2020 may have witnessed skyrocketing rallies for some biotechs, but it most certainly hasn’t been kind to Amarin (AMRN).

Shares are down by a gut wrenching 68% since the turn of the year. The one-trick pony – Amarin has a single product, high triglycerides treatment Vascepa – has faced strong headwinds from several directions. In addition to coronavirus-induced sluggish sales of Vascepa, Amarin has been embroiled in a patent court case – which it lost – against generic drug makers, Hikma Pharmaceuticals and Dr. Reddy’s, seeking to sell their own versions of Vascepa. Amarin has since appealed, while the generic drug companies are expected to respond any day now.

However, although not quite as major as a possible overturn of the court’s ruling, Amarin had some good news to share on June 16, as the company managed to iron out issues with another drug maker.

The biotech disclosed it had resolved its dispute with Apotex that arose after it filed an ANDA application to make a generic version of Vascepa. The agreement dictates Apotex cannot bring its product to market until August 29, 2029 – coincidentally, the same date Teva is allowed to launch its version.

Although Stifel analyst Derek Archila believes the development is encouraging, ultimately, it won’t have major consequences.

“Recall, Apotex is not a party in the ongoing appeal of the district court’s decision invalidating Vascepa’s patents (see our previous note here) – so this is an unrelated settlement with another generic ANDA filer. So, while this is a slight positive, we don’t see this a major stock moving catalyst,” Archila noted.

All eyes are now on the generics’ response. Following this response, Amarin is expected to reply by the end of the month. The hearing should commence in the fall, with a final ruling slated for later in the year or early 2021.

“We ultimately expect AMRN shares to remain range bound until we get closer to the hearing later this year,” Archila concluded.

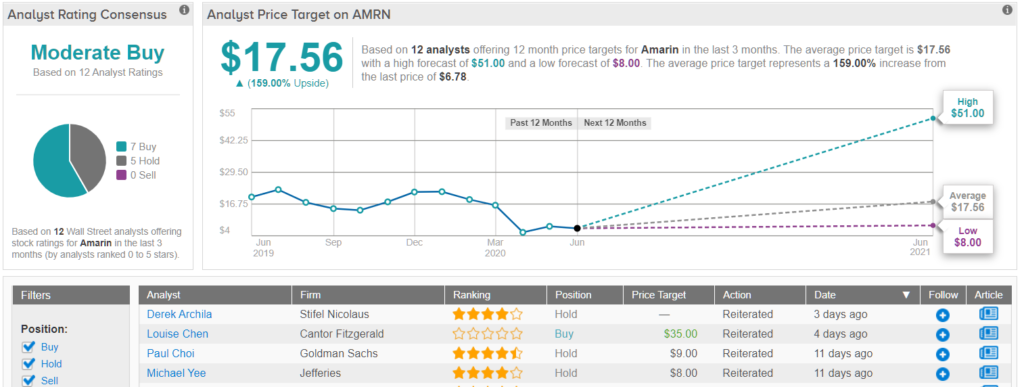

As a result, Archila maintains a Hold rating on Amarin, and keeps the price target at $8. This target implies shares could surge 18% in the next year. (To watch Archila’s track record, click here)

Among the analyst community, Amarin has a Moderate Buy consensus rating based on 7 Buy ratings and 5 Holds. There’s plenty of upside, according to the Street, as the $17.56 average price target indicates possible gains of 159%. (See Amarin stock-price forecast on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.