The uncertain economic environment is taking a toll on demand and lowering steel prices. This is impacting the profitability of steel companies, including United States Steel (NYSE:X), Nucor (NYSE:NUE), and Steel Dynamics (NASDAQ:STLD). Apart from lower average selling prices on steel, a spike in energy and input costs puts additional pressure on margins. Against this background, at least one of these stocks is still anticipated to beat the market. Let’s see what’s in store for these steel producers.

United States Steel

United States Steel recorded a significant decline in its Q3 earnings, reflecting lower steel prices, higher raw material prices, and tough year-over-year comparisons. It delivered an adjusted EPS of $1.95 in Q3 compared to $5.70 in the prior year.

Looking ahead, the lower average price realizations, a weak manufacturing outlook in Europe, and higher energy and input costs could all continue to hurt its bottom line. Its CEO, Jessica Graziano, expects the pace of decline in steel price would be in line with Q3. Graziano added, “Lower steel prices will continue to impact margins for the fourth quarter, reducing our average selling price sequentially.”

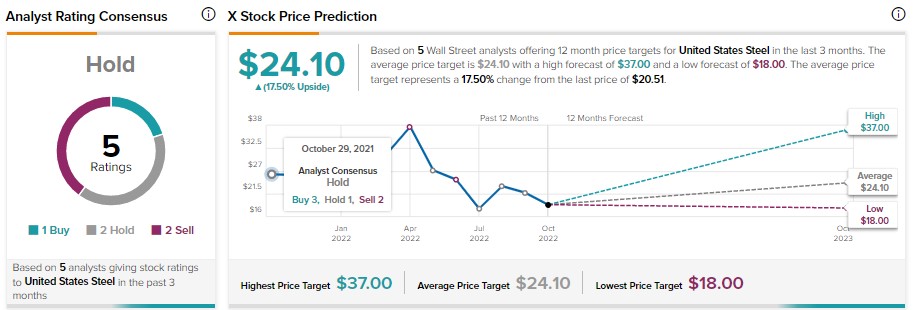

Is United States Steel Stock a Buy, Sell, or Hold?

United States Steel stock has a Hold consensus rating on TipRanks based on one Buy, two Hold, and two Sell recommendations. Meanwhile, the average price target of $24.10 implies 17.5% upside potential.

Overall, US Steel stock scores a six out of 10 on TipRanks’ Smart Scoring system, implying a Neutral outlook.

Nucor

Nucor’s Q3 earnings declined both on a year-over-year and quarterly basis. Its Q3 EPS of $6.50 compared unfavorably with the earnings of $7.28 per share in the prior-year period. Moreover, it declined about 33% from Q2 of 2022.

Nucor blamed metal margin contraction and reduced shipping volumes for this decline.

In Q4, Nucor expects its earnings to decline considerably from Q3 due to the moderation in average selling prices and lower volumes.

Is Nucor stock a Buy?

Nucor stock has a Moderate Buy consensus rating on TipRanks based on two Buy and five Hold recommendations. However, analysts’ average price target of $125.67 implies 6.2% downside potential.

Overall, Nucor stock scores a seven out of 10 on TipRanks’ Smart Scoring system, implying a Neutral outlook.

Steel Dynamics

Steel Dynamics’ Q3 operating income was $1.2 billion lower sequentially due to the decline in pricing and metal spread compression in its flat-rolled steel operations. Due to the lower pricing, its Q3 earnings of $5.46 per share declined sequentially.

Its CEO, Mark D. Millett, said, “Ferrous scrap pricing indices have decreased each month beginning in May and continued through October 2022, resulting in significantly lower earnings from our metals recycling operations.”

While weak pricing remains a drag, STLD’s management expects higher backlogs and order activity to support its financials in Q4.

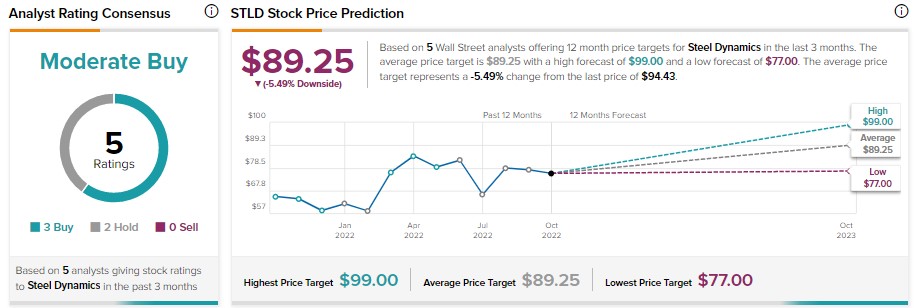

Is Steel Dynamics Stock a Buy?

On TipRanks, STLD stock has a Moderate Buy consensus rating based on three Buy and two Hold recommendations. Meanwhile, analysts’ average price target of $89.25 implies 5.5% downside potential.

Overall, Steel Dynamics stock scores a ‘Perfect 10’ on TipRanks’ Smart Scoring system, implying an Outperform outlook.

Bottom Line

The lower pricing and higher costs will continue to pressure the margins of these steel producers. On TipRanks, data shows that STLD has a higher probability of beating peers. However, US Steel stock has the highest upside potential (based on the analysts’ average price target).