E-commerce and cloud computing leader Amazon (NASDAQ:AMZN) is scheduled to report its third-quarter financials after the market closes on Thursday, October 26. The tech giant is expected to benefit from the strength in the cloud and advertising businesses, cost-cutting measures, and strong momentum in the e-commerce unit. Ahead of the company’s Q3 earnings release, several analysts remain bullish about AMZN stock and reaffirmed their Buy ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Overall, Wall Street expects AMZN to post earnings of $0.58 per share in Q3 compared to $0.28 in the prior-year period. Meanwhile, revenue is expected to rise 11.4% from the year-ago quarter to $141.54 billion.

Q3 Earnings: Here’s What Analysts Are Saying

Morgan Stanley analyst Brian Nowak projects the growth rate of the company’s Amazon Web Services (AWS) business to re-accelerate to the mid-teens, exiting 2023 and heading into the next year. Nowak reiterated a Buy rating on the stock with a price target of $175.

Another bullish analyst, Brian White of Monness, expects Amazon to reap the rewards from digital transformation, cloud technology adoption, new artificial intelligence (AI) products, and opportunities in healthcare. Additionally, the company’s skill in capitalizing on cost efficiencies adds to his favorable outlook.

Regarding Q3, the analyst expects AMZN’s revenue to grow 12% year-over-year to $142.34 billion. He projects Q3 EPS of $0.63. White anticipates that the company’s recent Prime Big Deal Days and AI developments will impact the results favorably. White reaffirmed a Buy rating on AMZN stock with a price target of $170.

Similarly, Brent Thill from Jefferies, who has a Buy rating with a price target of $175, views Amazon’s strategy to penetrate the $1.6 trillion U.S. grocery market as a significant opportunity. This strategy is supported by higher shopper frequency and the potential to capture about $200 billion in annual consumer packaged goods (CPG) advertising spend. The CPG ad spend provides a high-margin opportunity to significantly grow Amazon’s advertising business from its 2023 figure of $45 billion (estimate).

Finally, Thill emphasized the importance of Amazon expanding its physical presence beyond the existing 650 stores to support market share expansion.

Is Amazon a Buy or Sell Stock?

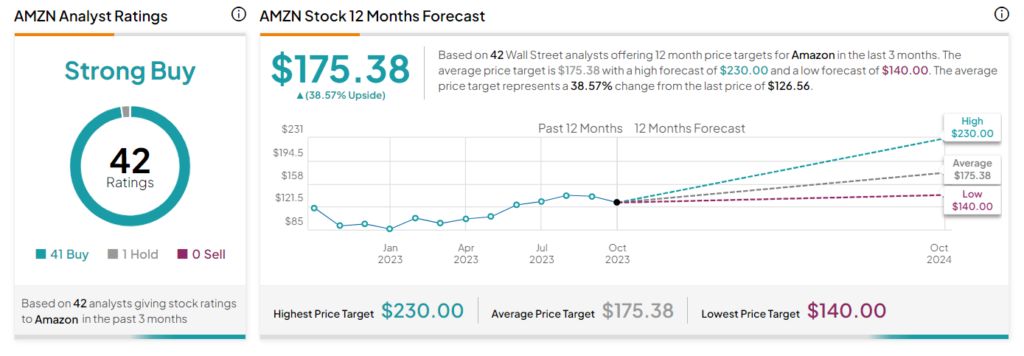

Of the 42 analysts covering Amazon stock, 41 have assigned a Buy rating, and just one has suggested a Hold in the past three months. Overall, the stock comes in as a Strong Buy. Meanwhile, the average AMZN stock price target stands at $175.38, implying an upside potential of 38.6%. Shares are up 47.5% year-to-date.

Insights from Options Trading Activity

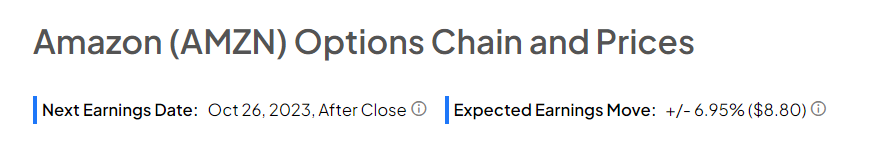

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 6.95% move on Amazon’s earnings. AMZN shares have averaged a negligible 0.41% downward move in the last eight quarters. In particular, the stock gained 8.27% in reaction to Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Note

Analysts remain optimistic about AMZN’s performance ahead of the third quarter results. Furthermore, the company’s strong market presence and diverse offerings are expected to drive further upside in the stock.