AMC Entertainment (NYSE: AMC) and Bed Bath & Beyond (NASDAQ: BBBY) aren’t only known for feature films and shower curtains. They’re also famous as targets of meme stock traders. However, sensible investors should consider not only the short squeeze potential but also the fundamentals of these two businesses. After weighing the pros and cons of both companies, I am bullish on AMC stock but neutral on BBBY stock.

Clearly, these are two completely different businesses. AMC Entertainment operates a movie theater chain, while Bed Bath & Beyond’s stores are known for selling home products such as bed linens and bath towels. Notably, they both belong in the consumer discretionary category since neither company provides anything that’s an immediate necessity in life.

That’s a major disadvantage during a time of persistently-high inflation. Nevertheless, many of today’s traders are eager to scoop up shares of AMC and BBBY because they had huge rallies during the meme stock mania of 2021 and, to a lesser extent, this summer’s short squeeze revival. Ultimately, it makes sense to pick one stock or the other, but not both, as you probably don’t want to over-leverage yourself of high-volatility assets. The question, then, revolves around whether you ought to focus on AMC Entertainment or Bed Bath & Beyond.

AMC’s CEO Will Fight for the Company

Can you name Bed Bath & Beyond’s CEO? Probably not, but there’s a pretty good chance you’ve at least heard about AMC Entertainment CEO Adam Aron. He’s not just an executive but an outspoken champion of the company who knows how to rally the troops and get AMC’s fans (known as “apes”) excited about the company’s future prospects.

Don’t get me wrong – AMC Entertainment has its share of financial hurdles to clear. Still, at last, the company seems to be improving in this area. Notably, AMC grew its revenue from $444.7 million in the second quarter of 2021 to $1.17 billion in Q2 2022 – quite an improvement, you must admit. Furthermore, during that same time frame, AMC Entertainment shrank its quarterly net losses from $344 million to $121.6 million.

While the “apes” are waiting for AMC Entertainment to gradually close its profitability gap, they can watch for messages from Aron, who is active on social media. Not long ago, the CEO revealed that he owns 793,974 AMC shares and that he’s going to “Guide AMC smartly through these challenging times.”

Aron even went so far as to thank AMC’s retail investors. He graciously wrote, “Thank you to retail! You really did save AMC.” Clearly, Aron is doing a “remarkable job in outreach and keeping his shares afloat with his shareholders,” as Wedbush Analyst Alicia Reese put it.

What is the Price Target for AMC Stock?

Turning to Wall Street, AMC stock is a Moderate Sell, based on two Holds and three Sell ratings. The average AMC Entertainment stock price target is $5.53, implying 43.2% upside potential.

Bed Bath & Beyond’s Turnaround Strategy Probably Won’t be Enough

Now, let’s shift gears and talk about Bed Bath & Beyond – which is hard to do without mentioning its financial challenges. Alarmingly, the company had barely more than $100 million in cash in its most recently reported quarter. Moreover, the company’s sales declined, and store traffic was weak.

Granted, Bed Bath & Beyond is trying to stage a comeback. The company even went so far as to release a turnaround plan. However, one financial expert warns that Bed Bath & Beyond’s strategy is “too little too late” to avert bankruptcy – and he’s probably right about that.

The company’s plan involves some retrenchment, it seems. Reportedly, Bed Bath & Beyond intends to shut approximately 150 underperforming stores down, as well as lay off 20% of its corporate and supply chain staff. All in all, the company plans to reduce its costs by $250 million in Fiscal 2022.

Here’s where Bed Bath & Beyond’s strategy could be problematic. Apparently, the company has secured $500 million worth of additional financing. This includes a $375 million loan from Sixth Street Partners. Remember, these are loans, not free money, and they’ll have to be paid back with interest. This could create a persistent overhang, financially speaking.

Additionally, an SEC filing indicates that Bed Bath & Beyond intends to sell as many as 12 million additional shares of the company’s common stock. This could put downward pressure on the share price, so it’s understandable if Bed Bath & Beyond’s loyal investors aren’t too pleased about the potential large-scale share sale.

In an interview, Macco CEO Drew McManigle expressed doubts regarding Bed Bath & Beyond’s turnaround strategy. “I’ve been in this business for 35 years in restructuring and turnarounds, and…unfortunately, it’s just a little bit too little too late,” McManigle warned.

McManigle added that Bed Bath & Beyond “should have started this process last year.” Furthermore, he wouldn’t be surprised if “the Chapter 11 petitions have already been drafted or are just waiting for a signature.” Loop Capital analyst Anthony Chukumba issued a harsh $1 price target on BBBY stock, while S&P Global (NYSE: SPGI) Ratings reiterated its CCC credit rating, which is definitely pessimistic, along with a negative outlook on Bed Bath & Beyond.

What is the Price Target for BBBY Stock?

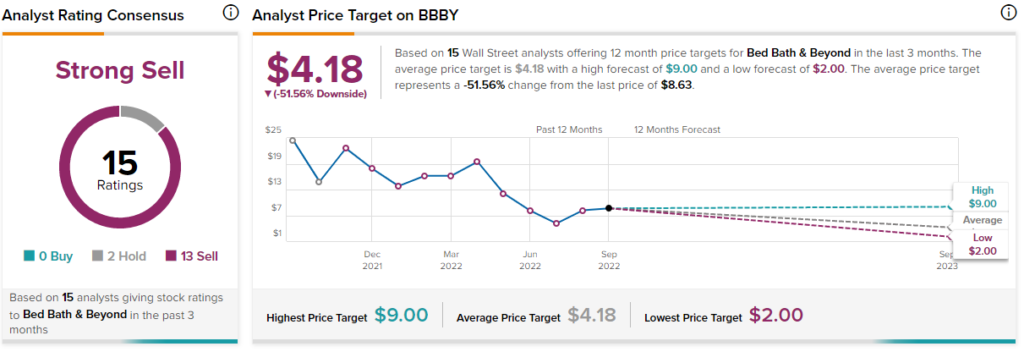

On Wall Street, BBBY is a Strong Sell based on two Holds and 13 Sell ratings. The average Bed Bath & Beyond stock price target is $4.18, implying 51.6% downside potential.

Conclusion: Should You Consider AMC or BBBY Stock?

Both AMC stock and BBBY stock involve volatility and risk, so please exercise caution with both stocks. That being said, the scales tend to tip in AMC Entertainment’s favor as the company’s financial situation looks more encouraging than Bed Bath & Beyond’s.

Besides, AMC Entertainment has a leader who keeps the company’s investors in the loop and who is adept at drumming up support among the fans. With all of that in mind, it’s fine to consider joining the “apes” and taking a small position in AMC stock.