American Airlines (AAL) is one of the most well-known airline companies, with strong brand awareness, economies of scale, and network advantages. The corporation will release its fourth-quarter 2021 upcoming earnings on January 20.

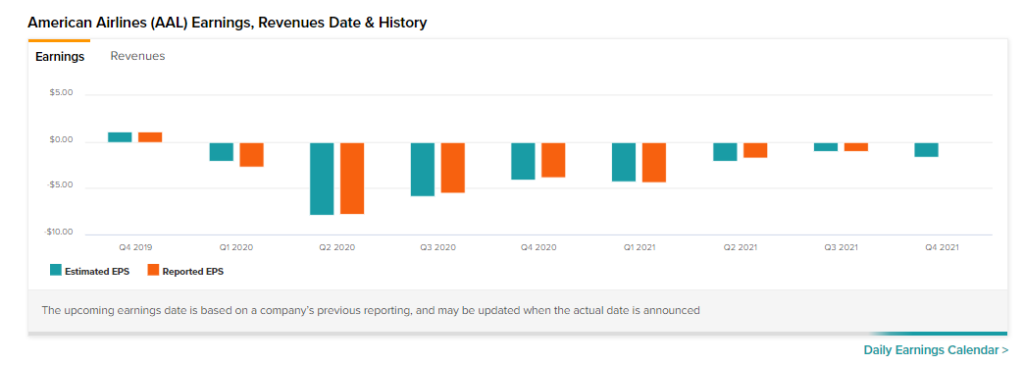

American Airlines reported strong top-line growth in the third quarter, owing to increased passenger and cargo revenues. Meanwhile, the company incurred an adjusted loss of $0.99 per share, which was less than the Street’s estimate of $1.20 per share.

Unfortunately, the firm had to cancel hundreds of flights throughout the Christmas and New Year holiday travel period due to the emergence of the Omicron variant. These cancellations may have an impact on American Airlines’ revenues in the Q4 quarter.

Revised Q4 Expectations – A Slight Hope

The good news is that, despite these cancellations, the airline recently raised its total revenue forecast for the fourth quarter. The carrier now expects total revenues to drop by around 17% in Q4, compared to the same period in 2019. Previously, the airline predicted a 20% reduction in the same.

However, owing to large-scale flight cancellations, it now expects capacity to fall 13%, compared to the earlier projection of 11-13%. In addition, the firm anticipates greater costs in the fourth quarter, which might have a negative impact on the company’s bottom line.

American Airlines is anticipated to announce an adjusted loss of $1.56 per share, down from $3.86 per share in the year-ago quarter, according to experts.

What’s Ahead?

Investors may have been reducing their exposure to AAL shares owing to the uncertainty created by the spread of the omicron variety.

According to TipRanks’ Stock Investors tool, investors have a pessimistic opinion of American Airlines shares. Per the tool, 7.6% of the investors holding portfolios on TipRanks have reduced their stake in American Airlines stock in the last 30 days. Furthermore, 4.2% of these individuals have reduced their holdings in the recent week.

Furthermore, the TipRanks website traffic tool shows a downward trend in website traffic. When we looked at the data more thoroughly, we saw that AAL traffic fell by 3.9% globally in December. This raises concerns about the top-line outcomes in the fourth quarter.

Wall Street’s Take

Given the uncertainty, Wall Street has stayed away from American Airlines stock. On TipRanks, American Airlines stock has received just 1 Buy, 4 Hold, and 2 Sell recommendations for a Hold consensus rating. Meanwhile, the average AAL stock price prediction of $18.64 implies that shares are fully valued at current levels.

Bottom Line

With negative investor sentiment, sluggish traffic, and an adverse travel environment, the stock doesn’t appear to be a Buy, ahead of Q4 earnings. Further, a weaker-than-expected earnings report on January 20 may also contribute to a drop in the stock price.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure