Airline major American Airlines, Inc. (NASDAQ: AAL) recently reported impressive results for the second quarter. However, the upbeat results should not have come as a surprise to users who have been keeping a keen eye on the company’s website traffic, through TipRanks’ Website Traffic Tool.

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into the airline giant’s performance this quarter and provides a hint of its future prospects.

According to the tool, the American Airlines website recorded a 40.07% monthly rise in global visits in June, compared to the same period last year. Moreover, year-to-date, American Airlines website traffic increased by 30.50%, compared to the previous year.

The spike in website visits hints at the fact that even in the face of an impending recession, demand for the company’s services remains robust. Learn how Website Traffic can help you research your favorite stocks.

A Look at the Q2 Numbers

American Airlines’ revenue jumped 79.5% from the prior year to $13.42 billion. Moreover, the company reported adjusted earnings per share (EPS) of $0.76, which compares favorably to a loss of $1.69 per share reported in the prior year.

Meanwhile, the company and its partners flew more than 500,000 flights in the quarter. This represents an increase of 8% from the prior year. Further, the load factor also improved from 77% in the previous year to 87%.

What is the Company Looking Forward to?

In the third quarter, American Airlines expects revenue to be higher by 10% to 12%. Moreover, the increased revenues are expected to be on a lower capacity of 8% to 10%.

Investors Remain Optimistic About American Airlines Stock

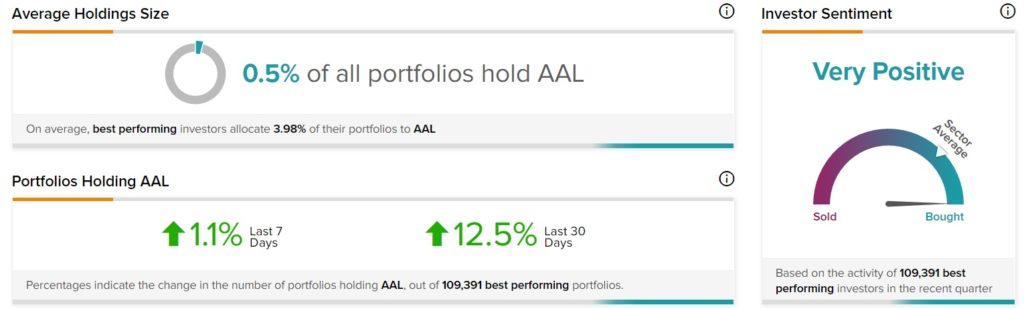

TipRanks’ Stock Investors tool shows that top investors currently have a Very Positive stance on AAL. Further, 12.5% of the top portfolios tracked by TipRanks, increased their exposure to AAL stock over the past 30 days.

Wall Street’s Take

Overall, the consensus among analysts is a Hold based on six Holds and two Sells. The AAL average price target of $15.29 implies upside potential of 11.2% from current levels. Shares have declined 37.7% over the past year.

Key Takeaways

The rebound in air traffic and higher bookings act as positive signs for the airline industry. Notably, American Airlines’ solid website traffic growth and the ensuing impressive results, along with higher revenue guidance for the third quarter, allude to the fact that the company remains on a strong footing.

However, prevailing economic headwinds and an impending recession can derail this growth.

Read full Disclosure