Amazon (AMZN) has been a relative laggard compared to its high-flying counterparts in the FAANG basket lately.

Buying and holding any relative laggard has proven to be a profoundly profitable strategy in recent years. When it comes to Amazon stock, investors are being dealt an opportune entry point in a broader market that’s arguably frothy.

As such, I’m incredibly bullish on Amazon stock at just north of $3,500 per share. (See AMZN stock charts on TipRanks)

What’s Behind Amazon’s Underperformance?

Amazon stock is up 9.9% year-to-date (YTD). Pretty respectable returns, but stacked up against the S&P 500, up over 16% YTD, and other FAANG stocks, it’s clear that Amazon now holds the unfortunate title of laggard.

Undoubtedly, Amazon has nobody else to blame but itself for its inability to sustain a meaningful breakout past $3,500.

The company delivered a solid second-quarter beat that saw EPS numbers of $15.12, surpassing the $12.30 consensus. However, investors were expecting so much more on the revenue front. Operating profits, while decent, were also not Amazon-esque. Hence the negative reaction to the quarter, despite strength in AWS (Amazon Web Services).

Amazon’s bread and butter e-commerce business has shown signs of slowed growth. Still, 24% in growth on a constant currency basis is not terrible. Factor in less-than-favorable year-over-year comparisons, and the quarter isn’t nearly as bad as many investors made it out to be.

Sure, there will be doubts, as this is the first truly underwhelming quarter in a while. Beloved founder Jeff Bezos is no longer in that CEO seat. Still, the company is in great hands under its new top boss Andy Jassy. Undoubtedly, AMZN stock could continue dragging its feet until Jassy has time to make his mark.

If you seek a FAANG stock that could really play catch-up, though, it’s tough to pass up on Amazon here.

What to Expect under Andy Jassy

Andy Jassy may not be Jeff Bezos, but that’s OK. The man has his own skillset, and Amazon is likely to thrive under his leadership, just as Apple (AAPL) did incredibly well when Tim Cook became CEO in place of the late Steve Jobs.

You don’t need to be an innovative founder to produce solid results over time. Given Jassy’s wealth of experience in the higher-margin AWS side of the business, I’d argue Amazon could be in a spot to really improve upon its operating margins. Not just with AWS and services comprising a greater slice of the pie, but with e-commerce, through various levers to bolster profitability.

Wall Street’s Take

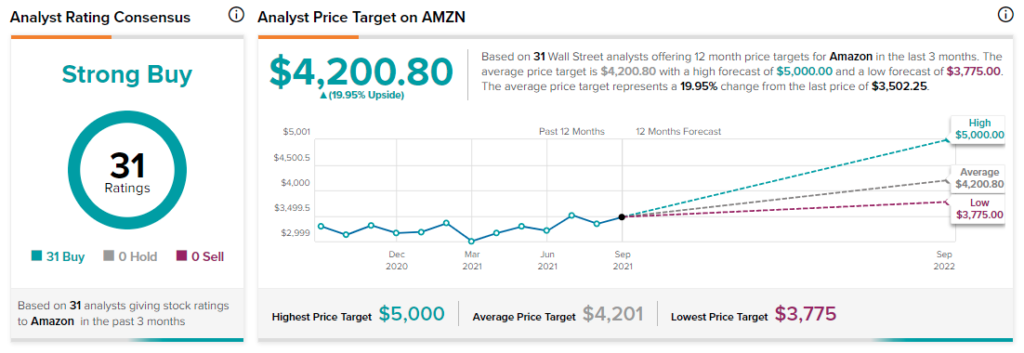

According to TipRanks’ analyst rating consensus, AMZN stock comes in as a Strong Buy. Out of 31 analyst ratings, there are 31 unanimous Buy recommendations.

The average AMZN price target is $4,200.80. Analyst price targets range from a low of $3,775 per share, to a high of $5,000 per share.

Bottom Line

Amazon could take its growth to the next level under Jassy. In any case, the FAANG stock is way too cheap after doing mostly nothing for around a year now.

There’s a reason why all 31 analysts covering Amazon stock have a Buy rating on the name. They think shares are headed higher, perhaps much higher, from current levels.

Disclosure: Joey Frenette owned shares of Amazon and Apple at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.