Banking giant Morgan Stanley recently held its 2022 TMT (Tech, Media, and Telecom) bash. Alphabet (GOOGL) CFO Ruth Porat was one of the guests and provided a rundown of the state of things at the search giant.

Firm analyst Brian Nowak has listed some of the most important learnings from the conversation. Let’s look at some of his findings.

For one, the company will keep on focusing on AI and machine learning to “drive the core ad business.” Via efforts such as MUM (multitask unified model), Lens and others, GOOGL will continue to innovate and make Search “more conversational and human-like.”

So far, the company’s retail-focused endeavors to “connect users to merchants,” such as Shopify and Square, construct a more open ecosystem and use technology such as Lens for search purposes, have “driven results.” More should follow, says Nowak.

There will also be further investment in advertising and cloud, the company’s “large core opportunities.” This entails adding to the workforce – Nowak estimates 22,000 new hires this year – and additional outlays for data centers and real estate. This is already in action, with the company having made real estate acquisitions in New York, London, and Poland during Q1. GOOGL anticipates 1Q22 real estate capex will reach $4 billion. “For perspective,” says Nowak, “We model total ’22 capex to reach ~$31bn…with ~$13bn from real estate and ~$18bn from core compute.”

Google Cloud will also receive additional investment, while continuing to innovate on YouTube via the “creator economy,” short form video, and shopping, remains a priority. Reflecting the popularity of FB’s Reels and TikTok, YouTube Shorts is seeing “strong traction,” so far having notched 5 trillion all-time views and claiming 15 billion views a day. As GOOGL is still “testing and iterating” on ads, monetization is still in the very early stages.

All in all, Nowak rates GOOGL as Overweight (i.e., Buy) while his $3,450 price target shows room for share appreciation of 31% over the coming months. (To watch Nowak’s track record, click here)

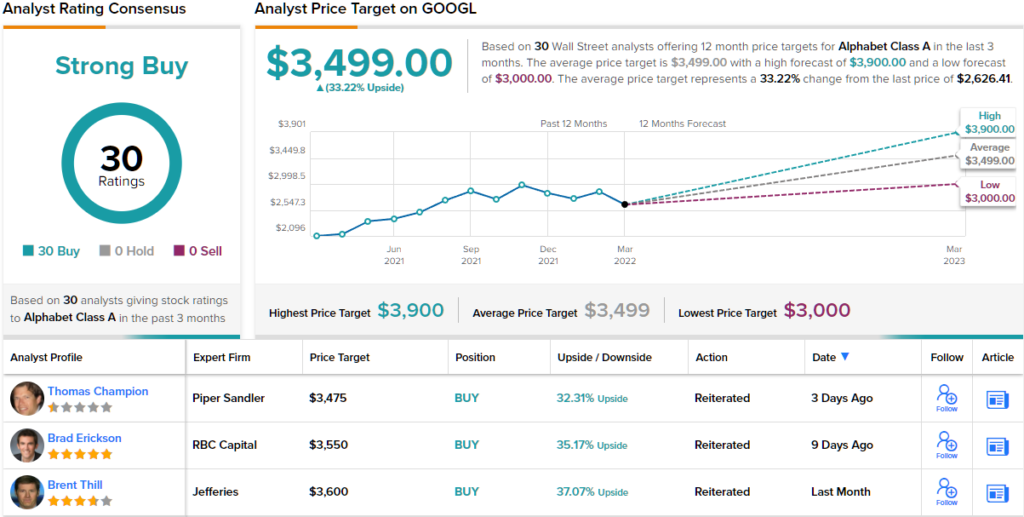

GOOGL is amongst a selected number of stocks with large unequivocal analyst coverage; all 30 recent reviews are positive, naturally providing this stock with a Strong Buy consensus rating. The $3,499 average target is only slightly higher than Nowak’s objective and set to generate returns of 33% in the year ahead. (See GOOGL stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.