Some companies can’t wait for a tumultuous 2020 to be over, but others will be more reluctant to wave goodbye to such a bountiful twelve months. For instance, Advanced Micro Devices (AMD); the chipmaker has accumulated 101% of share gains year-to-date.

That said, the perennial overachiever, which was a star performer before the pandemic’s onset, is all set to continue its relentless forward march in 2021 — at least according Rosenblatt analyst Hans Mosesmann.

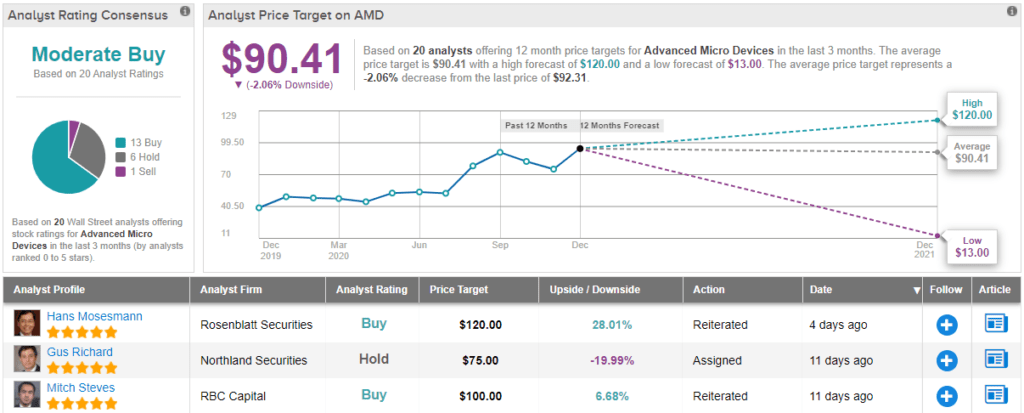

The 5-star analyst reiterated a Buy rating on AMD shares alongside a $120 price target. The implication for investors? Further upside of 30%. (To watch Mosesmann’s track record, click here)

AMD has performed a remarkable turnaround since nearly going bankrupt in the early 2010s. Much of the success can be attributed to the astute stewardship of CEO Lisa Su, who has been at the helm since 2014 and has overseen AMD’s transformation into a semiconductor heavyweight.

Mosesnmann’s latest vote of confidence in the company comes after Su said on Monday that she expects AMD’s 1Q21 to be better than usual.

Typically, between Q4 and Q1, the company experiences a 10% revenue drop. However, Su believes the growth exhibited by the PC segment during the pandemic is one which is set to continue. The company has consistently eaten away at rival Intel’s dominance, and the CEO expects the company’s latest release – the Zen 3 CPUs – to add to the market share gains.

So does Mosesmann, who summarized, “We continue to believe AMD can capture 50% of the entire x86 CPU market in coming years on technology/product roadmaps, accelerating design pipelines, increasing attach rates of GPUs to optimize EPYC server CPUs, etc. AMD’s CPU and GPU roadmaps will have significant and sustainable advantages in the world of computing that the competition currently do not have.”

As a result, Mosesmann increased 1Q21 revenue and non-GAAP EPS estimates from $2.56 billion and $0.34 up to $2.73 billion and $0.40, respectively. As for 2021, the estimates get a boost, too. The analyst increased the revenue forecast from $12.3 billion to $12.5 billion, while the non-GAAP EPS estimate increases to $2.18 from the previous $2.10.

Let’s take a look at how the rest of the Street sees 2021 panning out for AMD. Based on 13 Buys, 6 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. However, shares have just clocked another all-time high and some analysts anticipate a cooling off period; The $90.41 average price target implies a 2% slip from current levels. (See AMD stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.