Are we headed for a soft landing? That would be the best-case resolution to the current cycle of high inflation and high interest rates, and several indicators are flashing ‘yes.’

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The ongoing earnings season, bringing us results from 4Q23, is beating expectations, showing an overall 5.2% year-over-year boost, against the 1.3% expectation. Stocks are responding with solid gains, and the S&P 500 has been hitting record highs. Meanwhile, in difficult circumstances, the economy has been showing it is rather sturdy.

John Stoltzfus, chief investment strategist from Oppenheimer, lays out the case for optimism, noting: “The economic data points along with corporate revenue and earnings results in our view have provided the markets over the course of the last two years since the Fed funds hike cycle began with enough positive offsets to provide an overall resilience to the economy that has thus far given business, the consumer, and labor enough support to navigate a period of multiple levels of uncertainty and thus far resulted in a Fed rate hike cycle without many of the negative outcomes bears, skeptics, and doubters of glass half full thinking have projected.”

Following that line, the Oppenheimer stock analysts have picked out three top stocks to consider right now. We ran them through the TipRanks database to determine if there’s widespread agreement on the Street that these are all worth leaning into right now. Let’s check the results.

Bioceres Crop Solutions (BIOX)

The first stock on our list is Bioceres, an agricultural research company that has developed the agribusiness’s first drought-resistant strains of wheat and soybeans. These are two of the world’s major staple crops, and are vital ingredients in the foods that we depend on and in the animal feeds that nourish our livestock. Bioceres uses a unique, proprietary biotech platform to develop its seeds, and is working on the next generation of agricultural solutions.

This company is more than just a seed firm, however. Bioceres operates a Seed & Integrated Products division, but also has Crop Protection and Crop Nutrition divisions. From the farmer’s perspective, Bioceres is working to improve crop yields from three major directions, with improved seeds, improved pest control, and improved fertilizers and other crop health products.

On the business side, Bioceres can boast of several strong numbers, showing the strength of its model and its products. The company claims a 23% market share in the field of soybean inoculants, and has a commercial presence in 40 countries. To protect its own intellectual property, Bioceres has 1,400 trademarks and trademark applications, and 600 patents issued or pending. The company runs its business through 9 international subsidiaries, most of them based in South America.

Bioceres’ primary products, however, are the aforementioned wheat and soy strains. Based on the company’s HB technology, the HB4 Wheat and HB4 Soy are solid revenue generators. And, in its most recent quarterly report, Bioceres noted that HB4 Soy has been awarded a new US patent, which extends the patent protection on the seed product to the year 2042.

A ‘strong summer crop season’ in the Southern Hemisphere drove solid revenues in that last quarterly report, which covered fiscal 2Q24 (December quarter). The top line was $140.2 million, up an impressive 48% year-over-year and beating the forecast by over $23 million. Adjusted EBITDA reached $24.1 million, more than double the same period last year.

The HB4 wheat harvest met expectations, and seed inventories are in-line with FY24 guidance. The company is making strong inroads into both Argentina (with HB4 wheat) and Brazil (with HB4 soybeans), and has received regulatory approval from several governments, including Australia, New Zealand, Thailand and Malaysia for soybeans, and again in Thailand for wheat.

Turning to the Oppenheimer view, we find analyst Kristen Owen upbeat on the company’s path forward. Owen cites, in particular, the successes of the recent harvest season and the expansion and regulatory gains of the HB program as reasons for optimism: “BIOX’s F2Q24 results reflected a return to its DD growth model, normalized growing conditions in Argentina, and progress against securing its future growth runway. Improved weather conditions provided an attractive backdrop for BIOX’s 50% yr/yr top-line growth, which despite industry pricing pressure and destocking in certain end-markets, showed broad-based contribution across all three segments.”

“With HB4 wheat hitting an inflection point in commercialization, we are encouraged by continued progress in varietal expansion and yield performance, with management reiterating its EBITDA outlook ($15-20M from HB4 wheat in FY24),” Owen went on to add. “We believe the company’s ongoing shift toward lower capital-intensive revenue streams will see continued cash unlocked for reinvesting in future growth.”

