The new year is upon us, and in preparation, the Street’s analysts have been lining up their top picks for 2023. It’s a bit of cliché, but a fun one – and one that can also bring some interesting stocks to investors’ notice.

Remember that the analysts have been watching the markets all year, keeping close track of past and current performance, and they’ve built up a picture that puts stocks into perspective. For the retail investor, the year’s accumulated analysis is a gold mine of data, helping bring some sense to the market – and the analysts’ Top Picks are a great tool for cutting right to the chase.

So, let’s get the latest scoop on some analysts’ Top Pick stocks for the incoming year. We’ve ran them through the TipRanks database to also gauge general Street sentiment toward these names. Here are the details.

Cytokinetics (CYTK)

First up on our ‘top pick’ list is Cytokinetics, a clinical-stage biopharma firm engaged in the discovery and development, for commercialization, of first- and next-in-class muscle activators and inhibitors, for the treatment of debilitating diseases that compromise muscle function and performance. The company’s drug candidates are small molecules engineered to effect contractility.

Over the course of 2022, this company benefited from having multiple programs in the pipeline – and that is still an advantage. But last month, the company announced that the FDA’s Cardiovascular and Renal Drugs Advisory Committee, by an 8 to 3 vote, decided that, based on Phase 3 trial results, the company’s drug candidate omecamtiv mecarbil did not show benefits that ‘outweigh its risks for the treatment of heart failure with reduced ejection fraction (HFrEF).’

Interestingly, however, in what might seem unusual behavior, the stock surged ahead following the negative decision. That is because the decision now lets the company focus its energies on the drug considered to have the bigger potential.

The company has another Phase 3 drug candidate, aficamten, which is also nearing the commercial stage. This drug candidate is undergoing the Phase 3 SEQUOIA-HCM study testing the drug on patients with symptomatic obstructive hypertrophic cardiomyopathy (HCM), with enrollment at 70 sites in the US.

Cytokinetics has plenty of cash available to cover expenses related to the shift in focus. As of the end of 3Q22, the company had cash and liquid assets totaling $896.2 million, compared to combined R&D and G&A expenses of $110.9 million, giving a cash runway sufficient for 8 quarters of operation.

This is a key factor for JMP’s Jason Butler, who has high hopes for aficamten. “The company noted that it expects to end 2022 with >$800MM in cash which we believe is a strong basis to fund broad aficamten development and commercial readiness. Management also commented that it will provide an update on enrollment in the aficamten Phase 3 SEQUOIA-HCM trial in the near term and indicated that progress is encouraging. We view results from this trial in 2H23 as a key value inflecting event for the company and drives our conviction for CYTK as a top pick for 2023.”

Accordingly, Butler gives shares in CYTK an Outperform (Buy) rating, with a $71 price target that implies a gain of 55% in the coming year. (To watch Butler’s track record, click here.)

Cytokinetics gets plenty of support on Wall Street; Its Strong Buy consensus rating is based on 11 recent reviews that include 10 Buys over just 1 Hold. The shares are selling for $45.82 and their $63.18 average price target suggests a one-year upside potential of 38%. (See Cytokinetics’ stock forecast at TipRanks.)

Calix, Inc. (CALX)

From biotech we’ll shift to cloud tech, and look at Calix. This company offers cloud computing and software solutions in the communications industry, with platforms and services for broadband providers and other digital communications customers. Calix’s products allow enterprise customers to drive business and customer interactions more efficiently, for effective monetization.

This company’s focus on enabling broadband and fiber comes at an opportune time, as the Federal Government’s recent infrastructure bill includes funding for such projects, especially in rural areas. This sets up telecom companies – and their supporting adjuncts, like Calix – for gains going forward. And in some cases, those gains have already become visible.

Calix beat its revenue and earnings estimates in its last reported quarter, 3Q22. The company showed $236.3 million at the top line, compared to previously published guidance of $211 million to $217 million. The top line was also up 37% year-over-year and came in $21 million above the analysts’ expectations. At the bottom line, non-GAAP EPS was reported at 34 cents, down from the 36 cents in 3Q21 – but well above the 18 cent to 24 cent EPS forecast in the guidance, and well above the 23 cents analysts had predicted.

In his coverage of CALX shares for Needham, analyst Ryan Koontz writes, “Broadband and fiber deployments are expected to see several more years of sustained growth, even in light of a challenging macro, and remain top of mind as we enter 2023. We designate CALX our top pick for the year and add it to Needham’s Conviction List… We see CALX in its infancy of upsell for its Calix Cloud software products which, offer recurring, high margin subscription revenue that can further transform its operating model. A diverse, non-concentrated customer base further reduces risk while easing supply chain and a recently elevated CEO instill execution confidence.”

