There was plenty to like in AMC Entertainment’s (NYSE:AMC) recent Q3 print. Fueled by the outsized success of Barbenheimer – for the uninitiated, Barbie and Oppenheimer – and aided by the company’s leading footprint of IMAX and Dolby Cinema locations, the theater chain surprised Wall Street both on the top-and bottom line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Additionally, with total domestic box office revenues up 40.5% compared to the overall industry’s +37.7%, increase, AMC’s domestic results bettered the industry average.

Yet, that was not enough to stave off the bears, who subsequently sent shares down, not an uncommon sight in 2023; in total, AMC shares have shed an alarming 82% on a year-to-date basis.

The reason for the most recent leg down revolves around the company’s heavy debt load, which currently stands at around $5.1 billion. In response to this financial burden, AMC announced a $350 million share offering shortly after releasing its earnings report. This marks the second such offering in the past three months, following the sale of 40 million shares in September, which generated $325 million in proceeds for the theater operator.

According to Barrington analyst James Goss, “Significant uncertainty remains for AMC due to its high degree of financial leverage. Management has been successful in raising equity that has improved AMC’s potential to move past the pandemic, but risk levels remain high.”

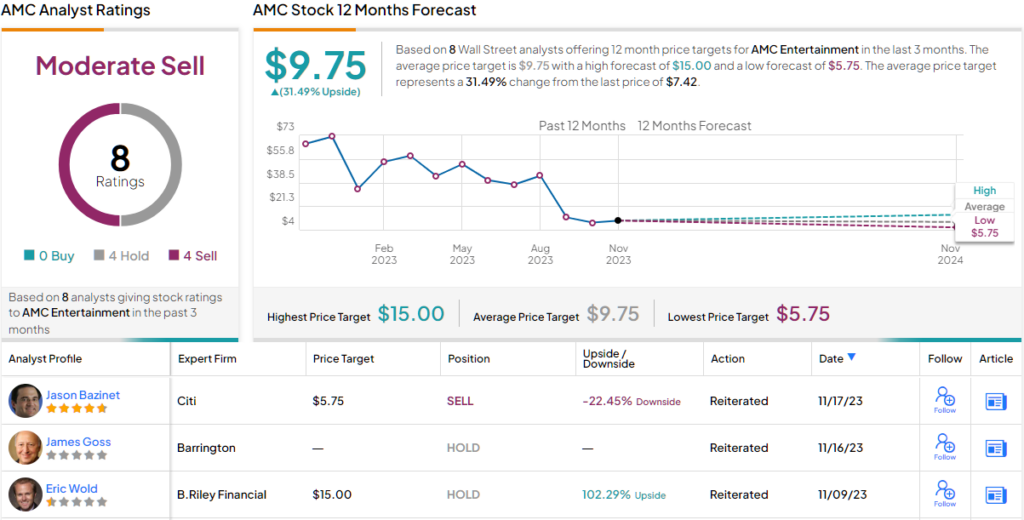

Accordingly, Goss remains on the sidelines, recommending a Market Perform (i.e., Neutral) rating on AMC shares, with no fixed price target in mind. (To watch Goss’s track record, click here)

That’s Barrington’s view, but what does the rest of the Street make of AMC’s prospects? It offers a confusing take. On the one hand, based on 4 Holds and Sells, each, the analyst consensus rates the stock a Moderate Sell. However, some evidently think the shares are due a bounce, since the $9.75 average target makes room for 12-month returns of 31.5%. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.