American Express (AXP) is a payments company with a lot of exposure to travel. The company offers credit cards and travel-related services. AXP will release its financial results for the first quarter of 2022 tomorrow, April 22.

The recovery in travel has already been reflected in American Express’ quarterly data. In the fourth quarter, the company posted solid profit results, with both the top and bottom lines growing year-over-year. Sales climbed by 30% to $12.1 billion, while adjusted EPS increased by 24% to $2.18 from the year-ago quarter.

Also, AXP stock has performed well, with the share price increasing 13% in value year-to-date and 29% over the past year.

Let’s take a look at how the business is expected to perform in the first quarter.

Q1 Expectations

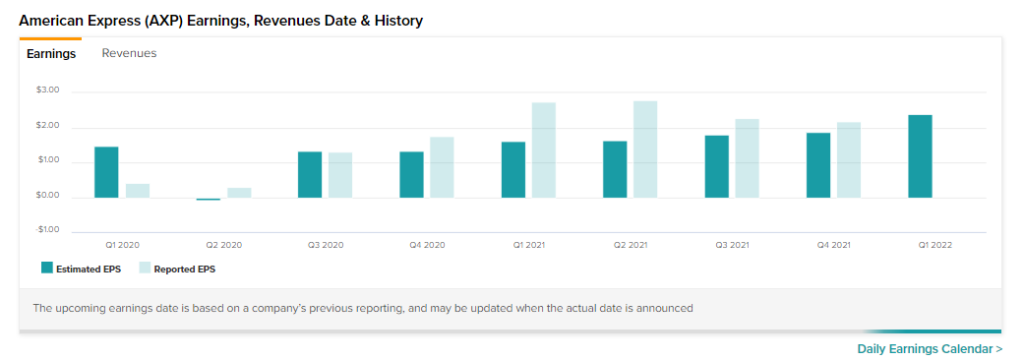

According to analysts, American Express is expected to report adjusted earnings of $2.40 per share. The Q1 EPS estimates reflect a double-digit decrease of 12.4% in earnings from the year-ago quarter.

The prolonged conflict in Ukraine could have harmed the travel industry as a whole, affecting the company’s profits. Furthermore, the Omicron COVID-19 variant, as well as forced lockdowns in China, may have had an impact on the company’s earnings in the first quarter.

Despite the uncertain macro environment, during the Q4 conference call, management showed its confidence in the company by allowing a 20% dividend increase, a healthy projection for top-line growth in the 18%-20% range, and profits per share projected at $9.25 to $9.65.

Wall Street’s Take

J.P. Morgan analyst Richard Shane is concerned about the economy’s prospects. He writes, “We see increased economic uncertainty, which reduces our confidence in forward estimates and an increased probability of recession.”

According to the analyst, American Express is one the most fundamentally intriguing names in his coverage. However, he believes that “current estimates and valuation fully incorporate a relatively positive base case.”

As a result, Shane downgraded AXP to a Hold from a Buy but maintained a price target of $200. This implies 6.1% upside potential from current levels.

The Street is also cautiously optimistic about American Express, with a Moderate Buy consensus rating based on eight Buys, 10 Holds, and one Sell. At $197.37, the average AXP price target suggests 4.7% upside potential from current levels.

Apart from analysts, investors also remain upbeat about the stock. Per the TipRanks Stock Investors tool, 1.8% of the investors holding portfolios on TipRanks have accumulated AXP stock in the last 30 days.

Bottom Line

Rising sales, increased earnings, and a recovering stock price all indicate that American Express is performing well in an improving consumer environment. However, current macro and geopolitical developments may have hampered this quarter’s performance.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.