It’s a digital world, driven by retail consumption, but heavy industry is far from obsolete. Manufacturing, mining, construction, steel – all remain vital in today’s economy, and all provide plenty of opportunity for investors. A recent report of Credit Suisse makes a case for going bullish on steel.

The firm’s 5-star analyst Curt Woodworth writes of the US steel industry’s business phases, “What was once viewed as a more transitory supply-driven cycle has now transitioned to a more durable demand-led cycle, which is very broad based in terms of drivers, with renewable energy an underappreciated part of the story in our view.”

“Steel demand has sharply accelerated over the past quarter, and thus despite increased domestic & foreign supply, steel prices continue to move up with spot deals as high as $2000/st,” Woodworth adds, getting into details on why he’s upbeat for the US steel sector. “Given upcoming mill outages, a sizeable demand increase from automotive in 2H-21, broad based need to restock, and limited import arbitrage, the US market is set to remain tight till at least early 2022.” Current conditions, in Woodworth’s view, are setting the stage for solid performance in the next year.

So that’s the background. Now it’s time to find out if Wall Street agrees. Analysts have tapped a couple of steel firms as likely candidates for share price gains in the 40% to 60% range over the coming months. Using the TipRanks platform, we’ve looked up the details. Here they are, fleshed out with the analyst commentary.

ArcelorMittal (MT)

Based in Luxembourg, ArcelorMittal is the world’s largest steel producer, and a multinational corporation with ops in 17 countries – and customers in 160. The company has operations in all aspects of the steel industry, from mining the iron ore to shipping out finished steel products. A look at the 2020 numbers tells the story of the company’s size: 58 million metric tonnes of ore mined, 71.5 million tonnes of crude steel produced, and 69.1 million tonnes of steel shipments. Total revenues last year came to $53.3 billion.

Those 2020 numbers, while impressive, represented year-over-year declines due to the slowed operations, reduced demand, and disrupted supply chains of the COVID pandemic period. The economic reopening – proceeding apace in the US and Europe – bodes well for ArcelorMittal’s mid-term production potential.

This past spring and early summer, ArcelorMittal sold off its US operations to the American company, Cleveland-Cliffs (CLF). As part of the completion of that transaction, MT completed a $750 million stock buyback. The buyback returned to shareholders the proceeds from the sale of the company’s 38.2 million shares of Cleveland-Cliffs. Total proceeds from the sale of ArcelorMittal USA came to more than $1.9 billion, and the company returned all of that to shareholders via buyback programs.

Covering this industrial giant for Deutsche Bank, analyst Bastian Synagowitz notes a combination of factors that should support the share price over the short term. He writes, “Earnings risk at MT remains to the upside, as: 1) the western world remains in a recovery, 2) China’s changed export policy marks a structural change and 3) supply discipline has proven resilient as of late. As we expect shareholders to be rewarded with significant direct returns (both dividends and share buybacks), we believe that MT’s stock remains highly attractive.”

In line with these comments, Synagowitz rates the shares as a Buy, and his $43 price target implies an upside of 42% for the next 12 months. (To watch Synagowitz’s track record, click here.)

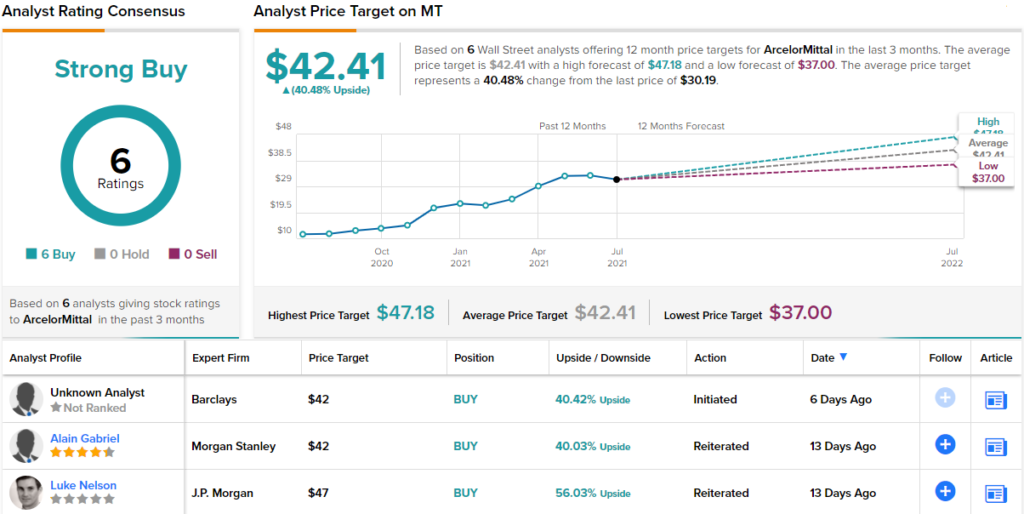

For now, shares in ArcelorMittal are selling for $30.19, and the average price target of $42.41 suggests a 40% potential upside this year. The stock’s Strong Buy consensus rating is based on 6 reviews and they are all positive, making the consensus unanimous. (See ArcelorMittal’s stock analysis at TipRanks.)

Schnitzer Steel (SCHN)

Next up is a big name in North America’s scrap steel market. Schnitzer has been in business for over a century, filling a vital niche: gathering, collecting, processing, and recycling scrap metals. The metals industry presents a unique opportunity for processing companies, as scrap metal can be recycled, processed into new products, and later recycled again. Schnitzer has 94 scrap metal collection facilities capable of processing 5 million tons of ferrous (iron-based, like steel) metals per year, along with 600 million pounds of non-ferrous metals. The company operates across the US and in Canada, and has 7 shipping facilities, located on the East and West coasts, plus Puerto Rico and Hawaii. In addition to its scrap metal purchasing, recycling, and sales activities, Schnitzer also runs 50 stores selling serviceable used auto parts – an important side product from automotive scrapping ops.

At the end of June, Schnitzer reported financial results for the third quarter, ending May 31, of fiscal year 2021. The report noted strong sequential gains in total sale volume, with a gain of 24% in ferrous metals, 15% gains in non-ferrous metals, and 12% in finished steel. It was the company’s best quarterly performance since the 2008 fiscal year.

Along with strong sales gains, Schnitzer also reported high revenues and earnings. At the top line, revenue was reported at $820.7 million, up a robust 103% year-over-year. Earnings came in at $2.15 per share, an enormous gain from the 18-cent EPS loss reported in the year-ago quarter.

In addition to solid financials, SCHN shares have been rising over the past year. The stock’s 12-month appreciation is an impressive 178%.

5-star analyst Gus Richard, from Northland Securities, notes several tailwinds in the metals industry that are supporting Schnitzer’s business, and adds that the company is particularly well-positioned to benefit. Richard writes, “We believe demand for scrap metal is likely to be robust for the foreseeable future driven by infrastructure spending, transition to a low carbon economy, the low carbon footprint of recycling material, and a limited increase in virgin material. SCHN is a leading metal and auto recycler with a significant NA footprint. We expect multiple expansion as investors recognize SCHN’s ESG credentials.”

Richard puts an $80 price target on SCHN shares, indicating his confidence in a 64% upside this year. He rates the stock as Outperform (i.e., a Buy). (To watch Richard’s track record, click here.)

While there are only 2 recent analyst reviews on Schnitzer, they both agree that this is a stock to buy – resulting in a Moderate Buy consensus rating. The company’s shares are selling for $48.88 and have an average price target of $72, giving an upside potential of 47% for the one-year time frame. (See Schnitzer’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.