Looking ahead, Owen rates this stock as Outperform (Buy), and gives a $17 price target that suggests a 27% one-year upside potential. (To watch Owen’s track record, click here)

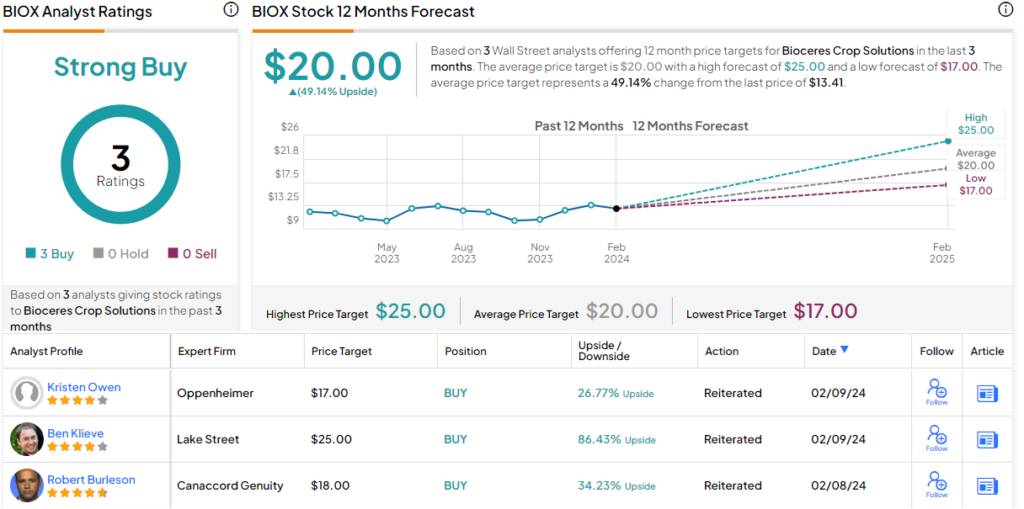

While BIOX shares only have 3 recent analyst reviews, they are unanimous that this is a stock to Buy, giving the shares a Strong Buy consensus rating. The current trading price here is $13.41 and the average price target of $20 implies a robust 49% upside for the coming year. (See Bioceres stock forecast)

Cedar Fair Entertainment (FUN)

Next on our list is a leisure and entertainment company, one that oodles of Midwestern kids likely have reason to be thankful for. Cedar Fair is an amusement park company, with 17 parks and 11 accommodation properties in its portfolio. The company is headquartered in Sandusky, Ohio, the location of its arguably best-known park, the famous Cedar Point amusement park that has amused generations of kids – and become a go-to summer destination for Michigan, Ohio, and Pennsylvania parents looking for kid-friendly fun.

The biggest recent news from Cedar Fair is the company’s upcoming merger-of-equals with the competing amusement park chain Six Flags. The merger will create a combined entity with an enterprise value – based on the combined debt and equity of Cedar and Six – of approximately $8 billion. As part of the merger, Cedar will end its master limited partnership business structure. Once the merger is complete, the combined entity will boast an expanded portfolio of 42 amusement parks and 9 resort properties, located across a diverse geographic spread, in 17 US states, Canada, and Mexico. The portfolio expansion will add more year-round operating locations, and shareholders in both Cedar and Six can expect accretions to the EPS within the first 12 months following completion of the merger transaction, which is expected during 1H24.

That’s the big news. We can look back at Cedar’s 4Q23 results to get an idea of where the company stands heading into that merger.

In the quarter, Cedar reported revenues of $371 million, a modest 1.4% YoY increase but coming in $4 million better than had been expected. The company reported a record Q4 attendance of 5.8 million, a 9% increase compared to 4Q22. Adj. EBITDA reached $89 million, a 1% uptick vs. the same period last year.

For Ian Zaffino, covering this stock for Oppenheimer, the upcoming Six Flags merger simply swamps any other news of the company. He writes of Cedar, “Poised to merge with Six Flags and dissolve its MLP structure, we believe FUN is an interesting investment opportunity. The merger should deliver meaningful synergies, and provide additional upside through operational improvements at underearning SIX—SIX’s 2024E adjusted EBITDA of $528M is well below management’s maximum compensation target of $710M. The transformational deal will make Cedar Fair the largest regional theme park operator in North America with 42 locations (27/15 theme/water parks) and increase its regional diversification.”

Plotting out where the company will go in the near-term, Zaffino adds, “Further, the elimination of the MLP structure should help broaden the shareholder base, improve liquidity, and potentially improve the valuation as well—FUN now trades at ~7.4x 2025E stand-alone EBITDA and ~6.9x ‘fully-synergized’ 2025E PF EBITDA.”

