Alteryx (AYX) is a leader in Analytic Process Automation or APA. The company’s APA software platform unifies analytics, data science, and business process automation in a single self-service platform to accelerate digital transformation, produce high-impact business outcomes, and ramp up the democratization of data.

Traditional data analysis tools and processes are slow, complex, difficult to use. They’re also resource intensive, often requiring multiple steps by various data specialists to conduct even the most basic analysis. For this reason, traditional processes are unable to keep pace with the complexness and pace of analytics demanded by organizations today.

Hence, one can guess that Alteryx’s total addressable market is quite vast, considering that the majority of businesses need to transform their data analysis capabilities, suggesting strong growth prospects.

This was initially the case following the company’s IPO back in 2017. The company would report exciting quarterly results, resulting in massive stock gains through 2020. However, growth has worryingly decelerated since, leading to the stock losing around two thirds of its value over the past year.

While I appreciate Alteryx’s efforts to regain traction, and the stock is likely rather cheap at 8.2x sales, following the recent decline in share prices in the tech sector, there are likely better opportunities with fewer risks attached to their investment cases. For this reason, I am neutral on the stock. (See Analysts’ Top Stocks on TipRanks)

Recent Developments

While most tech companies have thrived during the COVID-19 pandemic, Alteryx has experienced strong headwinds due to its heightened focus on the mid-market.

Since then, the company has appointed a new CEO to redirect its focus on enterprises. This is where Alteryx normally has the loftiest net retention rates. The company also expects to launch a cloud product early next year and offer enhanced machine learning capabilities. Still, Alteryx continues to struggle to find its footing lately, reducing its guidance earlier this year as its previously expected efficiencies fell behind initial estimates.

In its Q3 results, Alteryx posted a revenue descent of 4.8% year-over-year. Nonetheless, the company managed to grow its customer count by 10.5% year-over-year.

Further, gross margins remained at sky-high levels, at 87%, while net retention came in at 119%. The revenue decline was primarily due to a shorter average contract duration, which, as expected, came in just under 1.5 years in Q3, lower compared to both 2020 and 2019. It used to be around two years.

Management expects to continue to see contract duration shorten as it focuses its sales efforts on account level ACV and ROI-based outcomes, while greatly reducing discounts for multiyear contracts. In other words, the company is trying to increase revenues by higher-rate contracts in the short term.

Following such efforts, ARR growth re-accelerated to 29% in Q3, powered by a 79% increase in net new ARR year-over-year. Hence, once Alteryx’s business environment stabilizes going forward, revenue growth should start to accelerate and converge towards the ARR growth.

Wall Street’s Take

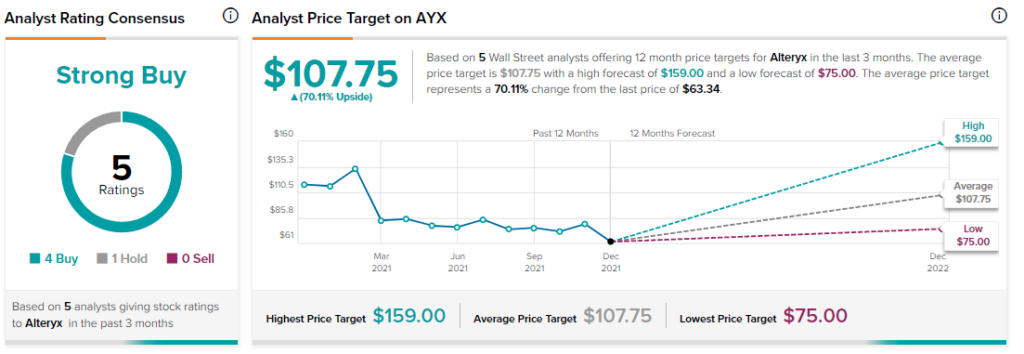

Turning to Wall Street, Alteryx has a Strong Buy consensus rating based on four Buys and one Hold assigned in the past three months.

At $107.75, the average Alteryx price target implies 70.1% upside potential.

Disclosure: At the time of publication, Nikolaos Sismanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >