The sheer scale and expectations from Amazon (AMZN) can be gauged by the fact the ecommerce giant reported 2Q21 sales of $113.08 billion, but it was not enough to satisfy investors.

Shares dropped by 7.5% in the subsequent session after Amazon delivered revenue below the Street’s forecast of $115.20 billion, amid a surprisingly mixed quarterly statement. The soft revenue was not the only letdown. The company’s 3Q21 outlook calls for sales between $106 billion and $112 billion, at the mid-point, below the Street’s $118.89 billion forecast.

Monness’ Brian White calls the display a “post-lockdown air pocket trip.” That said, the soft metrics are of no serious concern to the 5-star analyst, with the long-term bullish thesis still intact.

“Given the global reopening, Amazon hit an air pocket in near-term demand,” White said. “However, we believe the company is uniquely positioned to exit this crisis as one of the biggest beneficiaries of accelerated digital transformation.”

White says that compared to recent quarters, the “tone” of the earnings call was not quite as upbeat, as the world began exiting lockdowns and the company “experienced weaker online store trends.” That said, bullish highlights included the “strong growth” of the digital advertising business and especially that of Amazon’s cloud business AWS. After four straight quarters of posting the lowest growth rate amongst Amazon’s three business segments, the trend reversed. AWS delivered the fastest growth rate, as revenue grew by 37% year-over-year, compared to 32% in 1Q21, and reached $14.81 billion, above White’s estimate of $14.56 billion.

As Andy Jassy officially took over President and CEO duties on July 5, this was also the first quarterly earnings call without Jeff Bezos at the helm. With Big Tech continuously under the lawmakers’ microscope, Jassy will have a “lot on his plate.”

Amazon’s soft outlook also calls for a revision to White’s 3Q21 model. The analyst lowered the revenue estimate from $123.00 billion to $111.0 billion, indicating a 15% year-over-year uptick. White also reduced the EPS forecast from $15.15 to $9.05.

So, where does this all leave investors right now? All in all, there’s no change to White’s rating, which stays a Buy, or price target, which remains at $4,500. Shares could be adding 35% of muscle, should the analyst’s forecast play out accordingly over the next 12 months. (To watch White’s track record, click here)

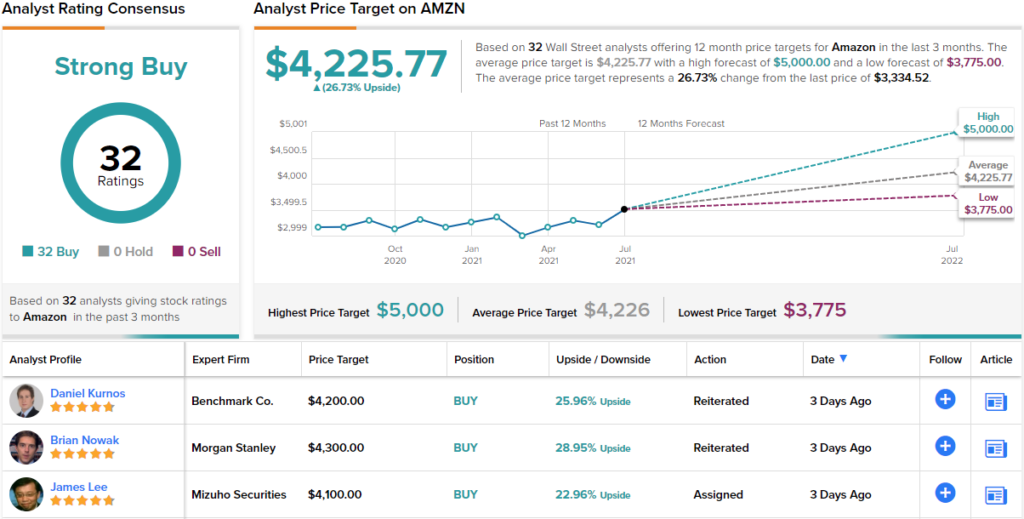

It’s a similar story amongst White’s fellow analysts. Amazon has 32 recent reviews on record, and all are to Buy, making the consensus rating a Strong Buy. The forecast calls for gains of ~27% on the one-year time frame, given the average price target currently stands at $4,225.77. (See AMZN stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.