Shares of American Airlines (NASDAQ: AAL) closed 10% higher on Tuesday following the company’s Q2 guidance. While AAL’s Q2 guidance came as a positive surprise to investors, TipRanks’ users, who leverage the Website Traffic tool, had a clue about it.

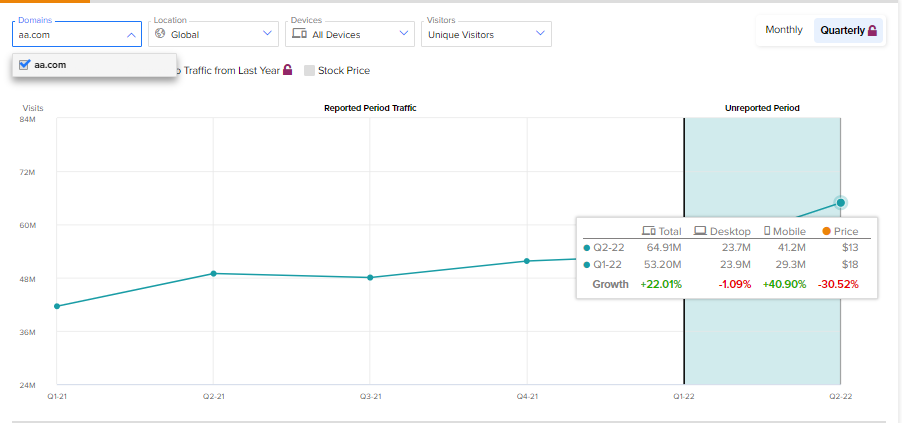

AAL’s Q2 financial results were evident on TipRanks’ new website traffic tool that measures visits to aa.com.

The tool showed rising web traffic trends for AAL, which is indicative of an improving operating environment. In Q2 2022, total visits to aa.com increased by 22.01% from Q1. Moreover, it increased by 32.65% on a year-over-year basis. This increase in web visits indicated that American Airlines could deliver improved financial numbers in Q2.

The prediction, based on TipRanks’ website traffic tool, aligned with AAL’s Q2 guidance. See the Website Traffic on Your Favorite Stocks

AAL expects its Q2 revenues to increase by 12% compared to the Q2 of 2019. Moreover, its TRASM (total revenue per available seat mile) is expected to increase by 22.5% compared to its previous growth guidance of 20-22%. Furthermore, AAL now expects to deliver an adjusted pre-tax margin of 5%, within its previous guidance range of 4-6%.

Factors Limiting Upside in AAL Stock

While rising web traffic and management’s Q2 guidance are positive, concerns over consumer spending amid fear of a recession and an inflationary cost environment could play spoilsport.

Jefferies analyst Sheila Kahyaoglu stated, “With positive price momentum Q2 unit revs should be better. However, concerns linger on what drives demand in the fall given a weakening consumer and limited visibility.”

Kahyaoglu maintains a Hold recommendation on AAL stock. Along with Kahyaoglu, Citigroup analyst Stephen Trent remains sidelined on AAL stock. Trent highlights AAL’s high financial leverage for his neutral stance.

Notably, AAL had $35.46 in long-term debt and finance leases (net of current maturities) at the end of Q1. However, deleveraging its balance sheet remains a key priority for the company. AAL plans to reduce debt at an accelerated pace and expects to lower its overall debt by $15 billion by the end of 2025.

Despite management’s clear guidance over debt, most analysts prefer to remain sidelined on AAL stock. It sports a Hold rating consensus on TipRanks based on seven Hold, one Buy, and four Sell recommendations. Further, the average American Airlines price target of $17.98 implies 21.7% upside potential.

Bottom Line

The rebound in travel demand is driving the recovery for AAL. However, macro headwinds, a higher cost environment, and concerns over debt play spoilsport. According to our data-driven stock score, AAL stock has an Underperform Smart Score of 2 out of 10.