Quantifying this stance, Koontz puts a Buy rating here, with a price target of $88 that indicates room for a potential upside of 29% in the year ahead. (To watch Koontz’ track record, click here.)

The Strong Buy consensus rating on this stock is unanimous, based on 7 recent reviews from the Wall Street analysts. The shares are trading for $68.43 and the $81.57 average price target implies that a gain of 19% lies ahead. (See Calix’s stock forecast at TipRanks.)

Cepton (CPTN)

Last on today’s list is Cepton, a maker of automotive LiDAR systems. These are the latest word in digitally based, laser ranging technology, and represent the state-of-the-art for automotive sensor technology, with particularly useful applications in the developing autonomous vehicle niche. In that niche, LiDAR will be the ‘eyes’ of the car, and the systems need to be both accurate and highly detailed. Cepton prides itself on delivering LiDAR units that are both reliable and scalable, with long range, high resolution, and 3-dimensional perception.

LiDAR systems also have applications in other fields, such as satellite mapping. Cepton is involved in non-automotive applications, and its LiDAR units have found homes in ‘smart city’ technologies, enabling pedestrian, road, and rail traffic analytics. They can also be found in industrial robots and ground vehicles.

The automotive sector of the LiDAR business is the main attraction, however, and Cepton has a solid base there. The company is a partner with the Big 3 automaker GM, and provides sensor units for several platforms, including two upcoming Cadillacs. And, during Q3 of this year, Cepton signed an agreement to receive a $100 million investment from the Japanese original equipment manufacturer (OEM) Koito, which will provide funding for the company’s next stage of growth and LiDAR scaling.

Cepton is in the early stages of its growth, and the market for LiDAR systems is just beginning to open up. The company reported 3Q22 product revenue of $1.8 million, up 171% y/y. The firm’s net loss of 11 cents per share was a slight improvement over the 12-cent loss reported in the year-ago period. Cepton expects to see between $7 million and $9 million in total revenue for calendar year 2022.

5-star analyst Gus Richard, of Northland Securities, notes that Cepton has the ‘right product’ for the rapidly expanding automotive LiDAR industry, and he writes, “We believe that most of the auto OEM lidar activity involves 4 companies with CPTN being one of them. Two top-tier auto OEMs have moved from the RFI (request for information) stage to RFQ (request for quotation). RFQ includes price discussions and vehicle integration. One of the RFQs could be a lifetime award of over $1B. The Company has moved into an advanced engagement with a 3rd OEM, a top 10 OEM in North America. We believe that CPTN also recently engaged with a smaller European OEM.”

All of this adds up to a “Top Pick” from Richard, with an Outperform (Buy) rating, and a $4 price target that implies a robust upside of 215% by the end of the year. (To watch Richard’s track record, click here.)

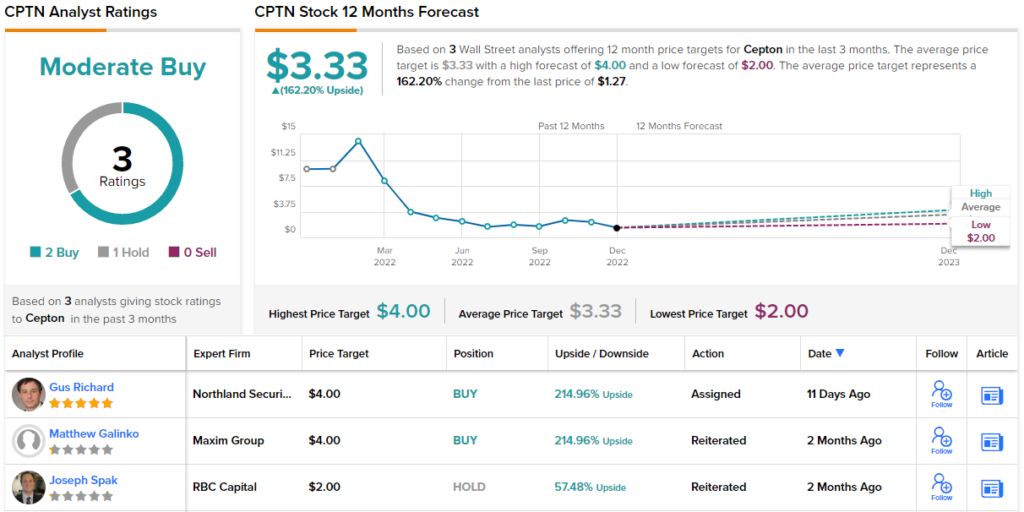

Overall, Cepton holds a Moderate Buy rating from the analyst consensus, based on 3 reviews including 2 Buys and 1 Hold. The shares are priced at $1.27 and have an average target of $3.33, suggesting a one-year upside of 162%. (See Cepton’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.