The Street’s tech heavyweights are all reporting Q2 earnings this week and once the closing bell rings on Thursday, Amazon (AMZN) will let investors in on the quarter’s action.

The company will also provide its outlook, and here, Oppenheimer’s Jason Helfstein has “conservatively” reduced 2H e-commerce estimates “assuming consumer spending slows after stable summer trends.”

The result is a reduction of 2022’s total revenue estimate by 1%, based on a 3% decrease in North America, partially offset by higher international sales.

More in the here and now, ahead of the Q2 print, Helfstein expects the Street’s focus will turn to margins, consumer spending, and AWS. There should also be some commentary regarding the recently announced $3.9 billion acquisition of One Medical, which offers Amazon an entry into teleheath/primary care.

The Street’s expectation is for a 6% year-over-year uptick for Q2 revenue, above Helfstein’s 5% estimate. That said, Street expectations are for a 5% increase in gross profits, yet based on “more bullish” expectations for AWS, Helfstein expects these to come in at 14%.

Looking ahead, Helfstein expects AWS trends to “remain robust,” growing by 35% in 2022 and 33% next year.

“Near term,” notes the 5-star analyst, “some risk stems from exposure to SMBs, but digital transformation at enterprises takes ~5 years, and we’re only mid-cycle. Longer term, growth should decelerate slightly as Azure/competitors play catch-up, while margins should hold steady on high switching costs.”

For Q3, the Street and Oppenheimer’s revenue expectations match, both calling for a 15% YoY increase, but once again Helfstein’s gross profit growth forecast is above the Street’s – at 22% vs. 15%.

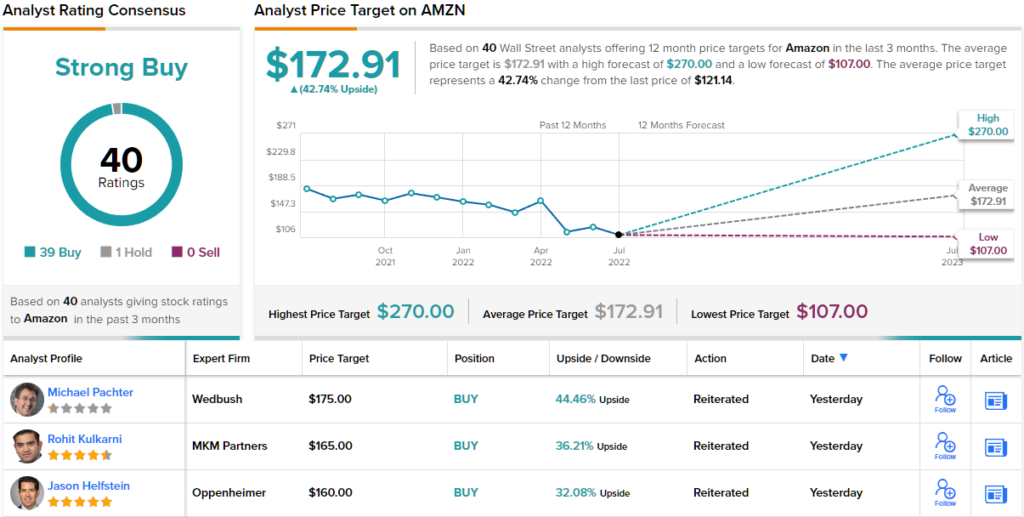

So, down to business, what does it all mean for investors? Helfstein’s rating remains an Outperform (i.e. Buy), although based on “modest estimate revisions and more conservative target multiples,” the price target is lowered from $175 to $160. Nevertheless, there’s still upside of 32% from current levels. (To watch Helfstein’s track record, click here)

It’s clear from the consensus that Wall Street agrees. AMZN has 40 reviews on record, with a 40 to 1 breakdown of Buys over Holds to support the Strong Buy rating. Shares are priced at $121.14 and their $172.91 average target implies an upside of ~43% from that level. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.