charged vehicle into their home or onto the grid.

During the recently third quarter, Wallbox achieved several important milestones. The company’s revenues, at 44.1 million Euros, grew 140% year-over-year, and were driven by an impressive 535% increase in North American business. Overall, Wallbox sold 67,000 chargers in the quarter, up 93% y/y. To support its growing US business, the company opened its first US factory during the quarter, in the state of Texas.

Covering this European EV niche firm for Northland, analyst Abhishek Sinha highlights its ‘powerful business model.’

“The in-house design, manufacturing and certification capabilities enable Wallbox to have very fast development cycles, adapt to the ever-changing global supply chain, never run out of stock, and expand to new countries without having to depend on international manufacturers,” explained Sinha.

“The business model is very scalable, which has allowed WBX to consistently achieve over 100% revenue growth rates year over year. The company has ~1 mm unit capacity today (assuming no product mix) which also differentiates it from its peers as WBX has built out capacity well in advance of when it would be needed,” the analyst added.

These comments support the analyst’s Outperform (i.e. Buy) rating on WBX, while his price target of $16 suggests a strong upside potential of 214% for the year ahead. (To watch Sinha’s track record, click here)

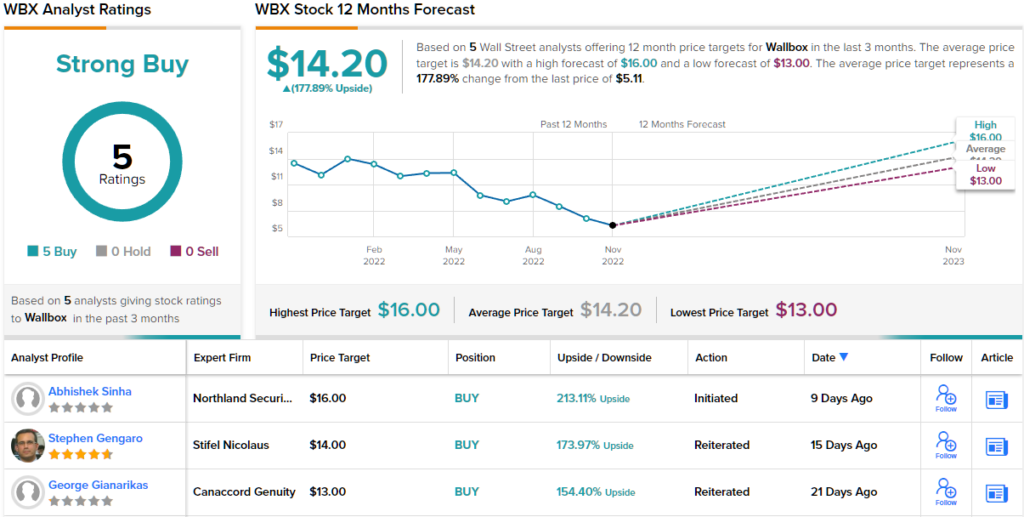

Overall, all 5 of the recent analyst reviews on this stock are positive, giving it a unanimous Strong Buy consensus rating. With an average price target of $14.20 and a trading price of $5.11, Wallbox boasts a potential gain of ~178% heading into next year. (See WBX stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.