REITs (real estate investment trusts) are promising investments for investors who seek a bit of shelter from the recent barrage of broader market volatility. In this piece, we used TipRanks’ Comparison Tool to check out three intriguing U.S. REITs — AMT, EQIX, and PLD — awarded with a “Strong Buy” consensus rating from Wall Street. Of the three stocks, Wall Street is most bullish on PLD.

With well-covered, growing dividends and lower correlations to the S&P 500 (SPX) – by having betas below one – top REITs may be able to help your portfolio navigate through the rough waters of 2023.

Indeed, many pundits see 2023 as a recession year. Unfortunately, this will mark the second recession in three years. Though recessions tend to bring forth lowered earnings expectations for the broader basket of businesses, the magnitude of the damage to come from the next recession may prove mild, at least according to many pundits.

Though the REITs above haven’t been spared from the recent barrage of selling, I do think they’re better able to handle more of the same going into a potential recession year.

American Tower (NYSE: AMT)

American Tower is a cell-tower REIT that’s currently down about 20% from its all-time high of around $300. The firm owns and operates over 220,000 towers across a wide range of countries. Though a recession is on the horizon, the 5G wireless boom is still ongoing in the U.S. and other parts of the globe. The geographically-diversified tower REIT is a great way to play the trend that will outlive the looming downturn.

Though small cells may pose a competitive threat to towers in the latter half of the decade in the U.S. region, I do think the economics of towers will make the most sense for many years to come. If needed, American Tower can pivot accordingly if the underlying margins to be had in small-cell rollouts show promise.

For now, developing markets are looking to play catch-up with the U.S. on the cell tower front. With the growing demand for high-quality wireless networks, American Tower’s international business could show solid growth for many years to come.

At writing, shares of AMT sport a 2.4% yield. The payout is safe and subject to impressive growth over time. However, the 39.5x trailing earnings and 11.1x sales multiples may be offputting to value-conscious investors. American Tower is an incredibly resilient (0.5 beta) and stable cash-flow generator, but you will pay a premium price tag for exposure.

What is the Price Target for AMT Stock?

Wall Street thinks American Tower is worth the price of admission, with a Strong Buy rating and the average AMT stock price target coming in at $294.55 — implying nearly 24.8% in year-ahead gains from today’s close.

Equinix (NASDAQ: EQIX)

Equinix is a data-center REIT, which, like American Tower, provides the perfect balance of cash-flow stability and secular tailwinds. Shares are down more than 30% from their ~$882 all-time highs.

Despite the negative momentum and lofty multiple, Equinix stock seems to be touching down with a strong level of support in the $610-615 range. With a safe 2% yield and a 0.5 beta (the same as AMT), Equinix shares seem like a great way to smoothen the rough waters. Undoubtedly, the path behind Equinix has been anything but smooth. In any case, Equinix stands to benefit from the continued rise of data centers in the U.S. and abroad.

Like American Tower, it’s the international business that could prove most bountiful moving forward. Long-term demand for data centers is likely to remain robust, even with a potential recession. If anything, firms across the globe will continue to use Equinix’s services as economic growth takes several steps back.

At writing, shares trade at 89.6x trailing earnings and 8.2x sales. Despite nearly getting cut in a third, Equinix shares remain priced with a premium in mind.

What is the Price Target for EQIX Stock?

Despite the lofty multiples, Wall Street is upbeat on Equinix stock in the face of a recession. The stock boasts a Strong Buy consensus rating, with 10 Buys and three Holds. The average EQIX stock price target of $775.00 implies 24.6% upside potential over the next 12 months.

Prologis (NYSE: PLD)

Prologis is an industrial and logistics REIT that stands to benefit from the continued rise of e-commerce. Though digital sales could fade in a big way due to the coming recession, industrial space is likely to face a surge in demand in the back half of the decade as more people shop online.

With a talent for creating value via M&A, Prologis is a very compelling option after its 35% plunge. The REIT has focused on expanding its footprint within high-density urban areas where consumption is relatively high. Indeed, such a density focus will allow Prologis to maximize the effect of ongoing secular tailwinds in e-commerce.

Even as the economy grinds to a slowdown, pandemic-era supply shortages could turn into an inventory glut at some point down the road. As supply comes back online in full force, while consumer demand for a broad range of products fades, demand for warehouse space could increase going into 2023. Of the three REITs in this piece, Prologis seems most resilient in the face of a downturn.

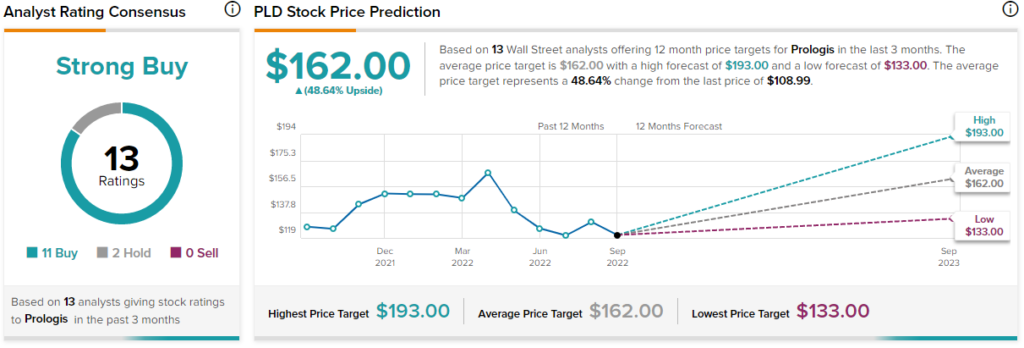

What is the Price Target for PLD Stock?

Looking to Wall Street, analysts remain incredibly bullish, with a Strong Buy rating. The average PLD stock price target of $162.00 implies a whopping 48.6% upside potential from here. That’s considerable upside for such a low-beta (0.91) REIT with a juicy 2.85% yield.

Conclusion: Wall Street is Most Bullish on PLD Stock

The following three REITs are great ways to play defense ahead of a mild recession. Of the three names, analysts expect the biggest gains from Prologis.