These comments come together to support the analyst’s Outperform (Buy) rating, while his $49 price target points toward an 18.5% share gain in the next 12 months. (To watch Zaffino’s track record, click here)

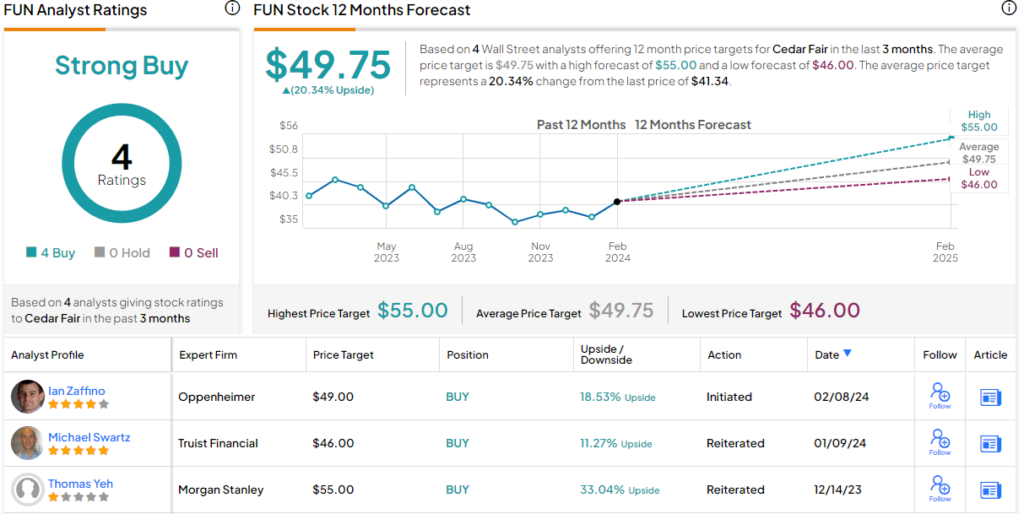

It’s clear that Wall Street likes this stock, as the Strong Buy consensus rating is based on 4 unanimously positive reviews. The shares have a current selling price of $41.34, and their $49.75 average target price suggests a 20% gain for the year ahead. (See Cedar Fair’s stock forecast)

Dick’s Sporting Goods (DKS)

Last on our Oppenheimer-backed list is Dick’s Sporting Goods, a major name in the sporting goods retail niche. Dick’s is one of the largest sporting goods retail chains in the US market, and a long-lived one – the company was founded back in 1948 when founder Dick Stack decided to open up his own fishing and tackle shop.

Today, in its 76th year of business, Dick’s can boast that it has become the leading retailer in the US, not just for fishing and tackle gear, but for sporting goods of all sort. Customers can find outdoor gear, clothing and shoes for men, women, and kids, accessories such as water bottles and rucksacks, and sporting gear, including bikes, air rifles, firearms and ammo, camping gear such as tents and cooking equipment. In short, Dick’s offers everything the customer needs for any outdoor pursuit, from a weekend fishing trip to a weeklong deer hunt to a camping trip with the kids.

We won’t see Q4 results for DKS until early next month, so let’s take a moment to look back at the company’s 3Q23 results. The quarterly report for that period showed a top line of $3.04 billion, a result that represented a modest year-over-year increase of 2.8% and also beat the forecast by $90 million. Dick’s generated a solid earnings figure of $2.85 per diluted share, by non-GAAP measures. This compared to the $2.60 figure from 3Q22, and came in 39 cents better than the forecast.

All of this gained the applause of investors and of Oppenheimer’s 5-star analyst Brian Nagel, who is unapologetically positive on this stock. Nagel writes, “Shares of DKS have spiked higher lately (up 50%+ since late October) and recently crossed our prior target. We reviewed carefully our stance on DKS. Our conclusion: Keep buying DKS. In our view, a still-discounted DKS share valuation under-appreciates meaningfully now-stronger fundamental underpinnings and competitive positioning of the company’s unique business, within one of the healthier segments of consumer discretionary. While our continued upbeat call on DKS is generally intermediate to longer-term in nature, we look upon the company’s upcoming Q4 (Jan.) report, scheduled for early March, as a near-term potential positive catalyst for shares.”

Getting down to basics, Nagle rates DKS as Outperform (Buy), with a $190 price target (up from the prior $145) that predicts a one-year upside of 14%. (To watch Nagel’s track record, click here)

With 9 recent Buy ratings, and 10 Holds, DKS shares have a Moderate Buy consensus rating from the Street’s analysts. However, the stock’s recent gains have pushed its price above the average price target. (See DKS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.