There are many polarizing issues on the agenda at present; from Covid-19 vaccines to gun control to climate change to abortion rights to fuboTV (FUBO). Ok, the last one is not quite as much of a “flip your lid” subject as the others, but still. Investors have been pretty sure where they stand on this one with the bears claiming the bullish indicator – a history of over-delivering on guidance since going public just under a year ago – is just a fig leaf for an unprofitable business doomed to fail in the long run.

One analyst who has constantly pounded the table for FUBO is Needham’s Laura Martin. In fact, it is the bullish indicator noted above which heads up Martin’s list of “favorite things about FUBO.” The 5-star analyst notes that as a result, she has had to raise subscriber and rev estimates “after every quarter.”

Second on Martin’s list are the fundamental KPIs (key performance indicators), which are “all trending in the right direction.” These include growing subs, revs, ARPU (average revenue per user) and gross margins. At the same time, churn and CAC (customer acquisition costs) are heading in the opposite direction.

Next up is the potential from sports wagering, with free-to-play games launched this quarter and the Fubo Sportsbook on track to go live in Q4 – 2 years ahead of the slated launch promised during the IPO.

The stock’s valuation is also enticing. At 4.7x EV/2022E revs, compared to the average of 6.4x for the 6 other streaming companies under Martin’s coverage, it is “inexpensive.” What’s more, being a sports “pure-play” is a differentiator, particularly with NFL ratings so far trending 7% higher from the same period a year ago.

Lastly, FUBO’s advertising revenue is based on “very high margins” being 100% generated from CTV (connected TV).

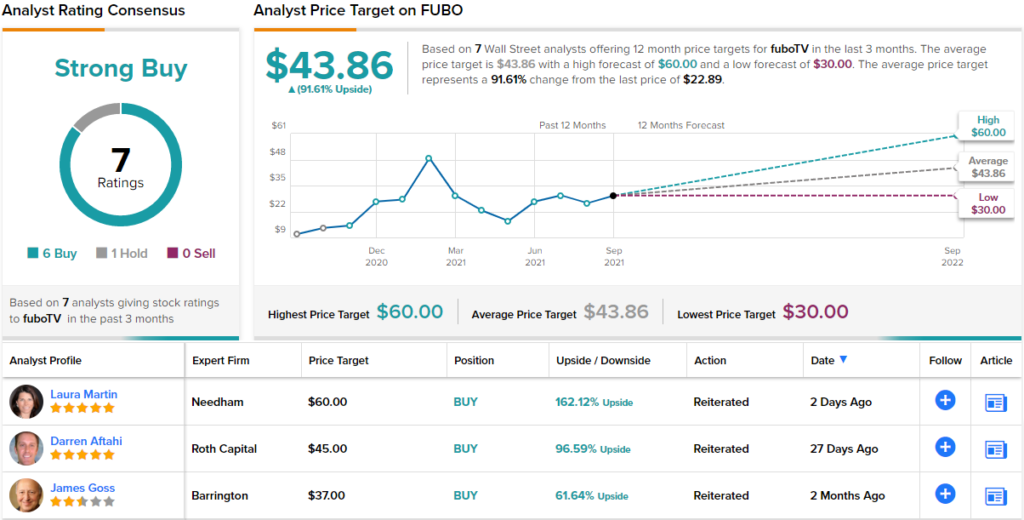

It should come as no surprise, then, that Martin rates FUBO a Buy. In addition, the analyst gives the stock a $60 price target, suggesting 161% upside potential. (To watch Martin’s track record, click here)

A glance at the consensus breakdown shows that barring 1 Hold, all other 6 recent reviews are positive, culminating in the stock’s Strong Buy consensus rating. While not quite as bountiful as Martin’s objective, the average price target is still a bullish one; at $43.86, the figure is set to generate returns of ~92% on the one-year horizon. (See FUBO stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.