The COVID-19 vaccine rollout of early and spring-2021 was enough to uplift reopening stocks like airlines and oil, although most of the accelerated trends were here to stay. Ecommerce saw a massive boom throughout the pandemic, and even as time has worn on, companies like Amazon.com, Inc. (NASDAQ:AMZN) have continued to expand. After another year of incredible demand and shifting consumer behaviors, one of the world’s largest retailers has embedded itself deep into the domestic logistical network.

Noting this expansion is analyst Robert Coolbrith of Wells Fargo, who explained that this past year has been one of “massive footprint growth,” with Amazon fulfillment centers now within a 45-minute drive of 77% of the U.S. population. The company’s logistics and infrastructure presence has actually outpaced consumer demand, and it delivered 72% of its own domestic packages in 2021.

Coolbrith rated the stock a Buy and reiterated his price target of $4,250. This target currently represents a 12-month upside of 20.63%.

The five-star analyst elaborated that even with covid-related setbacks and delays, AMZN still managed to move more small packages than UPS (NYSE:UPS) or FedEx (NYSE:FDX). This is due in part to the overwhelming existence of small sortable Amazon fulfillment centers, some with dedicated specializations. Through these small centers, the company has been able to continue to roll out its ultra-fast and same-day delivery services.

However, not all has been rosy for eCommerce globally. For instance, while AMZN’s stock has gained 10.56% year-to-date, British clothing retailer ASOS (GB:ASC) has declined 46.77% over the same period. While many of its compatriots have become UK top stocks, ASOS and other retailers are slipping.

Moreover, Amazon has its concerns. A high turnover rate among its labor-intensive roles remains with room to improve, and that wage inflation “could become a persistent part of the narrative amid demographic-driven workforce contraction,” according to Coolbrith.

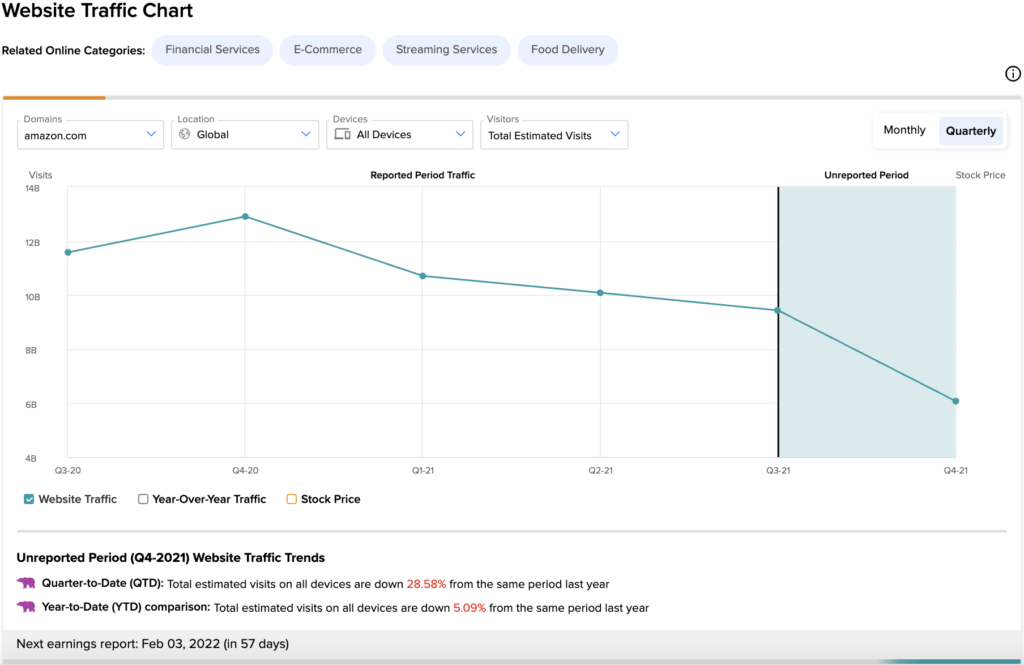

On the TipRanks website traffic tool, it can be identified that total device visits to amazon.com have declined 35.63% quarter-over-quarter, while the price per share has actually improved 7.25%. When looking at the year-to-date comparisons of 2020 and 2021, visits to amazon.com have declined 5.09%. This shows a slight underperformance from last year’s elevated pandemic-driven e-commerce trends.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >