As the market has moved away from stay-at-home stocks, preferring other sectors such as financials, materials, and manufacturing, Amazon’s (AMZN) stock has gained little in the past 12 months – just over 6%. The stock missed the Dow Jones industrial average by a large margin.

There are no issues with the company’s fundamentals, which are instead solid. The stock is set to rise faster in 2022.

The pandemic is being exacerbated by the highly transmissible strain of Omicron, forcing countries to place restrictions on economic and other human activities to prevent the virus from spreading further among populations.

As people must stay at home longer, they turn to shop and do other activities online as a distraction. This is expected to give a boost to the share price of Amazon and its peers. Thus, I am bullish on Amazon.

Based in Seattle, Washington, Amazon.com is an online retailer of consumer products and subscription services in North America and internationally. Amazon aims to become a leading global supplier of cloud computing, artificial intelligence, and machine learning technologies.

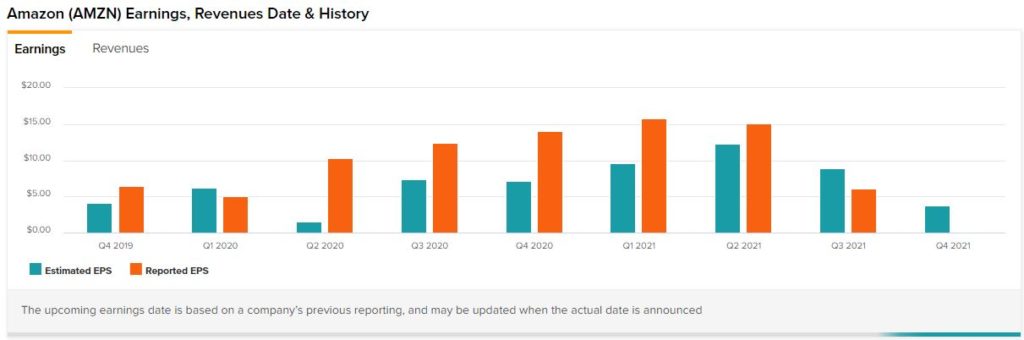

Third-Quarter Earnings

Amazon generated revenue of nearly $111 billion in the third quarter of 2021, reflecting an increase of more than 15% year-over-year. The company posted a GAAP net income of $6.12 per share.

While Amazon fell short of average forecasts on revenue by $785 million and GAAP EPS by $2.78, shareholders saw, however, significant jumps in the stock price for about a week after the earnings release, before pulling back starting mid-November.

Amazon Web Services accounted for 14.5% of total net sales, North America contributed 59.2%, while the international segment contributed 26.3%.

Q4 2021 Net Sales Guidance

The company aims for net sales of $130 billion to $140 billion, reflecting growth of 4%-12% from the fourth quarter of 2020. Based on this projected level of net sales, sell-side analysts on Wall Street expect earnings of $3.73 per share.

2022 E-Commerce Outlook

Retail e-commerce sales worldwide were close to $4.3 trillion in 2020 and are expected to reach $5.4 trillion this year.

So, both Amazon and its closest group of competitors are strongly positioned to see greater volumes of goods and services in the coming months, potentially pushing the stock price much higher than its current level.

Growing Presence in Consumers’ Life

The internet retailer giant exploits its cutting-edge technologies to increase its presence in consumers’ everyday lives through industries. The automotive sector represents an example of this.

Amazon Fire TV will be featured on BMW cars’ theater format screens that allow rear-seat passengers to watch TV through 31-inch displays.

Based on multi-year agreements, Amazon will enable drivers of automaker Stellantis (STLA) vehicles to use e-commerce platforms and various subscription services.

Wall Street’s Take

In the past three months, 30 Wall Street analysts have issued a 12-month price target for AMZN. The company has a Strong Buy consensus rating, based on 30 Buy ratings and no Hold or Sell ratings.

The average Amazon price target is $4,150.83, implying 25.5% upside potential.

Conclusion

In the short term, the stock price should receive a solid boost to the upper levels as anti-COVID-19 measures will keep people on the internet longer and more involved in e-commerce.

The company uses its advanced technologies to increase its presence in the lives of all consumers belonging to every income class of the population. I believe the stock is a Buy to keep in the portfolio for a very long time.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure