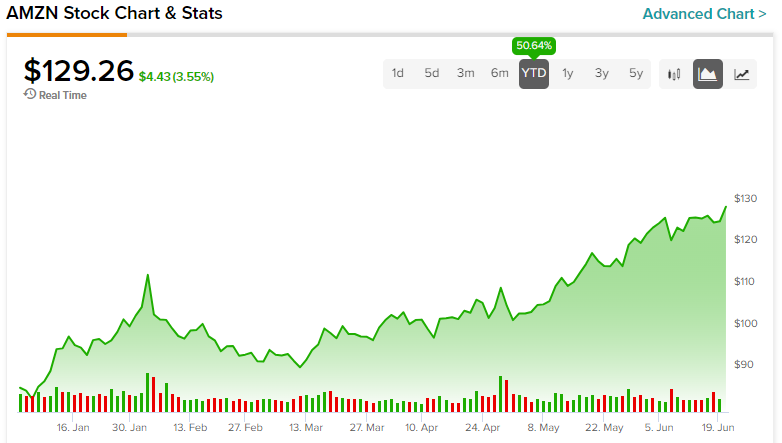

Similar to most tech stocks, shares of Amazon (NASDAQ:AMZN) have outperformed the broader market and have risen significantly on a year-to-date basis. It has gained over 50% this year compared to an approximately 14% jump in the S&P 500 Index (SPX). While AMZN stock has appreciated quite a bit, analysts maintain a bullish stance and list multiple growth catalysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AMZN Stock: Better Days Ahead

The easing of inflationary pressure and management’s cost-cutting initiatives position AMZN well to deliver profitable growth in the coming quarters. While enterprises continue to remain cautious in their IT spending due to economic uncertainty, analysts remain upbeat and expect a rebound in the AWS (Amazon Web Services) segment (its high-margin cloud offering).

On June 21, Jefferies analyst Brent Thill raised his price target on AMZN stock to $150 from $135. The analyst maintains a bullish outlook on the company’s prospects and expects it to benefit from improving profitability, recovery in the AWS segment, and artificial intelligence.

While AWS is likely to support growth, JPMorgan analyst Doug Anmuth believes Amazon could become the largest U.S. retailer in 2024, surpassing Walmart (NYSE:WMT). Anmuth termed AMZN stock as the “Best Idea” in its sector and reiterated a Buy rating on June 20.

Earlier in May, Mizuho Securities analyst James Lee highlighted that the “AWS’ Gen-AI (Generative AI) demand has been accelerating due to its ease-of-transition and product differentiation.” Further, due to the premium pricing of AWS’ Gen-AI, it will likely support revenue and margins.

What is Amazon Stock’s Price Target?

The easing of inflationary cost headwinds, reacceleration in AWS’ growth rate, cost-saving measures, and benefits from AI tailwinds position AMZN well to deliver solid financial performances in the future.

AMZN stock has received 37 Buy and one Hold recommendations for a Strong Buy consensus rating. Further, the average AMZN stock price target of $138.06 implies 10.6% upside potential from current levels.